Non-performing loan rate, close to 4.12%/ Loan portfolio quality remains good despite slight increase

The rate of non-performing loans remains close to historical lows, despite a slight fluctuation in recent months. According to data from the Bank of Albania, at the end of May 2025, this rate was recorded at 4.12%, up from 4.03% in April and 4.02% in March. Although this is a minimal increase, this indicator continues to remain significantly lower compared to the long-term average and very close to the historical low recorded in March 2008 (3.92%).

The gradual increase in net non-performing loans to capital indicates a slight increase in their financial impact on banks' balance sheets. In May, the ratio of net non-performing loans to regulatory capital reached 6.54%, up from 5.95% in April and 5.03% in March. However, this level still remains manageable and within the limits of sustainability for the banking system, especially in conditions where capital ratios remain high.

In fact, regulatory capital to total assets has further strengthened, standing at 9.97% at the end of May, from 9.87% in March, while return on assets and return on equity maintain stable levels. Interest income remains high, with the margin standing above 76%, while the sector continues to maintain a good liquidity position.

In broader terms, the stability of the non-performing loan ratio is a clear signal of the maturity of the banking system and the improvement of borrower behavior. Despite the challenges that may arise from the increase in financing costs or other macroeconomic factors, the overall balance remains positive. Maintaining this balance between credit growth and portfolio quality demonstrates efficient risk management and paves the way for further support for the real economy.

What happened in the foreign exchange market today? – Pound and Dollar weaken!

The US dollar did not start the day positively as it was bought this morning compared to the previous day at 82.9 lek and sold at 83.8 lek according to the......

Government plan: Inclusive employment and quality training - New jobs, over 10 thousand additional employees per year

In the priorities of the medium-term budget 2026-2028, employment and vocational training remain in focus. According to the document published in the......

Subsidies in agriculture/ Denaj: United beekeepers benefit from 100% financial support!

Through the subsidy scheme, the government addresses special support for the development of the beekeeping sector. In the National Agricultural Support......

Greece suspends asylum requests from Africa - Government aims to limit the entry of migrants into Greek territory

Greece will temporarily suspend asylum applications from migrants from North Africa. The measure aims to manage the influx of foreigners before they enter......

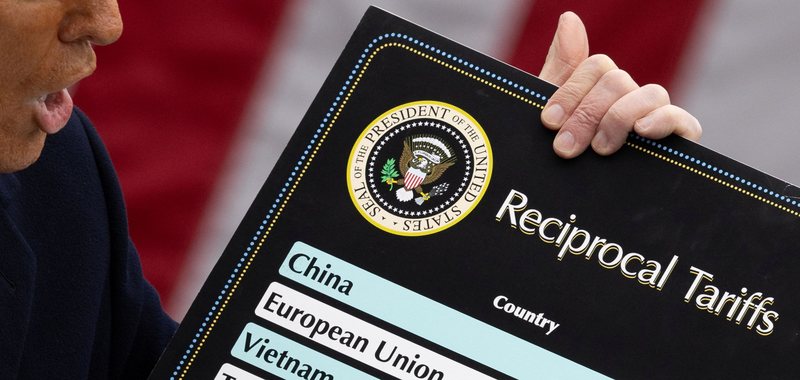

Trump imposes 50% tariffs on copper imports - US announces "punitive" measures against Brazilian goods

President Donald Trump announced the imposition of a 50% tariff on copper imports into the US. He also took action against Brazil, imposing 50% taxes on the......

Modernization of the “ASYCUDA” customs system - A step towards European integration!

The Director General of Customs, Genti Gazheli, who is conducting a working visit to Switzerland, was received by representatives of UNCTAD (United Nations......

Minister Hasani in Latvia: Partnership with Riga, an investment for the common European future!

The Minister for Europe and Foreign Affairs of Albania, Igli Hasani, paid an official visit to Riga, where he was received by the Minister of Foreign Affairs......

Milk production fell by 6.6% during 2024/ Negative change also for cheese, marked a decrease of 9.9%

According to data published by INSTAT for 2024, a total of about 95 thousand tons of milk were collected in the Albanian territory. Compared to the previous......