Who benefits from VAT compensation in agriculture? - Instruction/ Farmers must keep sales receipts, tax application

Farmers must collect all invoices for the sale of agricultural products from collectors in order to benefit from the 10% VAT compensation measure. The detailed instructions of the Ministry of Finance clarify how the scheme will be implemented.

Referring to the instruction, the collector, a taxable person registered for VAT, for each supply of agricultural products received from the farmer issues a fiscalized tax invoice in which it records as the seller, the farmer seller, the farmer's NIPT and other data required according to the invoice.

This invoice, which does not include VAT, is issued by the buyer at the time of delivery of agricultural products by the farmer.

The total invoice value represents the value of the supply paid by the collector on behalf of the farmer seller, on which the compensation rate is applied.

The request for VAT compensation will be made by farmers by December 31, for supplies made during the January-June period of the respective year and by June 30 of the following year, for supplies made during the July-December period of the previous year.

The farmer, through postal service or electronically, submits to the tax administration the standard request for compensation. The request must contain the total value of the invoices issued during the compensation period, as well as the farmer's bank account number.

This request is also accompanied by copies of invoices issued by the buyer which must be signed by the seller-farmer.

But who benefits from compensation? To benefit from compensation, farmers must meet certain conditions.

Specifically, the annual turnover must not exceed the minimum VAT registration threshold; have made supplies of agricultural products; have supplied taxable persons who do not benefit from the compensation scheme in the Republic of Albania, who are registered for VAT and carry out activities as a collector and/or processor of agricultural products or agrotourism certified according to the legislation in force on tourism; have been provided with a taxable person identification number; the invoices received from the buyer, on the basis of which compensation is requested, are fiscalized and registered in the database of the central tax administration.

The 10% compensation rate is applied to the value of the tax invoice(s) that the collector has issued to the farmer, during the six-month period for which compensation is requested.

The compensation aims to cover a portion of the VAT paid by farmers on the purchase price of goods and services purchased for the purposes of carrying out their agricultural production activity.

The tax administration conducts the relevant verifications and within 30 days pays the compensation amount directly to the farmer's account.

There is no excise tax reduction for domestic beer! - The majority rejects the proposal. Tobacco: 11% production drop

The unification of the excise tax on beer in 2022 at 710 lek/hectoliter has led to damage to domestic production and an increase in imports. With the......

How much do banks earn from our interests? - BoA: Total net income including commissions, lower than in 2024

Have you ever wondered how much money banks make from the interest we pay on loans? Gross interest income last year was 97 billion lek, about 3% higher than......

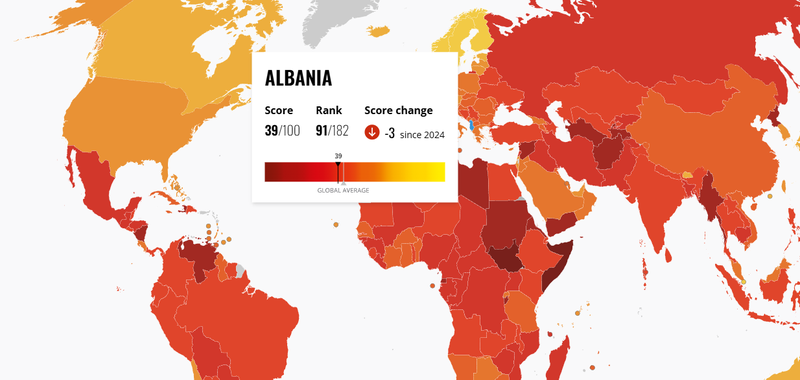

Corruption index, the region does not perform well / Albania in 91st place for 2025. Serbia with 33 points ranks last

The best way to measure corruption in a country is precisely the perception of it, and Transparency International publishes the most prestigious global......

Qiratë në Shqipëri ndër më fitimprurëset në Europë/ Në Tiranë, Durrës e Vlorë investimi kthehet më shpejt falë qirave

Shqipëria po konsolidohet gradualisht si një nga tregjet më interesante në Europë për investime në pasuri të paluajtshme, veçanërisht në sektorin e qirave.......

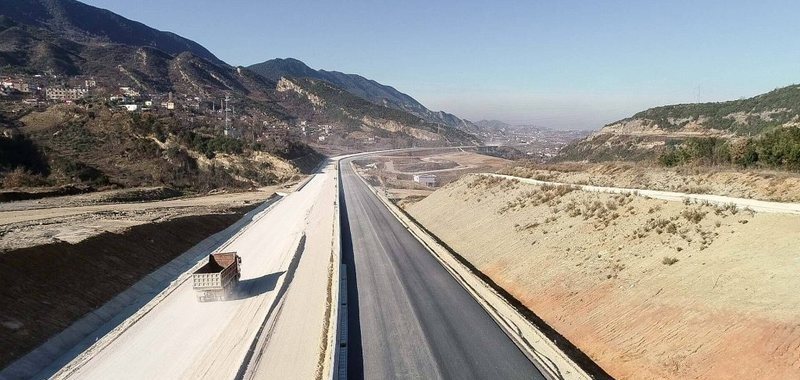

Construction of the 8th road corridor - Expropriations for 148 properties in Lot II of the Elbasan - Qafë Thanë segment are about to begin

The issue of expropriations in Lot II of Corridor 8 is moving towards a solution, paving the way for the completion of the works. The State Expropriation......

Car imports on the rise, led by South Korea - Over 6 thousand vehicles registered per month, Tirana with the main weight

First-time vehicle registrations in the country have increased at the beginning of 2026. According to official data from the DPSHTRR, during January 6,895......

OBP completes the Digital Archive: A platform developed by the institution's ICT experts

The Centralized Purchasing Operator (CPO) has successfully completed the construction and operationalization of the Digital Archive, one of the main pillars......

Trump threatens to stop opening of US-Canada bridge: "Canada must treat US with the respect it deserves"

US President Donald Trump threatened to stop the opening of a new $4.7 billion bridge connecting Detroit and Windsor, Ontario, in his latest attack on Canada......