Property tax, buildings account for 75.6% - What will change from January 1, 2026 and will there be exceptions?

Municipalities have significantly increased their revenues from real estate taxes over the years, and this has also been influenced by the increase in reference prices in the capital, which provides the highest contribution to revenues from this item.

Specifically, during 2024, about 7.9 billion lek or 79.4 million euros were collected from real estate in Albania with a progressive increase from year to year, while compared to 2023, the increase is approximately 15 million euros.

If we compare it with 2013, the revenues from this item of local government have doubled.

But how is their specific weight divided? Specifically, the building tax accounts for 75.6 percent of total revenue, or about 60 million euros.

The tax on agricultural land accounts for 8.8 percent of the total, or nearly 7 million euros.

The tax on real estate transactions accounts for a specific share of 8% or 6.4 million euros. While the tax paid on land accounts for 7.6% or about 6 million euros.

From January 2026, citizens will pay a new real estate tax which will be above market value and will start with buildings, to be extended further in 2028 to agricultural land.

The government anticipates that the Fiscal Cadastre Information System (SICF) will soon be finalized, as well as its interaction with other systems and extension to municipalities.

As well as piloting, capacity building and institutionalization of procedures for the valuation of real estate, the population and maintenance of real estate data in SIKF.

The medium-term revenue strategy argues that since real estate tax revenues constitute the main source of local government revenue, it is necessary to keep exemptions to a minimum and, in the meantime, tax relief for vulnerable groups should be provided through other mechanisms and forms.

Currently, real estate taxes in Albania contribute 0.3% of GDP, while the average revenue generated from property taxes in other countries in the region is around 0.8% of GDP.

KAYO signs agreement with Israeli company - On May 8, the aircraft landing test on the runway of Vlora Airport

An agreement was signed this Sunday in the coastal city of Vlora between Albania's state-owned military company, KAYO, and Israeli defense giant Elbit......

''On May 8th, the first flight from Vlora'' - Balluku: It will be the first test of the airport

Deputy Prime Minister, Minister of Infrastructure and Energy, Belinda Balluku announced today that on May 8, the first flight from Vlora International......

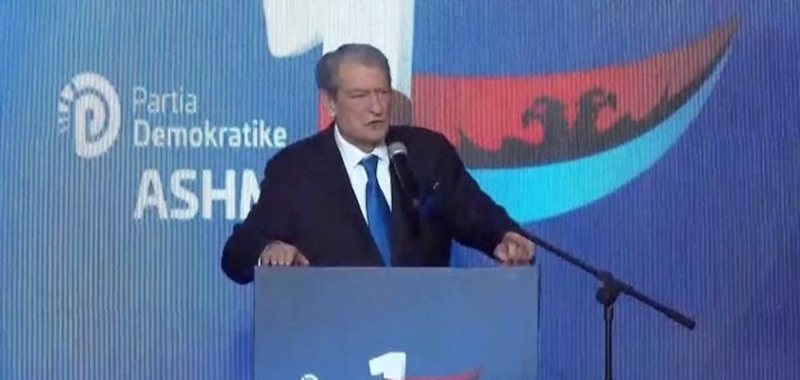

DP-ASHM, meeting with Albanian emigrants in Thessaloniki - Berisha: 2025, the year of the Diaspora

The Chairman of the Democratic Party, Sali Berisha from Thessaloniki, where he held a meeting with Albanian citizens living and working in the Greek state,......

''GDP increased 2.5 times within a decade'' - Rama: Aviation Academy in Vlora, regional

Prime Minister Edi Rama declared from Vlora that the level of Gross Domestic Product today is 2.5 times higher in just a decade. According to him, for 2030,......

Sejko at the spring meetings of the International Monetary Fund and the World Bank!

The Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group (WBG) were held in Washington, D.C., from 21 to 26 April 2025. The......

Vlora Airport receives code from the International Air Transport Association

IATA (International Air Transport Association) has assessed the application of Vlora International Airport in accordance with international standards and has......

The best European countries for real estate investments in 2025: The Balkans at the top!

The best European countries for real estate investment in 2025 are in Central and Eastern Europe, with Moldova at the top. The Balkan country earned the......

US plans Alaska LNG summit - Trump urges Japan and South Korea to support project

US President Donald Trump's Energy Security Council plans to hold a summit in Alaska in early June. During that time, the Trump administration hopes that......