New deadline for declaring business income tax - Unified with DIVA, obligation until March 31

The tax administration has set a new deadline for businesses to declare their profit tax.

The General Directorate of Taxes announces that the date for declaring Profit Tax and DIVA 2024 has been unified.

Thus, like the annual business declaration, the DIVA or the 2024 Profit Tax declaration, will have a deadline of March 31, 2025. Failure to declare on time will result in a fine for taxpayers in the country.

The Simplified Profit Tax Declaration for taxpayers with turnover up to 8 million lekë, for which the deadline was February 10, 2025, is excluded from this deadline.

This year, the rules for declaring income through DIVA will be different than before. The Income Tax Law defines the categories of those who must declare their income to the tax administration. Specifically, an individual is required to file an annual personal tax return when their annual taxable income is more than 1.2 lek per year from all sources.

When he is in an employment relationship with more than one employer, regardless of the amount of income he receives from the employers. As well as when he has more than 50,000 lek of any other income that is not subject to final tax at source. Also, every natural person who carries out economic activity is obliged to submit an annual tax declaration for business income.

According to official data from the Tax Administration for 2023, DIVA was completed by 73,790 individuals, of which 24,224 individuals with income over 2 million lek, a threshold that was in effect until 2023, and 49,566 dual-employed individuals.

With the new threshold of 1.2 million lek, the number of individuals who have a declaration obligation reaches around 140 thousand employees.

In cases where individuals, for one reason or another, do not file their declaration on time, they are penalized with a fine of 3,000-10,000 lek.

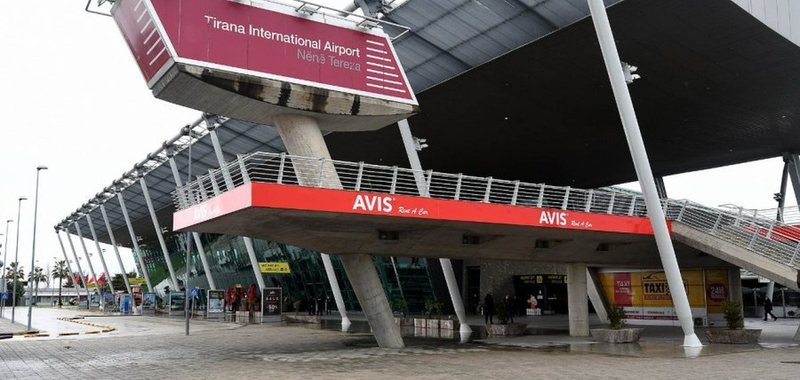

Montenegrins prefer Tirana airport - Around 53 thousand citizens from the neighboring country chose "Mother Teresa"

Around 53,000 passengers from Montenegro flew from Tirana Airport last year, Deutsche Welle reports. According to Montenegrin travel agencies, they often......

Corruption Index Report: Balkan countries are getting worse. Albania and Kosovo are improving!

People in the Balkans believe the fight against corruption has taken a downturn this year, except in Kosovo and Albania, watchdog Transparency International......

Germany ahead of elections - Citizens concerned about rising cost of living and political crisis

The majority of German citizens are concerned about high prices as Europe's largest economy is now shrinking, a poll showed ahead of the February 23......

ECB signals inflation easing - Calls for advancement of digital euro!

European Central Bank (ECB) President Christine Lagarde has told European policymakers that inflation is easing and recent rate cuts are starting to take......

What happened in the foreign exchange market today?

The US dollar started the day on the rise, as compared to yesterday it was bought today for 95.5 lek and sold for 96.8 lek according to the local exchange......

100 villages where the "Mountain Package" will focus - Duma: If 500 beneficiary entities are exceeded, the law will be reviewed

The draft law "Mountains Package" was reviewed this Monday in the Committee on Productive Activities for Trade and Environment. But what were some of the......

Romanian President Klaus Iohannis resigns to avoid political crisis!

Romanian President Klaus Iohannis resigned from office on Monday in a move he said was to prevent the country from entering a crisis that would ensue after......

A new transatlantic trade war? Trump's tariffs could push Europe to target American tech services!

Donald Trump's plan to impose new tariffs on the European Union could provoke retaliation in an unexpected way not by taxing American goods, but by targeting......