Albanians pay 482 million euros in 7 months - revenue from payroll tax triples

Albanian citizens pay a considerable amount in the form of taxes withheld from their salaries or real estate transactions.

According to data from the Ministry of Finance, personal income tax revenues for the period January - July 2025 amount to 48.2 billion lek or about 482 million euros.

From this source, 101 million euros were collected, or 26.5% more than in the first 7 months of 2024, making it the item with the largest increase among other revenues collected by the state.

On the other hand, if we analyze the historical data of the revenues generated for the 7-month period from this budget item, a progressive increase is observed from year to year. And compared to 2015 when the collected revenues were recorded at 165 million euros, the increase is 192% or 3 times higher.

But what were the factors that influenced this trend?

Over the last two years, a salary increase reform has been undertaken in the public administration, where the average salary exceeded 900 euros, causing the tax paid on the salary they receive to be higher.

This reform has also put the private sector in motion by indirectly encouraging wage movements, which has also led to increased consumption.

On the other hand, the anti-informality campaign undertaken by the government regarding the under-declaration of salaries had an impact, causing over 9 thousand businesses to react by declaring their employees' salaries with an increase in October 2024 alone. The campaign continued with a second round among those businesses that had not reacted.

The gradual increase in the number of contributors to the insurance scheme, mainly in private entities, which may have also come from the anti-informality campaign, has also led to an increase in the amount paid as payroll tax.

Meanwhile, the doubling of the number of employees who completed the Individual Income Tax Declaration this year, due to the reduction of the income declaration threshold to 1.2 million lek per year, has had a considerable impact.

In the personal income tax item, the highest contribution is made by the tax on salaries of employees in the private and public sectors, followed by the tax paid from the sale of real estate, which is at the level of 15 percent, as well as the tax on rents. This shows that in addition to salaries, the real estate sector has also had positive performance and the finalization of transactions, as well as the increase in the price of rents mainly in the capital, has caused the payment of taxes to be higher for those declared rents.

Also, a significant amount of space is occupied by tax on income from dividends and tax on income from interest.

Personal income tax is the second most influential item in the annual state budget, after VAT, and accounts for approximately 26.7% of total tax revenues.

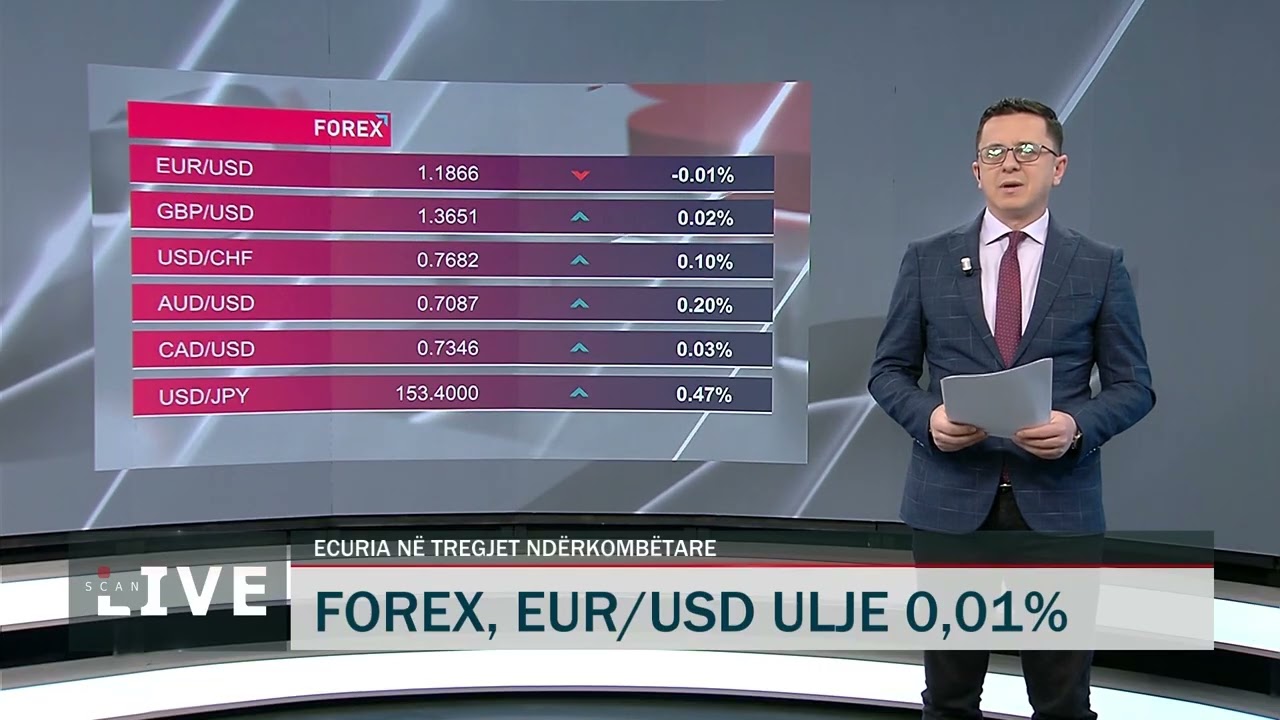

How did this week end for the major currencies?

The US dollar closed this week positively, recovering points throughout this period, as it was bought this morning at 82.9 lek and sold at 84.1 lek compared......

Albanians are preferring banking services from home - BoA: In five months, 21% more home banking transactions than in 2024

Albanians are using more banking services from home, through online websites or bank applications, saving time and avoiding queues at their physical......

Schools, with new rules - From the fight against bullying, to security officers

The instruction "On the continuous professional qualification of teachers of professional culture in vocational education and training" has been published in......

Energy consumption in water supply systems is increasing - WRA: Each company must draft specific studies on efficiency

Energy efficiency in the water supply and sewerage sector has suffered a slight deterioration in 2024, compared to the previous year. Data published by the......

"TEG Talent", the spectacle of the most prominent children on stage, is coming!

For the first time in Albania, a unique talent show takes place in a shopping mall. And who else but TEG could bring this innovation? This September, TEG......

China "conquers" the European car market - Chinese electric vehicle registrations increase by 60%

Strong competition from China and the lack of charging infrastructure in many European countries are creating serious challenges for electric vehicle......

The costs of the war in Ukraine - Which country is bearing the main "burden" of defense?

As transatlantic talks on the future of Ukraine intensify, one issue comes to the fore, particularly in the statements of former US President Donald Trump:......

Europe motivates “green” visitors - Cities offer innovative rewards to boost sustainable tourism

Dozens of popular destinations in Europe have imposed fines, taxes and other restrictions on travelers in recent months, aiming to combat overtourism. Last......