In lek or in euros, how do Albanians store their money? BoS: Foreign currency deposits, with a decrease in June. Factor, the depreciation of the European currency

After three months of decline, it seems that deposits included in broad money have returned to growth. According to newly published data from the Bank of Albania, the value of deposits included in broad money increased slightly by 0.3% compared to May. Specifically, at the end of last month, total deposits were almost 1.39 trillion lek.

Deposits included in broad money refer to all money that citizens and businesses hold in banks, i.e. money in bank accounts, savings accounts, short-term or long-term deposits, and others.

If we refer to the currency, deposits in foreign currency reach higher values than those in lek. So, most of our money in the bank turns out to be in foreign currency. However, compared to May, savings in foreign currency have decreased. The depreciation of the euro has pushed many citizens to move away from keeping savings in the European currency and to choose more deposits in lek. Also, interest rates on deposits in euro have been very low.

Deposits in the national currency are estimated at 655 billion lek, 1.5% more than in May. Meanwhile, deposits in foreign currency reach a figure of 733 billion lek, a value about 0.7% lower than in the previous month.

Meanwhile, the latest data from the Bank of Albania shows that transferable deposits, which refer to the money we hold in our bank accounts, continue to be in higher amounts, followed by demand deposits and other types of deposits.

Transferable deposits in lek reached 381 billion lek in May, while those in foreign currency decreased to 360 billion lek. On the other hand, demand deposits and other deposits in lek resulted in a slight increase.

Meanwhile, as regards foreign currency deposits included in broad money, the figures show an increase in highly liquid deposits (demand deposits) and a decrease in other types of deposits.

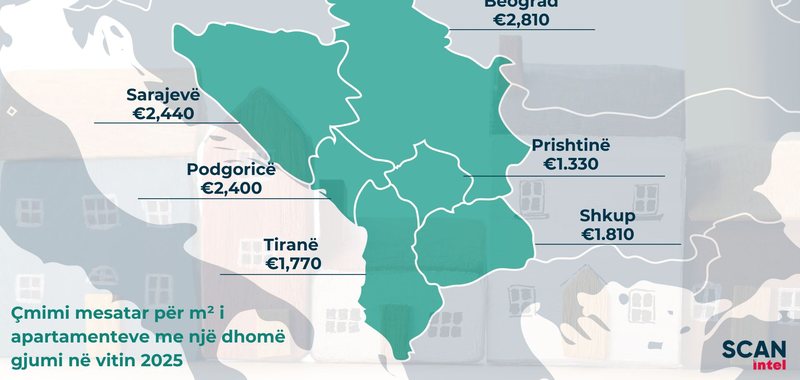

Are properties in Albania the most expensive in the region? In Tirana, square meters are cheaper than in Skopje. But we leave behind only Pristina

The real estate market in Southeastern Europe shows significant changes in the prices of one-bedroom apartments per square meter in 2025, based on average......

Phase III of the expansion of the Tirana-Durrës expressway / ARRSH opens the tender with a limit fund of 25.64 million euros

The Albanian Road Authority has announced the opening of the tender for the expansion of the Tirana-Durres expressway Phase III. The limit fund made......

Fires "break out", but properties are uninsured/ AMF: About 2.4% less gross written premiums in the first half of the year

Despite the fact that in recent months there has been a spread of fires throughout the country, often endangering people's lives, homes or agricultural land,......

Businesses, deadline for submitting financial statements/ Failure to submit, fines of up to 60 thousand lek for businesses

Businesses will have to submit financial statements to the National Business Center. According to an announcement on social networks, e-Albania informs that......

8.8 magnitude earthquake hits eastern Russia, tsunami warnings issued for Alaska and Japan

The 8.8-magnitude earthquake that shook northeastern Russia on Wednesday prompted tsunami warnings in the US states of Alaska and Hawaii, as well as in......

University of Tirana towards internationalization/ Rector Hoxha: Reorganization of programs for 2025–2026

While the Ministry of Education and Sports has announced that study programs have officially opened, it is of great importance to create mechanisms that......

Kamchatka and the Ring of Fire/ A reminder of the power and unpredictability of the Earth

The magnitude 8.8 earthquake that struck Kamchatka, Russia, has once again focused attention on one of the most dangerous and geologically unstable regions......

Britain, a beneficiary of the EU-US agreement? Tariff difference could favor British trade with partners

As world leaders and economists in Europe scrutinize the trade deal between the European Union and the United States, some experts have warned of negative......