The difference between a fiscalized and an unfiscalized invoice, Taxes message for business and citizens

The tax administration asks citizens and taxpayers to cooperate in the fight against informality and tax evasion. Through a video, the tax authorities explain what a fiscalized invoice is and the legal obligation to issue and request it.

Notice to citizens and taxpayers

The difference between a fiscalized and a non-fiscalized invoice

The Tax Administration reminds taxpayers that, pursuant to Law No. 87/2019, "On invoicing and the circulation monitoring system", they are obliged to issue fiscalized invoices for every sale of goods or provision of services.

On the other hand, we bring to the attention of citizens that they also have an important role in the implementation of this law. Every citizen must request and be provided with a tax invoice for every purchase or service performed.

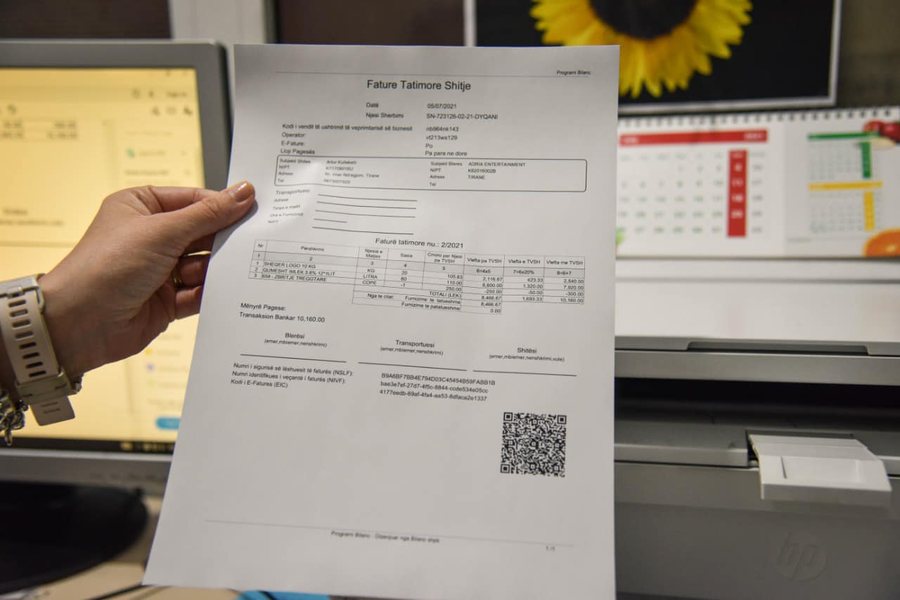

The Tax Administration clearly illustrates the difference between a fiscalized invoice and a non-fiscal invoice, highlighting the elements that make them identifiable.

The fiscalized invoice contains the following elements:

• Unique Invoice Identification Number (NIVF) – a unique code for each fiscalized invoice, linking the invoice to the issuing entity.

• Billing Issuer Security Number (NSLF) – ensures accurate identification of the issuer.

• QR Code – which can be scanned and verified in real time through the Tax Administration system.

These invoices are automatically registered in the Tax Administration system at the time of issuance.

The non-fiscal invoice does not contain any of the above elements and does not guarantee that the transaction is registered, creating opportunities for tax evasion.

???? Attention: Even if a non-fiscal invoice visually resembles a fiscalized one, its verification is possible by scanning the QR code. If this code is missing or does not work, the invoice is not fiscalized.

Receiving an invoice is a legal right and obligation and a way to ensure that all economic transactions are transparent and declared.

Failure to receive an invoice favors informality and tax evasion, which harms the business climate, the economy, and the public interest.

To combat informality and with the aim of formalizing various sectors of the economy, we call on citizens and businesses to implement the law on issuing and providing fiscalized invoices, as well as to denounce abusive cases through the official channels of the Tax Administration.

Are businesses ready for European brands? - Expert Laknori: Legislation is 100% harmonized with the EU

Albania is in the process of integrating into the EU and businesses will be among the main actors that must adapt to the rules, standards and competition of......

GDP expands by 3.46% in the second quarter/ Administration, trade and tourism stimulated economic growth

The economy in our country during the first two quarters of the year had a positive performance that was stimulated by the increase in income in its main......

VIII Energy Corridor - Government Program: Construction of the underwater line with Italy begins within this mandate

"The construction of the Albania-Italy underwater transmission line will begin within this government mandate." The objective is foreseen in the approved......

Albanians do not "share" the euro even in savings - BoA: Deposits in broad money, 1.43 trillion lekë. Those in foreign currency, the largest increase

Albanians are not separated from the euro even when it comes to savings, as most of our money in the bank turns out to be in foreign currency. According to......

"Restrictions" do not stop home loan/ August marks growth for individuals, loans for businesses continue to shrink

According to the latest data from the "Bank of Albania", total credit reached 900.5 billion lek in August 2025, with a significant increase of 11% compared......

"Albania, a regional leader in technology and science" - Prime Minister Rama, at the Nanotechnology Congress: Programs for digital systems

The International Nanotechnology Congress was held in Tirana, as a space for dialogue and new opportunities. The head of government, Edi Rama, described......

Railway projects, a "condition" for decarbonization - World Bank: Economic and environmental benefits are great

Rail, whether diesel or electric, is much more energy efficient and emits less CO₂ per passenger-km or tonne-km than almost all other forms of transport,......

Do Albanians know the value of property? - AFSA: Fires brought "zero" awareness to insure it. 1.5% drop in premiums

With 128 fires burning nearly 60,000 hectares of land, causing irreparable damage even to homes, this summer's alarming situation has not served as a turning......