“Banka e re Ziraat do të rrisë konkurrencën në treg” - Zefi: Qytetarët do të përfitojnë nga produkte të reja dhe ulje të normave të interesit

Pas vitesh të tëra konsolidimi, tregu bankar pritet të pësojë tashmë ndryshime të rëndësishme me dhënien nga ana e Bankës Qendrore, të miratimit paraprak për licencimin e Ziraat Bank. Ziraat, duhet të përmbushë edhe disa kushte të tjera përpara se të hapet zyrtarisht për të ofruar produktet e saj për qytetarët dhe bizneset shqiptare.

Sipas pedagogut Altin Zefi, futja e një aktori të ri në treg do të rrisë edhe më tej konkurrencën, e cila mund të përkthehet në uljen e çmimeve të produkteve, si në rastin e normave të interesit.

“Mund të ndikojë në rritjen e konkurrencës dhe të detyrojë bankat e tjera që të ulin normat e interesit, të ofrojnë produkte të reja për huamarrësin dhe gjithashtu të investojnë në teknologji të reja, të përmirësojnë operacionet, të ulin kostot operacionale në mënyrë që të rrisin efikasitetin. Pra, mund të krijojë përfitime direkte për qytetarët dhe bizneset e vogla me uljen e kostove të huamarrjes”, nënvizoi Zefi.

Duke qenë një bankë e specializuar për financim në bujqësi, me futjen në tregun shqiptar, Ziraat Bank pritet të përballet edhe me disa sfida të cilat lidhen me nivelin e lartë të informalitetit në bujqësi dhe mungesën e kolateralit nga bujqit.

“Banka Ziraat duhet të njihet me tregun shqiptar dhe duhet të përshtatet me tregun shqiptar, me sfidat, të cilat mund të jenë sfida strukturore, sfidat e informalitetit, mungesa e hipotekave për tokat bujqësore, aftësia pra për të lënë kolateral nga bujqit është në nivel të ulët dhe si e tillë, ata duhet të përshtatin produktet e tyre. Gjithashtu, duhet marrë parasysh që Banka Ziraat ka njoftuar se nuk do të fokusohet vetëm në bujqësi, kështu që do të shohim se si do të operojë, se sa përqind e aseteve të saj dhe investimit të saj do të shkojë për zhvillimin buqësor”, tha pedagogu.

Zefi u shpreh ndër të tjera se rritja e financimit dhe e kreditimit, do të nxisë rritjen afatgjatë ekonomike.

Intervista e plotë me Pedagogun Altin Zefi

“Hyrja e një banke si Ziraat, pas 19 vitesh siç e përmendët edhe ju, mund të ketë implikime të rëndësishme. Sipas teorisë së konkurrencës, shtimi i një aktori të rëndësishëm në treg, siç është Banka Ziraat, mund të ndikojë në rritjen e konkurrencës, mund të ndikojë në çmimet e produkteve siç janë normat e interesit, pra mund të krijojë përfitime direkte për qytetarët dhe bizneset e vogla me uljen e kostove të huamarrjes. Gjithashtu, ka implikime edhe për tregun bankar. Duke qenë se një bankë e tillë me një përvojë shumë të gjatë, më shumë se 100 vite mund të themi në tregun bankar dhe sidomos me ndikimin e saj në bujqësi dhe me financimet në bujqësi, mund të ndikojë në rritjen e konkurrencës dhe të detyrojë bankat e tjera që të ulin normat e interesit, të ofrojnë produkte të reja për huamarrësin dhe gjithashtu të investojnë në teknologji të reja, të përmirësojnë operacionet, të ulin kostot operacionale në mënyrë që të rrisin efikasitetin. Pra, mund të krijojë një dinamizëm të ri. Mund të jetë një shok për sistemin, një shok i vogël, sigurisht në varësi të masës së investimit që Banka Ziraat do të ofrojë dhe mund të jetë pozitive për ekonominë shqiptare.

Kjo gjithashtu sigurisht krijon edhe sfida, sepse do të detyrojë bankat ekzistuese (një treg tashmë që është i konsoliduar në Shqipëri, por që ka potencial për t'u zhvilluar, ka akoma kapital të papërdorur me të cilin mund të jepet hua), mund të ndikojë në uljen e marzhit të fitimit, që mund t'i detyrojë bankat të ndërmarrin rreziqe të pajustifikuara në huadhënie.

Megjithatë, pritet të ketë ndikim pozitiv në përgjithësi në ekonomi. Sigurisht që Shqipëria është një vend me një nivel kreditimi shumë të ulët në rajon, krahasuar me rajonin, për sa i përket krahasimit me GDP-në, jemi rreth 35% e kreditimit në ekonomi, dhe bujqësia sidomos, një nga sektorët strategjikë të Shqipërisë zë një përqindje shumë të vogël në krahasim me rajonin.

