Average personal tax rates in Europe: Which countries saw the biggest increases in 2024?

Workers pay not only income tax but also social security contributions. Together, these two components make up the average personal tax rate, expressed as a percentage of gross earnings. This combined rate is often referred to as the "tax burden". Average personal tax rates vary considerably across Europe and tend to change annually in most countries, directly affecting net income.

So which countries had the highest personal income tax and employee social security contributions in 2024? And where were the biggest annual increases or decreases in average personal tax rates observed? According to the OECD's Taxation Wages 2025 report and Eurostat data, among EU countries, the United Kingdom, three EFTA members and candidate country Turkey, the personal income tax rate ranged from 4.1% in Cyprus to 35.7% in Cyprus.

These figures reflect the average salary of a single worker without children, expressed in national currency values. Employee social security contributions ranged from zero in Denmark to 29.9% in Romania, followed by Slovenia at 23.6%. These rates do not include what employers also pay for social security. They are often equal to or even more than the employee's share.

Significant gap in average personal tax rates

In 2024, average personal tax rates ranged from 15.6% in Cyprus to 39.7% in Belgium. This means that two out of every five euros in gross income went to tax in Belgium. In seven EU countries, average personal tax rates exceeded a third of gross income. In addition to Belgium, this group included Lithuania (38.2%), Germany (37.4%), Romania (36.9%), Denmark (35.7%), Slovenia (35.6%) and Hungary (33.5%).

In five other EU countries, average personal tax rates exceeded 30%: Austria (32.7%), Luxembourg (32.1%), Croatia (30.9%), Italy (30.4%) and Finland (30.3%). Overall, in 12 EU countries, at least three out of every ten euros of a worker's salary goes directly to income tax and social security contributions.

Apart from Cyprus, Switzerland is the only country where the average personal tax rate remains below 20%. It was also below the 25% level in Estonia (20.5%), the Czech Republic (21%), the United Kingdom (21.4%), Bulgaria (22.4%), Spain (22.5%), Sweden (23.1%), Poland (24%) and Slovakia (24.1%).

Among Europe’s five major economies, Germany has the highest average personal tax rate at 37.4%. Italy follows with 30.4%, which is 7 percentage points lower. France is in the middle with 28%. The United Kingdom has the lowest rate at 21.4%, with Spain slightly higher at 22.5%. There is a 16 percentage point difference between Germany and the United Kingdom, which is mainly due to a significant gap in employees’ social security contributions: 20.7% versus 5.9%.

Changes in average tax rates in 2024

In more than half of the countries, annual changes in average personal tax rates were minimal, ranging between -2% and +2%, with no change in some countries. However, some countries saw significant increases or decreases. Italy recorded the highest increase, with its average personal tax rate rising from 28.3% to 30.4% – an increase of 7.5%, or more than 2 percentage points.

Cyprus followed with a 6.9% increase. The average personal tax rate also increased by more than 4% in Slovenia, Estonia and the Czech Republic. The United Kingdom (-8.6%) and Portugal (-8%) were clear exceptions in 2024, with large tax cuts resulting in average personal tax rate reductions of at least 8%. In both the United Kingdom and Portugal, rates fell by more than 2 percentage points.

Two Nordic countries, Sweden and Denmark, also reduced their rates, both by 3.7%. In Southern Europe, tax rates were mostly increased in 2024, especially in Italy, Cyprus and Spain. In Eastern Europe, the trend was mixed, with some countries seeing increases while others remained unchanged. All of the above figures are based on a single person with an average income without children. Average personal tax rates can vary significantly depending on the family situation, especially due to changes in personal income tax.

In general, single individuals without children pay the highest income tax, while families with children tend to pay less, which lowers their average tax rate. For data on different marital statuses and family types, see our full article titled: Personal Income Tax Rates in Europe.

Birth bonus, only 1 million euros are given - 3-month period/ Falling birth rate, 4 million euros remain "stock"

Only 1 million euros have been distributed to babies born in the first 3 months of this year in Albania. Official data from the Ministry of Finance show......

Rama awaits Sánchez: Spain's continued support for Albania's European integration!

Prime Minister Edi Rama hosted today in a meeting the Prime Minister of the Kingdom of Spain, Pedro Sánchez, who is in Tirana within the framework of the......

The sixth summit of the European Political Community begins in Tirana

The sixth summit of the European Political Community begins its work today in Tirana under the logo "New Europe in a new world", marking its first meeting in......

Greece, tourism generates over 30 billion euros - The sector gave "breathing space" to the economy and employment in 2024

The direct contribution of tourism to the Greek economy in 2024 is estimated to be 30.2 billion euros. The data comes from a study by the Institute of the......

How did this week end for the major currencies?

The European currency, although with slight fluctuations for some time, now remains at relatively constant values against the local currency, being bought......

Rutte arrives in Tirana/ Rama: Further strengthening of Albania's role in NATO!

Prime Minister Edi Rama hosted today a meeting with NATO Secretary General Mark Rutte, who is in Tirana as part of the European Political Community......

Priority PPPs, in intersectoral filter - Draft: Selection Committee to be established, institutions that can grant concessions expanded

Setting priorities and identifying concession or public-private partnership projects that merit specialized expertise will be done by a special......

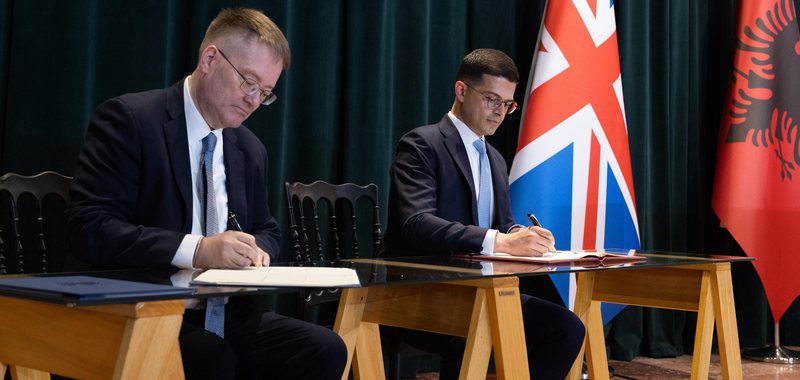

Albania, production of military vehicles with Britain - Agreement signed for their joint sale

In cooperation with Great Britain, Albania will produce and sell military vehicles. A Joint Declaration on Advancing Bilateral Cooperation on Common......