Changes to the personal status declaration and new payroll!

The changes in the new Income Tax law have also brought changes to the payroll declaration. The payroll declaration has changed since January of this year in accordance with the new Income Tax law. Businesses and their employees, current and new, must change their personal status declaration.

Personal Status Declaration:

Every employee has the right to benefit from a deduction from the taxable value of salary income, of the amounts determined, according to point 1 of Article 22 of the aforementioned law, only once during a monthly calendar period;

The personal status declaration, according to Article 66 of the above law, must be signed by both parties (the taxpayer and the employee) before the start of the employment relationship (before the first payment of taxable employment income);

An employee cannot sign the personal status declaration with more than one payroll tax agent (taxpayer) for the same monthly calendar period. So, in the case where an individual has more than 1 employment during 1 month, the status declaration is submitted to only 1 entity and the deduction is applied only to the payroll submitted by this entity. In the other entity(ies), the calculation of employment income tax will be carried out on the gross salary.

Change in the new payroll:

It will contain a box for the declaration of personal status. This selection (check) allows the deduction of amounts determined depending on the gross salary they have from the tax base. All employers whose employees are employed by only one employer (before 01.01.2025) will automatically have the check box for "Personal Status", but they will keep this check only if the employee and the employer have signed the declaration of Personal Status.

It is a legal obligation that tax deductions will be made by the employer (even in the case of employment with only one employer) if the "Personal Status" declaration is signed by both (employer - employee) and is available from the employer.

However, it should be kept in mind that the personal status declaration must be submitted and signed to the employer.

Self-employed individuals are exempt from the declaration of personal status.

In case an individual is employed by more than one employer, the box will not be filled in as the personal status declaration must and can only be selected by one of the employers, which must be determined by the employee himself. In case all employers of the individual attempt to select for the same employed individual, then the system will check in real time and will accept deductions from the tax base of the employer who has selected and declared the payroll first.

The system will display a notification to other employers that the deduction cannot be applied to the employee, as it has been previously applied by another taxpayer employer. Deductions from the tax base that the employee benefits from are only obtained once, regardless of whether he is employed by two or more employers.

For newly hired employees, this box will be selected or not by the entity declaring the payroll, depending on whether or not the employee has submitted the status declaration. Consequently, the tax calculation will be carried out on this basis.

The amount deducted from the salary for voluntary pension funds (based on Article 20 of Law 29/2023 "On Income Tax", as amended), the value of the monthly contribution is deducted from the employee's personal income for the purpose of calculating and withholding tax, but this deduction cannot exceed the value of the minimum wage approved at the national level (currently the approved minimum wage is 40,000 lek).

The progressive tax rates for calculating the tax have not changed, they are 13% and 23%.

Financial Development and Sustainability Program - Governor Sejko meets with the World Bank team!

Governor Gent Sejko hosted a meeting today with a World Bank (WB) team, within the Financial Development and Sustainability Program, led by Rekha Reddy, in......

"Young people should be careful with the development of technology" - Activity on the occasion of International Data Protection Day

The Office of the Commissioner for the Right to Information and Personal Data Protection organized an awareness-raising activity on the importance of......

Increasing cybersecurity in energy - ERE changes rules, obligations for ISO standard include gas and some private operators

The changes that the energy sector and relevant legislation have undergone have forced the Energy Regulatory Authority to undertake changes to the regulation......

Estate agencies in a modern building - How will government real estate be managed?

The Albanian Investment Corporation has launched the "Development and Management of State Buildings" project, which aims to transform all state assets that......

Bank of Greece, 2.5% growth in 2025 - Economy will expand thanks to high investment and consumption

The Bank of Greece forecasts economic growth of 2.5% in 2025, supported by investment, high consumption and wage growth. Despite global uncertainty, the......

Britain starts a revolution at work - Over 200 companies make the work week 4 days

Around 200 companies in the UK have adopted the four-day workweek for their employees. The model is gaining ground across many sectors, offering more free......

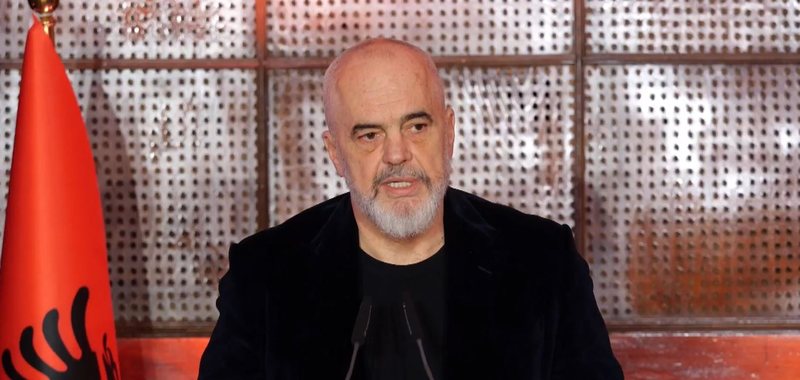

Former Film Studio into Hollywood Training Center - "Over 40 Professionals", Rama: An Encouraging and Inspiring Program

“Tirana Training Centre”, is the new center for the development of cinematography and audiovisual productions in Albania, which comes as a result of......

“Tirana Training Center”/ Gonxhja: Training for 400 students, great economic and touristic gains

The Minister of Economy, Culture and Innovation, Blendi Gonxhja, was present today at the presentation of the "Tirana Training Center", an innovative center......