Teoria ekonomike thotë që me rritjen e financave, pra me rritjen e financimit dhe produkteve të reja nga një bankë e specializuar në këtë fushë, mund të ketë përfitime direkte dhe të shpejta për huamarrësin, sidomos për familjarët dhe bizneset e vogla në bujqësi. Bujqësia, siç e përmenda më herët është një nga sektorët strategjikë, 18% e GDP, e Produktit të Brendshëm Bruto të Shqipërisë e ka origjinën nga bujqësia dhe rreth 1/3 e të punësuarve janë të punësuar në bujqësi, pra një sektor tepër i rëndësishëm për Shqipërinë, por me financim minimal, rreth 1.7% ose poshtë nivelit të 2% është disproporcional krahasuar me të gjitha vendet e tjera. Duke qenë sektor aq i rëndësishëm, rritja e financimit dhe produktet e reja që Ziraat mund të ofrojë për tregun bankar shqiptar dhe ekonominë shqiptare, do të nxisin rritjen ekonomike, pra rritja e financimit dhe rritja e kreditimit është e lidhur, sipas shumë studimeve, direkt me rritjen afatgjatë ekonomike.

Megjithatë, kjo ka rreziqet dhe sfidat e saj. Banka Ziraat duhet të njihet me tregun shqiptar dhe duhet të përshtatet me tregun shqiptar, me sfidat, të cilat mund të jenë sfida strukturore, sfidat e informalitetit, mungesa e hipotekave për tokat bujqësore, aftësia pra për të lënë kolateral nga bujqit është në nivel të ulët dhe si e tillë, ata duhet të përshtatin produktet e tyre me tregun shqiptar. Gjithashtu, duhet marrë parasysh që Banka Ziraat ka njoftuar se nuk do të fokusohet vetëm në bujqësi, kështu që do të shohim se si do të operojë, se sa përqind e aseteve të saj dhe investimit të saj do të shkojë për zhvillimin buqësor, por që bujqësia shqiptare do të jetë ajo që do të përfitojë më shumë. Do të jetë një përfitim i rëndësishëm, sepse niveli tashmë është tepër i ulët dhe specializimi i Bankës Ziraat në investimet në bujqësi do të përbëjë një faktor të rëndësishëm për zhvillimin e këtij sektori strategjik për Shqipërinë.”

“6.7 mld euro të ardhura nga turizmi” - Strategjia 2030, “luftë” informalitetit. Rritje e shtretërve, por jo për qiratë afatshkurtra

Strategjia e re Kombëtare për Turizmin 2025–2030 vendos objektiva ambiciozë për transformimin e sektorit në një shtyllë të zhvillimit ekonomik të......

Korriku 2025, i treti më i nxehtë në histori - Ndryshimet klimatike nuk janë ndalur, pavarësisht fundit të valës “rekord”

Korriku i këtij viti ishte i treti më i nxehtë i regjistruar në nivel global, sipas të dhënave të fundit nga Shërbimi i Ndryshimeve Klimatike Copernicus......

