Commercial banks are under in-depth investigation - Competition Authority: Abuse in the life insurance market for loans

The Competition Authority has launched an in-depth investigation into second-tier banks. According to the official announcement, an in-depth investigation procedure has been opened in the life insurance intermediation market for loans that require life insurance for enterprises.

A few months ago, the Competition Authority launched a preliminary investigation that included the opening of investigative procedures to avoid obstacles, restrictions, distortions of competition in the life insurance market for credit. In assessing the data obtained during the preliminary investigation phase in the life insurance market for credit, the Authority concluded that the conduct of the undertakings may constitute a violation of Article 4 of the Law on the Protection of Competition, which includes agreements, which have as their object or effect the obstacle, restriction or distortion of competition in the market, in particular agreements that determine, directly or indirectly, purchase or sale prices, or any other trading conditions, share markets or sources of supply, and others. Meanwhile, the conduct of the undertakings may also constitute a violation of Article 9 for abuse of a dominant position in the market.

For these reasons, it was decided to open an investigation procedure. The in-depth investigation covers the period from November 2021 to March 2025.

From the preliminary investigation, almost all banks are licensed as “Brokers” in insurance by the Financial Supervisory Authority. However, not all of them apply mandatory life insurance in case of borrowing. During the monitoring, it was observed that banks licensed as “Brokers” present the portfolio of insurance companies with which they have active contracts, and then allow customers to make their selection after the conditions of mediation regarding the life insurance product have been explained to them. Despite the explanation provided in writing by the second-tier banks, it turns out that the percentage of the total life insurance market according to the AFSA statistical report for 2023 is not reflected in the division of the life insurance portfolio for loans.

Given the fact that such a market share for a single product does not reflect the total division of the life insurance market, it may result from exclusionary behaviors of an anti-competitive nature, making customers not free to choose life insurance for loans from insurance companies selected by them.

How much does a public master's degree cost a student in Albania? Analysis by faculties, average prices range from 99 thousand to 210 thousand lekë

In Albania, pursuing a master’s program at public universities comes with varying costs, depending on the faculty, study program, and credit load. A Scan......

The administration is not only "attracting" new applicants/ In 2024, cases of dismissals from the civil service decreased by 36%.

Demand for a civil service job has been high in recent years, with around 17.5 applicants applying for a position in 2024 alone. A high number of applicants......

Trump's tariffs take effect - New measures "shock" markets. China is punished with a 104% tax

President Donald Trump's "reciprocal" tariffs on dozens of countries have taken effect, including massive 104 percent duties on Chinese goods. Trump's......

DP presents program for Security and Order - Berisha: They will be the absolute greatest priority

The “Democratic Party-Alliance for a Greater Albania” has presented its program for Security and Order. According to Sali Berisha, for the DP and its......

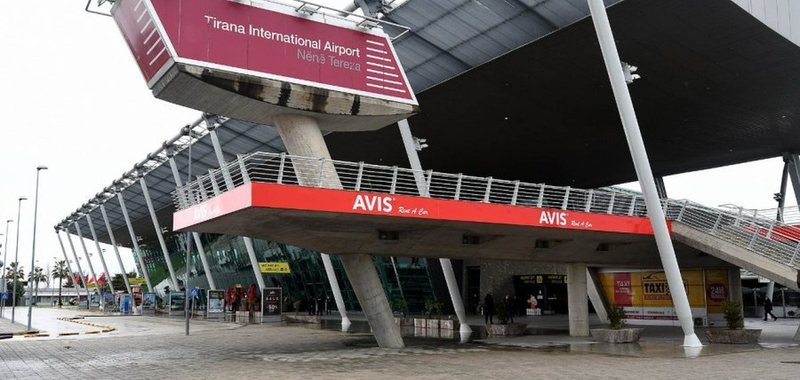

"Safe Stay in Albania" - Border Police increases measures at Rinas Airport for the tourist season

"Mother Teresa" International Airport, as the main air gateway of Albania, is preparing for a summer season with a high influx of travelers. Under the motto......

"Albania, with a stable outlook" - Moody's Agency confirms the rating at "Ba3"

In its latest report, the prestigious international rating agency Moody's has confirmed Albania's rating at "Ba3" with a "stable" outlook, highlighting the......

Expofestival unites music and the creative economy - Pipa: Focus, employment opportunities and increasing professional capacities

For the first time, a music and arts expo festival will be organized in Tirana from April 11 to 13. In a press conference, the Deputy Minister of Economy,......

Velipoja and Ulcinj with new energy connection? ERE: The project foresees the construction of a 110 kV line with a length of 27 km

The Parliament of Montenegro has recently ratified the agreement with Albania for the construction of a new bridge over the Buna River, which will shorten......