12-month bonds in “free fall” - Weighted average yield reaches 2.54%. High interest from investors

The average interest rate on 12-month treasury bills has registered a decline. In the last auction, the weighted average yield fell to 2.54%, approaching the base interest rate of 2.50%. In the auction held about a month ago, the weighted average yield was 2.57%.

Regarding investor demand, the data shows that it was high. The number of competing requests was 17, while only 11 of them were accepted. Meanwhile, from the 7.8 billion lek that was the amount announced for financing, the total demand was 14.448 billion lek, almost twice as high. In this way, the amount of financing received increased to 8.970 billion lek.

The Bank of Albania's decision on July 9 of this year to lower the key interest rate to 2.50% from the previous 2.75% has had an impact on the further decline in the yield of 12-month bonds.

The low level of bond yields also means cheaper costs for loans in lek, which affects the expansion of bank lending. On the other hand, the government can finance domestic debt at a cheaper cost.

Referring to the Ministry of Finance's borrowing calendar, in the last quarter of this year, i.e. October-December, 64.9 billion lek are scheduled to be financed in the domestic market.

Yield is the annual interest that the bondholder will receive over its term to maturity. The yield on a 12-month Treasury bond refers to the return that an investor realizes from an investment in such an instrument. The yield matches the coupon rate of the bond when it is issued, although the yield often changes while the bonds are outstanding. The current yield is the bond's coupon rate divided by its market price.

"Tax hikes and spending cuts" - Britain warns of new measures to face economic challenges

Britain's finance minister, Rachel Reeves, has admitted that tax increases and spending cuts are being considered in the next budget, suggesting the......

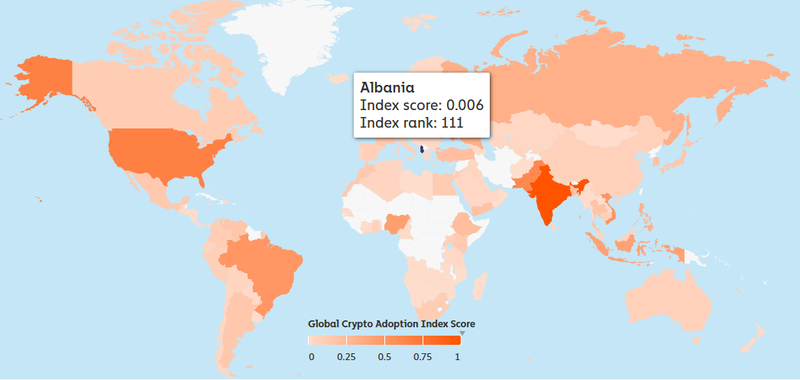

Albania Loses Ground in the Cryptocurrency Market/ Chainalysis 2025 Report: Ranked 111th out of 151 Countries Worldwide

Chainalysis’ 2025 Crypto Geography Report features an index that measures cryptocurrency adoption in 151 countries around the world. But where does Albania......

Over 4700 new businesses opened in 3 months - 11,464 online applications at the Central Business District in September alone

1,483 new businesses opened throughout the country in September alone, following the trend of the two peak months of the tourist season. Official data from......

Reconstruction of the electricity network in Tirana - OSSH opens the 198.9 million lek tender for improving the quality of energy

The Regional Directorate of OSSH Tirana has announced the opening of the tender for the reconstruction of the 20 kV cabins of the Kashar, Qendër, Selitë,......

Von der Leyen: Over 100 million euros of investments in Serbia - President Vučić asks the EU for exemption from steel tariffs

Serbian President Aleksandar Vučić stated that membership in the European Union remains a strategic commitment and priority of the country's foreign policy,......

“Reducing mobile call tariffs and investing in 5G” - Termination costs, according to EU methodology. Parliament, 11 recommendations for AKEP

Reduction of call termination fees and more investments in the 5G network. The Albanian Parliament has recommended to the Electronic and Postal......

Digital Livestock Registry in Albania - New Order/Rules for Registration and Traceability

Albania will have a digital register for animals bred on the country's territory. The order of the Ministry of Agriculture published in the Official Gazette......

The new 20 kV network in Velipojë - Balluku is completed: It guarantees quality electricity supply

Deputy Prime Minister, Minister of Infrastructure and Energy, Belinda Balluku announced that the investment for the construction of the 20 kV network in the......