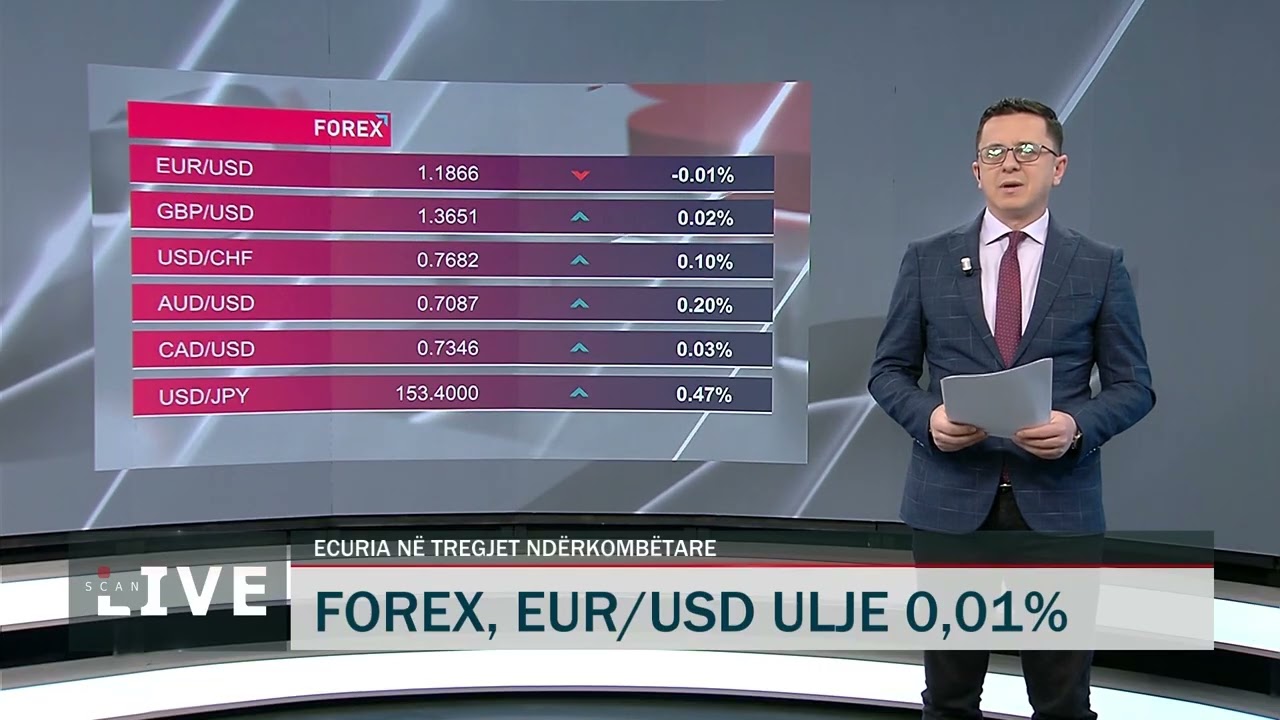

Rënie përgjithshme në tregun valutor – Dobësohen monedhat e huaja!

Dollari amerikan ka vijuar edhe këtë të enjte të pësojë rënie kundrejt monedhës vendase pasi në raport me një ditë më parë është blerë sot me 82.5 lekë dhe......

Britania, në kërkim të “frymëmarrjes” financiare - Qeveria duhet të rrisë taksat për të ulur deficitin buxhetor

Britania e Madhe do të duhet të rrisë taksat për të mbuluar një hendek në shpenzimet qeveritare që pritet të arrijë mbi 40 miliardë paund, për shkak të......

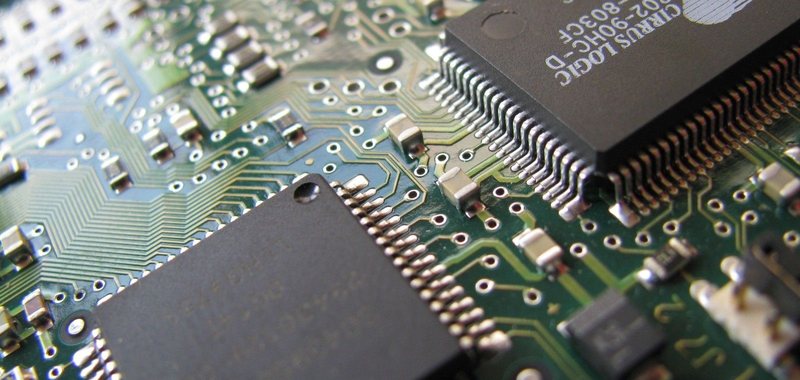

SHBA, tarifa 100% për importet e çipeve - Përjashtohen kompanitë që prodhojnë në territorin amerikan

Shtetet e Bashkuara do të vendosin një tarifë prej 100% për gjysmëpërçuesit e importuar nga vendet që nuk prodhojnë në SHBA ose nuk planifikojnë ta......

Apple, 100 miliardë USD investime në SHBA - Vendimi synon të shmangë tarifat e mundshme ndaj kompanisë

Presidenti Donald Trump njoftoi se Apple do të investojë 100 miliardë dollarë shtesë në Shtetet e Bashkuara. Ky veprim do të zgjerojë angazhimin e kompanisë......

Tarifat japin rezultatet e para - Tkurret me 4.6 miliardë dollarë deficiti tregtar i SHBA-së me Kinën

Deficiti tregtar i SHBA-së me Kinën u tkurr ndjeshëm në muajin qershor, ndërsa tarifat e Presidentit Donald Trump hynë në fuqi plotësisht. Të dhënat e fundit......

Vijon aksioni për “çlirimin” e hapësirave publike - Mbi 36 mijë metër katror e liruar në Tiranë. Malaj: Në fokus, sundimi i ligjit

Aksioni për lirimin e hapësirave publike nga tavolinat dhe karriget që kanë zaptuar trotuaret vazhdon me intensitet në të gjithë vendin. IKMT vijon aksionin......