Albanians' demand for loans "boils" - EIB Report: Financial market active. But banks temporarily "hold back" on housing loans

The financial market in Albania is going through a dynamic phase, where the desire of citizens and businesses to invest remains at record levels.

According to the latest report by the European Investment Bank for the end of 2025, the demand for credit has increased beyond the expectations of bankers themselves. This momentum is mainly driven by families looking to buy a house and by individuals seeking consumer credit to increase their standard of living. What is striking is that the "euro era" in credit is fading. Albanians are massively choosing the local currency, the Lek, thus protecting themselves from exchange rate risks.

But while demand is surging, the situation on the other side of the counter is more measured. For the first time after a period of easing, banks have begun to tighten their criteria. Obtaining a salary certificate or collateral is no longer enough as it used to be. This tightening is happening mainly in home loans and large business financing.

The factors are related to new supervisory regulations and a slight uncertainty coming from international markets. However, this "retardation" is not expected to be long-term. Experts predict that in early 2026, banks will find a new balance, returning to a more neutral and supportive position.

One of the most positive news coming from this report is the improvement in credit quality. Even though we live in a time of economic challenges, the ratio of non-performing loans has decreased. This shows that Albanian families and businesses have shown themselves to be responsible and correct in repaying their installments.

This stability has increased the confidence of parent banking groups in Europe, which see Albania as a market with high potential. However, a slight warning comes for the coming months, banks expect a slight increase in payment difficulties, which requires increased caution on the part of borrowers.

Railway sector reforms - Transport Community: Division into 4 companies, consolidation expected within 2026

The implementation of reforms in the railway sector in Albania is progressing at a moderate pace, reaching an implementation level of 45%, according to the......

Payment of vehicle tax/DPSHTRR: Now 100% online through the e-Albania platform!

The General Directorate of Road Transport Services (GDRTS) informs citizens that vehicle tax payment is now carried out 100% online through the e-Albania......

"Only immigration visas are suspended" - US Embassy Clarification: Tourism and visits continue normally

The US State Department announced a day ago that it is suspending immigration visas for applicants from 75 countries around the world. These include Albania,......

Reimbursement of up to 13 thousand lek for children's education - Who benefits and how to apply by completing the DIVA

Employed citizens who have an annual taxable income of up to 1.2 million lekë, by completing the Individual Income Tax Declaration, DIVA, will have the......

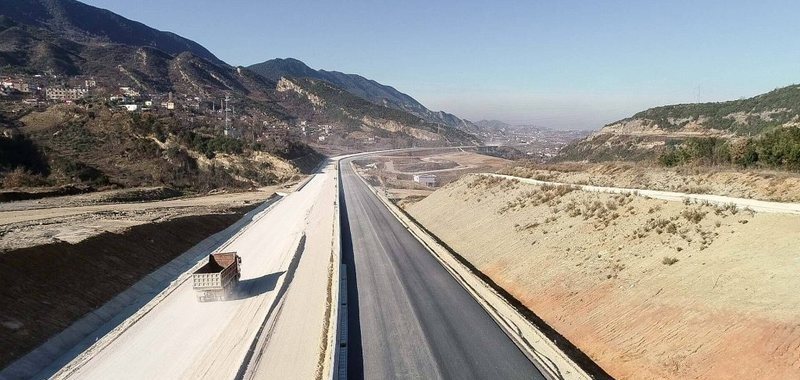

364 million euros for road construction - The most financed projects during 2025 by the Albanian Road Authority

The Albanian Road Authority is the budgetary institution with the highest value of transaction payments for 2025. According to data from Open Data Albania,......

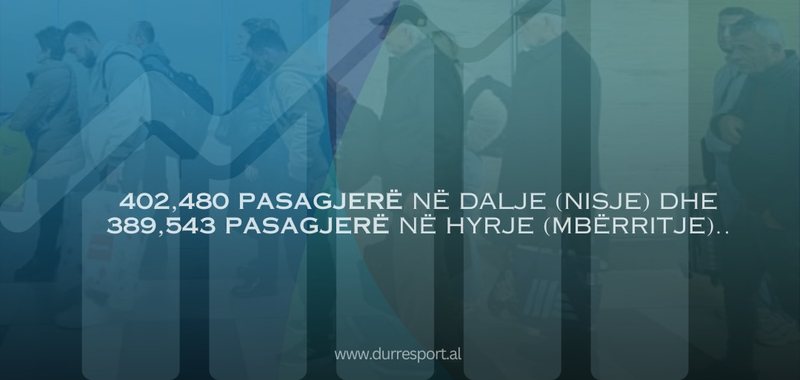

Port of Durres, over 790 thousand passengers in 2025/ APD: Summer season increased passenger flow

The Port of Durres continues to remain the main maritime passenger transport hub in Albania throughout 2025. According to the Durres Port Authority, a total......

How much money do emigrants send and save? Returnees saved the most, with 76% of their financial target achieved

Albanian emigrants returning to the country send more remittances during the emigration period compared to those still abroad. Meanwhile, according to the......

30% profit tax deduction for sponsorships - National Electronic Registry for Donations is created, restrictions for donors

Sponsors who contribute to the field of art, sports or culture will benefit from fiscal relief through a direct deduction of up to 30% from profit tax, both......