Around 1.2 billion lek of loans were restructured by banks - BoA: Less than last year. Businesses were the ones that requested maturity extensions

Banks restructured fewer loans in the first half of the year. According to data from the Bank of Albania's Financial Stability Report, the amount of restructured loans was lower than last year.

Specifically, the restructured loan during the period was around 1.25 billion lek or less than 1% of the new loan flow of the period and as much as 3.5% of the stock of non-performing loans.

Banks can restructure a loan to ease the heavy burden that a borrower may have. So the bank offers borrowers some facilities, due to the financial difficulties they may encounter during the repayment process. These facilities include changes in the terms and conditions of the loan, such as changing the product and capitalization of interest, the maturity period and the interest rate, the execution of collateral or other assets for partial payment of the loan, the replacement of the original borrower or the inclusion of an additional borrower.

The annual flow of restructured loans has decreased in recent years. Thus, the value of restructured loans during the first half of 2025 is 23% of the value of restructured loans in the same half of 2021.

The restructuring was carried out mainly for loans in lek and foreign currency of the business sector. The latter have mainly requested an extension of the maturity period.

What about write-offs of lost credits?

Write-off volumes were much higher than in the previous period, reaching around 5.3 billion lekë. The write-off of bad loans, i.e. those that the borrower can no longer afford to pay, was dominated by businesses. The Bank of Albania reports that the value of loans written off in the recent period was 17.6% of the total outstanding non-performing loans in the banks' portfolio, up from around 2.7% in the previous six months.

Europe "fills" Russia's coffers - Over 8 billion euros in tax revenue from European gas imports

European imports of Russian liquefied natural gas brought Moscow 8.1 billion euros in tax revenue between 2022 and 2024, according to research published by......

EBRD, 29 million euros for the energy network in Kosovo - The project aims at digitalization and increasing capacity by 300 MW

The European Bank for Reconstruction and Development (EBRD) is considering providing a corporate loan of up to EUR 29 million to the Kosovo Transmission......

New state enforcement fees revealed - Instruction enters into force. How much do debtors pay, from property to fines

The government has determined new fixed fees that will be applied by state bailiffs, some of which are increasing compared to those applied so......

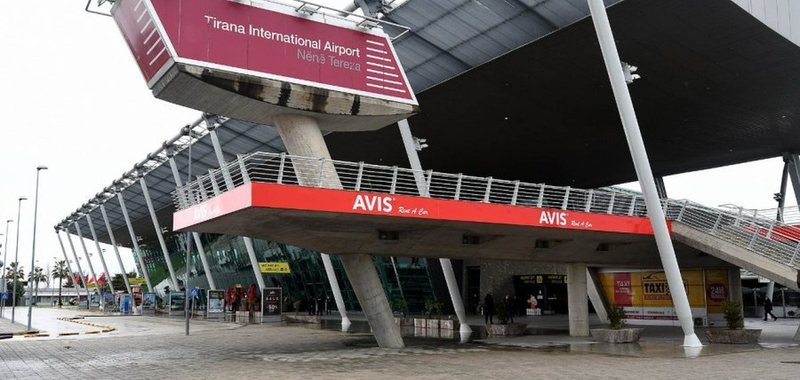

Tirana Airport "broke" a record in August - Over 1.4 million passengers and 8,106 flights registered

Tirana International Airport is continuing its positive trend, confirming the steady growth of air traffic in Albania. During the month of August 2025 alone,......

Rama: Will enable recruitment for a special internship for a number of students

Prime Minister Edi Rama was present today at the Polytechnic University of Tirana together with the Minister of Infrastructure and Energy, Belinda Balluku,......

Government agreement with Polytechnic University/Balluku: Let's respond to EU demands!

The Minister of Infrastructure and Energy, Belinda Balluku, gave a strong message during the signing of the agreement with the Polytechnic University of......

The US government shutdown also affects the US embassy in Tirana!

The US federal government began shutdown proceedings on Wednesday, just hours after the US Senate failed to pass a short-term bill to temporarily fund the......

The month starts negatively for the Dollar - How much are other currencies being exchanged today?

The US dollar has started this month negatively, suffering a decrease in value compared to the day and month we left behind, being bought today at 81.8 lek......