Banks collected 75 billion lek from interest in 2024 - BoA: 38% increase in deposit expenses

The higher number and values of loans and transactions from citizens and businesses have meant that commercial banks' income from loan interest and commissions has continued to grow during 2024.

The latest data from the Bank of Albania shows that banks' gross interest income has reached 94 billion lek, an increase of 13.6% compared to December 2023.

Meanwhile, 2.3 billion lek more was secured from fines and commissions in 2024. The figures show an increase of 13.9%, bringing the total income from the portfolio of fines and commissions receivable to 18 billion lek at the end of 2024.

On the other hand, interest expenses, which refer to the expenses of banks to pay interest on deposits to citizens and businesses, or interest on government securities, resulted in 19 billion lek, an increase of 38%. In total, commercial banks' losses or profits from financial instruments such as treasury bills, or bonds, reached 2.3 billion lek.

According to official statistics, the largest increase in loan interest income was recorded in 2023, while the lowest expenses for deposit interest were in 2021.

The ratio between banks' profit from loan interest and their expenses for deposit interest is very large. The interest that the bank has paid on deposits constitutes only 25% of their net profit of 75 billion lek from loan interest. The profit from loan interest compared to the expenses for deposits is considerably higher, taking into account the fact that their number, value and rates are different in the bank.

Cultural heritage sites/ Gonxha: 21,800 visitors during January alone!

The Minister of Economy, Culture and Innovation, Blendi Gonxhja, published on social media the figures for January for visits to our cultural sites, which......

Construction of the Vorë-Hani i Hotit railway - EBRD extends the deadline for receiving offers from interested companies

The European Bank for Reconstruction and Development has extended the deadline for accepting bids for the construction of the Vorë-Hani i Hotit railway. The......

Kosovo, counting of votes for MPs begins - How many mandates have political parties secured so far?

The Central Election Commission in Kosovo has begun the process of counting the votes of candidates for deputies. The CEC explained that during this......

New deadline for declaring business income tax - Unified with DIVA, obligation until March 31

The tax administration has set a new deadline for businesses to declare their profit tax. The General Directorate of Taxes announces that the date for......

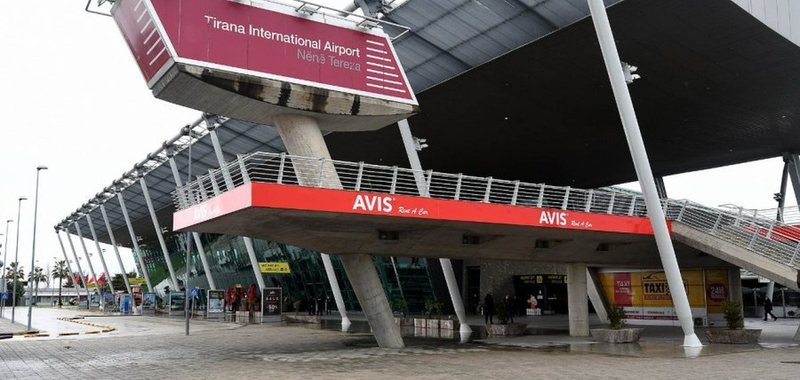

Montenegrins prefer Tirana airport - Around 53 thousand citizens from the neighboring country chose "Mother Teresa"

Around 53,000 passengers from Montenegro flew from Tirana Airport last year, Deutsche Welle reports. According to Montenegrin travel agencies, they often......

Corruption Index Report: Balkan countries are getting worse. Albania and Kosovo are improving!

People in the Balkans believe the fight against corruption has taken a downturn this year, except in Kosovo and Albania, watchdog Transparency International......

Germany ahead of elections - Citizens concerned about rising cost of living and political crisis

The majority of German citizens are concerned about high prices as Europe's largest economy is now shrinking, a poll showed ahead of the February 23......

ECB signals inflation easing - Calls for advancement of digital euro!

European Central Bank (ECB) President Christine Lagarde has told European policymakers that inflation is easing and recent rate cuts are starting to take......