Why does the EBRD trust OSHEE?

Why does OSHEE take out loans when its balance sheets are profitable?

By Fatos Çoçoli

The government approved several decisions in its last meeting, one of which was related to the 20 million euro guarantee agreement between the Ministry of Finance and "Tirana Bank", for the needs of the OSHEE group.

Referring to the data in the balance sheet, the largest public company in the electricity sector results in profits in the years 2023-2024, in the amount of over 120 million euros. And this year, OSHEE is expected to close with a profit again.

The government reduced the price without damaging investments in OSHEE

In February of last year, the Government reduced the price of electricity for household consumers by 11 percent for the first time, without affecting OSHEE's investment plan, a reduction that was justified by the company's stable economic results and financial soundness.

Naturally, the question arises: why should OSHEE Group take out a loan from a bank, especially a private one, when the financial results show positive data?

Referring to documents made public, during the ratification in the Parliament of the Loan Agreement with the European Bank for Reconstruction and Development (EBRD), OSHEE had timely initiated negotiations with banks for the restructuring of loans taken during the 2021 energy crisis.

Due to high import prices, the public company faced increased energy purchase costs, for which it received state guarantees for a loan worth 81.5 million euros. The debt was mainly overdraft, with fast repayment terms and unfavorable interest rates, but the immediate need to supply the country with imported energy was great.

Why does the EBRD trust OSHEE?

The consolidation of the OSHEE group's finances after 2021, as well as the ever-increasing performance indicators, enabled the company to enter into negotiations with banks to restructure the 81.5 million euro debt, from the terms of an overdraft facility, into a long-term loan with favorable repayment terms.

The invitation was positively responded to by the European Bank for Reconstruction and Development (EBRD), which undertook to finance around 45 million euros in loans, a guarantee agreement, which was approved by the Parliament in the middle of this year.

The conditions were favorable, as from the overdraft, OSHEE would now repay the loan over a long-term period of 12 years (where in the first three years it would not pay principal), with an interest rate of 1% plus 6-month Euribor.

Under the same conditions, the government yesterday approved the guarantee agreement with "Tirana Bank", for the amount of 20 million euros, which will be followed up for the remaining part with another international commercial bank, the Austrian "Raiffesen Bank".

Debt restructuring in the above terms allows OSHEE to repay its obligations to banks on time, and not just the interest (as was the case with overdrafts). On the other hand, this restructuring does not force the public company to freely manage its revenues, part of which goes to investments.

According to financial data and public statements, OSHEE has repaid its debts from its own revenues, without the need for liquidity directly from the state budget, even though it has benefited from a sovereign guarantee. The latter is a document that allows the public company to negotiate freely with banks and borrow at favorable interest rates.

Development through refinancing?

If the OSHEE group continues to make profits in the coming years, it is likely that the restructuring of loans, i.e. the refinancing mechanism, moving from overdrafts to long-term loans, will be seen as an implementation option for other debts it has with banks.

The fact that OSHEE is currently investing through loans, from international financial institutions such as the EBRD, the Germans of KfW, the Italian Cooperation, and most recently from the French of AFD, is another guarantee that increases the credibility of the public company in the eyes of strategic investors.

Nine European banks create a company to issue cryptocurrencies

Italian bank UniCredit and Austrian bank Raiffeisen Bank International have announced that they will, together with seven other European banks, establish a......

Olta Xhaçka elected Vice-President of the Parliamentary Assembly of the Council of Europe

Albania has secured a high level of representation in the Parliamentary Assembly of the Council of Europe, following a unanimous decision that elected......

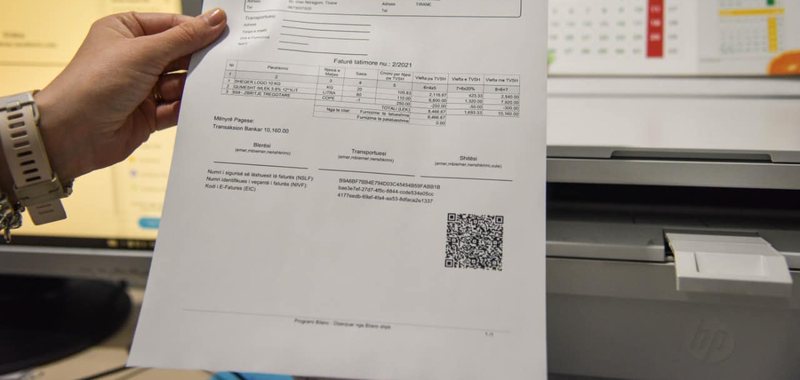

The difference between a fiscalized and an unfiscalized invoice, Taxes message for business and citizens

The tax administration asks citizens and taxpayers to cooperate in the fight against informality and tax evasion. Through a video, the tax authorities......

Are businesses ready for European brands? - Expert Laknori: Legislation is 100% harmonized with the EU

Albania is in the process of integrating into the EU and businesses will be among the main actors that must adapt to the rules, standards and competition of......

GDP expands by 3.46% in the second quarter/ Administration, trade and tourism stimulated economic growth

The economy in our country during the first two quarters of the year had a positive performance that was stimulated by the increase in income in its main......

VIII Energy Corridor - Government Program: Construction of the underwater line with Italy begins within this mandate

"The construction of the Albania-Italy underwater transmission line will begin within this government mandate." The objective is foreseen in the approved......

Albanians do not "share" the euro even in savings - BoA: Deposits in broad money, 1.43 trillion lekë. Those in foreign currency, the largest increase

Albanians are not separated from the euro even when it comes to savings, as most of our money in the bank turns out to be in foreign currency. According to......

"Restrictions" do not stop home loan/ August marks growth for individuals, loans for businesses continue to shrink

According to the latest data from the "Bank of Albania", total credit reached 900.5 billion lek in August 2025, with a significant increase of 11% compared......