Loans over 5 years "take the reins" of the financial market - Individuals lead long-term loans in lek. Business leads capital investments in foreign currency

The Albanian financial system closes 2025 with a record volume of loans to the economy, reaching a total value of 929 billion lek. This figure, beyond the volume, reveals a fundamental change in the behavior of borrowers, where the main weight is the orientation towards long-term stability and the local currency.

The main pillar of this portfolio is long-term loans, with a maturity of over 5 years. In this segment, individuals are the most active actors. They own over 233 billion lek in loans in the national currency and about 76 billion in foreign currency, confirming that the preference for real estate investments remains dominant, with increased caution towards exchange rate fluctuations.

On the other hand, the private non-financial corporate sector presents a more complex dynamic. Big business leads capital investments in foreign currency with over 92 billion lek, while in the lek currency this sector has injected over 112 billion lek for long-term plans. However, unlike individuals, businesses continue to be the main consumers of short-term loans. For immediate liquidity and goods circulation needs, private corporations have taken out about 80 billion lek loans with terms of up to one year in the lek currency alone.

In the detailed analysis by enterprise size, medium-sized businesses appear as a stable force in the medium and short-term category. Meanwhile, microbusinesses and small businesses, although with more modest figures, reflect an increase in the need for financing, where in the small business sector alone, long-term loans in lek reached 20 billion lek at the end of this year.

Another striking element in these is medium-term loans, from 1 to 5 years, where an almost equal distribution between lek and foreign currency is observed, while other financial intermediaries and public corporations play a supporting role, although with more limited volumes than the private sector.

The figures for the end of 2025 confirm that the Albanian economy is moving towards a long-term investment cycle. With around 65% of all debt concentrated in loans over 5 years, the market shows a kind of maturity where capital is no longer used simply for immediate consumption, but for building long-term assets for households and expanding the production base for big business.

Moderate business growth at the end of 2025/ Albania, with above-average performance in Europe. Ireland, with the strongest decline

The European Statistical Agency has published some data on new business registrations in the European Union. In the fourth quarter of 2025, business......

Integration, 6 billion euros needed for water supply and sewage systems/ Investment needs, 50 million euros program approved. Interventions in several areas

Achieving the objectives for membership in the European Union in the water supply and sewage sector requires about 6 billion euros. The figures were made......

Prime Minister Edi Rama, working visit to Kosovo – On the eve of the declaration of independence day

The Prime Minister of Albania, Edi Rama, has begun a working visit to Kosovo today. The first meeting was held by Prime Minister Rama with the President of......

How secure are Albania's critical systems? - AKSK: 20 more cyber incidents in 2025. Hundreds of credentials exposed

Albania has faced 51 cyber incidents in critical and important information infrastructures over the past year. These include the systems of OSHEE, OST, KESH,......

"Kosovo's economy, growth of 3.8% in 2026" - IMF lowers forecast. Also lists risks

The International Monetary Fund (IMF) said it expects Kosovo's economy to grow by 3.8% this year, lowering its forecast made in October by 0.2 percentage......

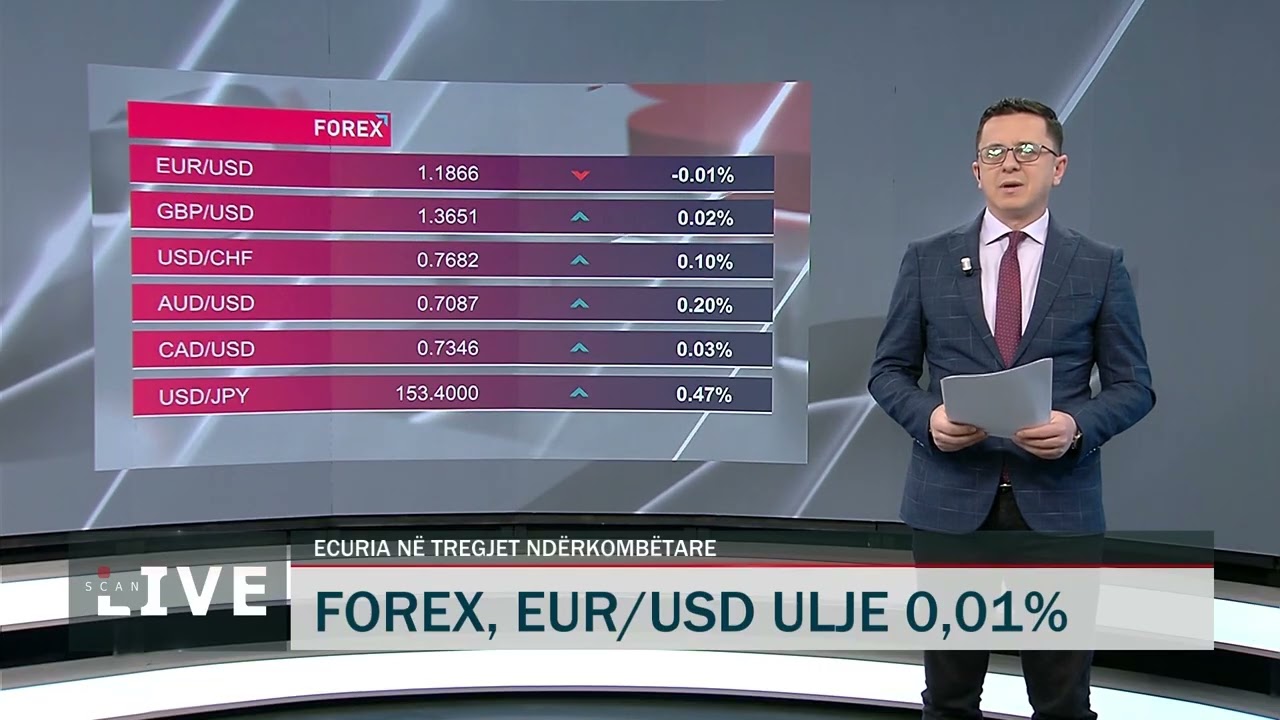

Why is the euro depreciating? - Analysis/ Appreciation of the Lek, from tourism and remittances

For a long time now, the Lek has continued to be strong against the European currency. But what are the reasons for its appreciation and how has it......

7 subjects cannot be suspended from duty by court order - Manja presents the amendment to the Criminal Code: Investigations can be carried out

The Chairman of the Parliamentary Committee on Laws, Ulsi Manja, has presented the legal initiative regarding the amendments to Article 242 of the Criminal......

How much does it cost to furnish and maintain a home? From the sofa to the garden. An Albanian family spends about 76 thousand lek per year

In recent years, the home is no longer seen as just a basic need, but as a space where continuous investment is made. In the past, many Albanian homes were......