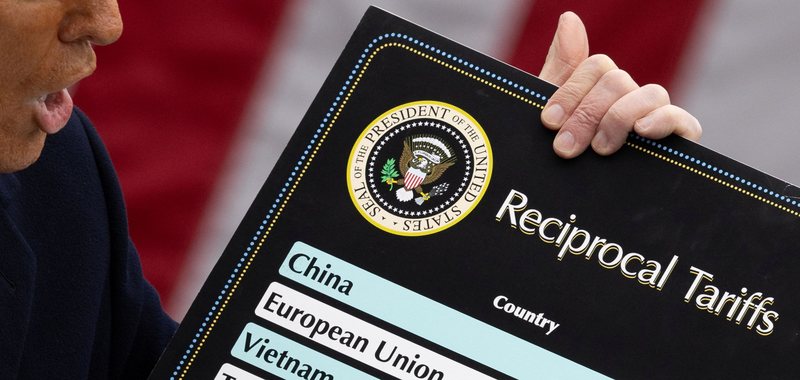

“High inflation could be prolonged” - Fed chief warns of effect of Trump tariffs

Inflation is likely to rise due to President Donald Trump's sweeping tariffs and could remain high, Federal Reserve Chairman Jerome Powell said.

“We face a very uncertain outlook with heightened risks, both for higher unemployment and for higher inflation,” he said. “While tariffs are expected to generate at least a temporary increase in inflation, it is also possible that the effects will be more lasting.”

Powell's latest comments come just days after the Trump administration unveiled the sharpest tariff escalation ever in the U.S., based on data dating back 200 years, Fitch Ratings said, exceeding tariffs imposed under the 1930 Smoot-Hawley Act. A 10% tax on all U.S. imports will take effect on Saturday, with higher duties scheduled for April 9.

Trump's tariffs were worse than expected, sparking a global stock market sell-off this week. Economists at JPMorgan now see a 60% chance of a global recession if the tariffs remain in place. Several forecasters expect consumer prices, especially for cars, to rise this year.

Trump’s risky gamble to correct trade imbalances and bring manufacturing back to the U.S. could send the economy into “stagflation,” a toxic combination of stagnation and rising unemployment, along with accelerating inflation. The Fed will have to handle this situation as it did in the 1970s.

Shortly before Powell's speech, Trump in a post on his social media platform called on the Fed to lower borrowing costs, accusing the central bank leader of playing political games.

"This would be a perfect time for Fed Chairman Jerome Powell to lower interest rates," Trump wrote.

Fed officials are holding off on cutting interest rates, waiting for inflation to slow further and to see how Trump's major policy changes play out in economic data. They still expect to cut rates at some point this year, according to the latest economic projections released last month.

The Fed cut interest rates three times last year as inflation slowed. But that progress stalled toward the end of the year, weakening the chances of further cuts. The Federal Reserve kept borrowing costs steady last month.

America's labor market also remains solid, according to new government data, meaning there is no urgent need for the Fed to provide relief to the economy through additional cuts.

But the tariffs recently approved by Trump, if they are not rolled back, promise to have far-reaching effects on the U.S. economy. If those effects are higher inflation and rising unemployment, Fed officials will have to make some very difficult choices. The central bank is tasked by Congress to maximize employment and stabilize prices.

The Consulate General of Albania in Ulcinj is inaugurated - Hasani: "We are dedicated to the development and well-being of Albanians wherever they live"

A historic day today in Ulcinj, in the city of natural, historical and cultural treasures where the Consulate General of Albania was inaugurated, in the......

Exports of medicinal plants, at risk! - Requests to the government: 10% VAT refund, as much as Trump's tariff

The Albanian Medicinal and Aromatic Plant Industry, in a statement to the media regarding the imposition of a 10% tariff by US President Donald Trump on......

Ballots for the diaspora arrive in Albania - CEC publishes guide to help emigrants

250,724,000 ballots have arrived for voters living and working in different countries around the world. Chief Commissioner Ilirjan Celibashi announced that......

What are the safest currencies on the market that are withstanding Trump's ongoing tariffs?

Investors are flocking to safe-haven assets after US President Donald Trump announced a series of reciprocal tariffs last week, and many analysts are......

The bank network expanded with 11 new branches - BoA: There are about 400 throughout the country. The number of foreign exchange points also increased

In the past year, the banking network in Albania has expanded with 11 new branches. This wider spread of banks in the territory further increases financial......

How much are fashions affected by US tariffs? - Zekja: Our exports will be affected by the taxes imposed on Europe

For imports from various countries around the world, the President of the United States of America, Donald Trump, applied additional tariffs. It imposed a......

Rritet numri i rasteve të krimit kompjuterik - Dokuzi: Në fokus sektori financiar, por edhe informacioni privat

Zhvillimi i teknologjisë viteve të fundit ka thjeshtuar shtigjet për të huajt, por edhe për shqiptarët, për të zgjeruar aktivitetin e krimit......

"Tender winners, highest bids" - KPP overturns the decisions of the institutions, the state budget was saved about 536 million lek

During 2024, state institutions announced the winners of tenders to companies with the highest economic bids, risking millions of lek more being paid from......