ECB signals inflation easing - Calls for advancement of digital euro!

European Central Bank (ECB) President Christine Lagarde has told European policymakers that inflation is easing and recent rate cuts are starting to take effect, but warned that uncertainty remains, especially amid trade frictions and geopolitical tensions.

"Most measures suggest that inflation is converging towards our target on a sustained basis," Lagarde said during her plenary speech before the European Parliament on Monday, noting that eurozone inflation had fallen to 2.5% in January, from 5.5% a year earlier.

Despite the progress, she reaffirmed the ECB's cautious approach: "We are not committing in advance to any particular rate path," she said, warning that disruptions to global trade could still disrupt the inflation trajectory. Lagarde's comments come after the ECB cut interest rates by 125 basis points from June 2024, bringing its deposit facility rate to 2.75%.

She also stressed the urgency of advancing the digital euro, arguing that a regional payments system would reduce Europe's dependence on external providers and strengthen its financial resilience.

The eurozone economy barely expanded in 2024, with gross domestic product growing by just 0.9% year-on-year. The last quarter of the year was particularly weak, as industrial production stagnated and consumer spending remained subdued despite an improvement in real incomes.

“Manufacturing remains under pressure, but services are holding up,” Lagarde noted, offering a mixed view of the eurozone economy. “The good news is that labor markets are resilient,” she said, pointing to rising real incomes and a solid labor market as potential drivers of consumer confidence. However, “households are hesitant to spend more,” and business investment remains weak.

According to Lagarde, lower borrowing costs should gradually improve conditions, making credit more accessible to businesses and households. External demand could also provide relief, but global trade frictions pose a potential threat. “Greater frictions in global trade would make the euro area’s inflation outlook more uncertain,” Lagarde said.

Why the digital euro matters for Europe's autonomy

Beyond monetary policy, Lagarde underlined the importance of strengthening Europe's financial independence, particularly in digital payments. She noted that Europe remains overly dependent on foreign providers, leaving the region vulnerable to external economic and geopolitical changes.

"Payments are the backbone of our economy and Europe cannot afford to be overly dependent on external providers," she said. The ECB is moving forward with plans for a digital euro, which would complement physical cash while ensuring that Europe has a resilient and sovereign payments system.

Lagarde also called for progress in capital market integration, arguing that removing financial barriers could unlock investment, boost technological progress and support economic growth. "With the right framework, Europe can mobilize its large pool of savings to finance its innovation and technological progress," she said.

For those hoping for clearer guidance on future rate cuts, Lagarde's message was one of patience and flexibility. "We will follow a data-dependent, meeting-by-meeting approach to determine the appropriate monetary policy stance," she said, reinforcing the ECB's commitment to carefully assess economic conditions before making further moves.

She also indicated that the ECB is continuously refining its economic models to better navigate a rapidly changing environment. “We are making an assessment of a changed inflation environment and economic context,” she said, adding that the ECB remains focused on managing risk and uncertainty.

Concluding her speech, Lagarde left the Parliament with a clear call for European unity. "European unity was the dream of a few. It became the hope of many. Today it is a necessity for all of us," she said, underlining the need for cooperation in addressing economic challenges.

What happened in the foreign exchange market today?

The US dollar started the day on the rise, as compared to yesterday it was bought today for 95.5 lek and sold for 96.8 lek according to the local exchange......

100 villages where the "Mountain Package" will focus - Duma: If 500 beneficiary entities are exceeded, the law will be reviewed

The draft law "Mountains Package" was reviewed this Monday in the Committee on Productive Activities for Trade and Environment. But what were some of the......

Romanian President Klaus Iohannis resigns to avoid political crisis!

Romanian President Klaus Iohannis resigned from office on Monday in a move he said was to prevent the country from entering a crisis that would ensue after......

A new transatlantic trade war? Trump's tariffs could push Europe to target American tech services!

Donald Trump's plan to impose new tariffs on the European Union could provoke retaliation in an unexpected way not by taxing American goods, but by targeting......

Members added to the Albanian Electricity Exchange - Market developments, the number of entities listed on ALPEX reaches 36

About 2 years after the start of operations, the Albanian Electricity Exchange has 36 companies listed for the day-ahead market. The data is reported by......

Real estate loans dominated in 2024 - BoA: Increased by 11.5% compared to 2023

Real estate loan demand continued to dominate in 2024. In December, loans taken for real estate by individuals and businesses reached 252 billion lek. The......

Favorable energy price for water utilities - Regulatory Authority approves tariffs to be applied during 2025

The Energy Regulatory Authority has approved the prices at which water utilities supplied by the Supplier of Last Resort will pay for electricity during......

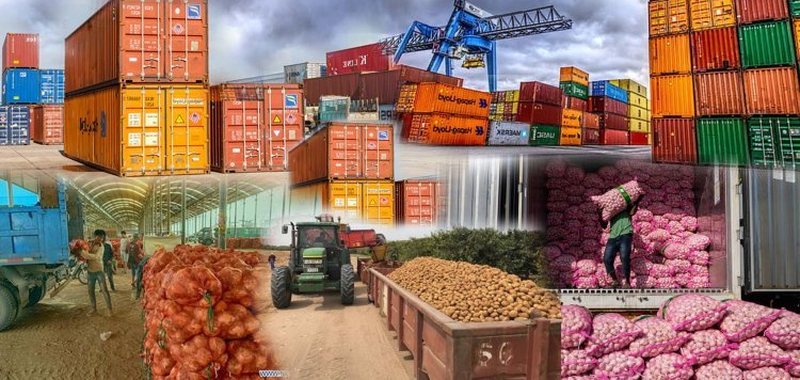

Who bought Albanian agricultural products? Cambodia and Tajikistan tried “Made in Albania” for the first time

In recent years, Albanian agricultural exports have been experiencing steady growth, contributing to the country's economic development. With a particular......