Property sector at risk? More countries could follow Spain's tax moves!

Following Spain's recently proposed 100% property tax on non-EU buyers, there have been growing concerns about other major European countries such as Greece, France and Portugal potentially doing the same.

New research from relocation specialists at 1st Move International has warned that this scenario could have a major impact on the EU property sector, making it particularly difficult for UK buyers, among others, to buy second homes abroad.

In 2024, according to data from 1st Move International, Portugal, Spain, France and Germany were some of the most popular destinations for British buyers to relocate to. However, tighter restrictions and rising costs could potentially lead to the emergence of other favorable destinations.

Mike Harvey, managing director at 1st Move International, said in an emailed note: " Spain's decision to impose taxes on foreign property buyers has set an important precedent, with other high-tourism countries such as France, Greece and Portugal now considering similar measures."

"While these policies are intended to address the housing shortage, they may have unintended consequences - impacting digital nomads, retirees and international buyers who contribute to local economies."

How could a potential 100% property tax affect European economies?

Countries such as France, Greece and Portugal are already facing an escalating tourism problem, which has driven up rental prices, making it much more difficult for locals to find affordable housing.

Spain has also announced that its golden visa program will end on April 3, 2025. Spain's golden visa program, also known as the residency by investment program, allows foreign nationals to legally reside in Spain in exchange for an investment. This investment can be in property, government bonds or company shares.

The program is being completed primarily to address the housing crisis in Spain, as well as to make real estate more affordable for locals.

Similarly, Greece, Portugal and France are also making moves to tackle overtourism, such as cracking down on short-term rentals, focusing more on sustainable tourism practices and promoting lesser-known and niche tourist destinations.

However, these countries still rely heavily on tourism, as well as foreign investment, particularly in the property sector, to boost their economies. As such, a 100% property tax could have very large consequences for economic growth, especially if alternative revenue generation and investment flows do not develop simultaneously.

Harvey said: " A 100% tax on foreign buyers could harm Greece's competitiveness and economic stability. The country is already dealing with housing pressures by banning new short-term rental licenses in key areas of Athens. Further changes could reduce investment and impact both the property market and the local economy."

"France's tourism contributes about 9% of GDP, with $68.6 billion (66.4 billion euros) in tourism revenue in 2023 - up 110% from 2020. Additional taxes on foreign buyers could strain the market, slowing property investment and tourism."

"Portugal's tourism contributes 15% of GDP, reaching €25.1 billion in 2023 with a projected revenue of €66.5 billion by 2034. However, with the introduction of new property taxes on foreign buyers, this growth could be at risk. Portugal remains a top destination for Britons, but the introduction of interest in the market could impact the rise in property taxes. economy".

Where can British buyers move to next?

With popular European destinations for second homes now seeing tax increases and cost uncertainty, some British buyers are looking further afield to relocate. According to 1st Move International, between 2022 and 2024, the US, Australia, the UAE, Canada and New Zealand were the top destinations for Britons to move to. Others included Cyprus, South Africa, Singapore, Saudi Arabia and the Cayman Islands.

More lucrative career and earnings opportunities, lower taxes, a better quality of life and natural landscapes have been some of the driving factors that have prompted Britons to move. A lower cost of living and no language barrier in some of these countries have made them more attractive.

Harvey highlighted: " Cyprus is becoming an increasingly popular choice for Britons looking to relocate. Our internal data shows it was the 6th most sought-after destination between 2022 and 2024. The island offers a wonderful Mediterranean lifestyle, with sunny weather, affordable living and a welcoming environment."

"With tax benefits, widespread English speaking, expat-friendly living and a relaxed yet vibrant atmosphere, it's clear why Cyprus is gaining traction as a top destination for those seeking a vibrant lifestyle abroad."

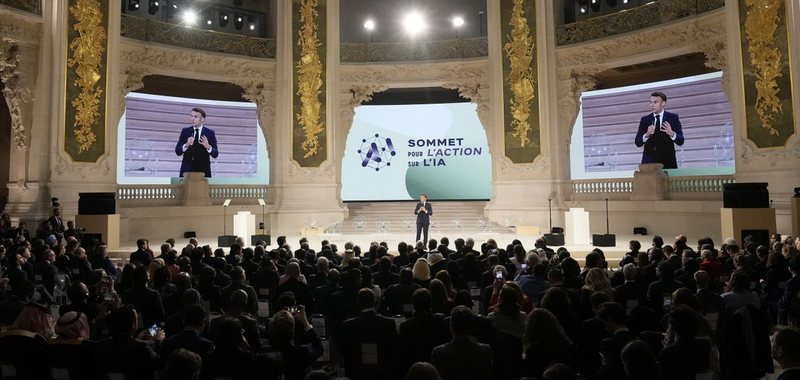

The EU will mobilize 200 billion euros for investments in AI!

Europe will mobilise €200 billion for investment in artificial intelligence, European Commission President Ursula von der Leyen announced at the AI Action......

"Tariffs, no exceptions" - Trump's new tariffs on aluminum and steel take effect on March 4

US President Donald Trump sharply increased tariffs on steel and aluminium imports to a level of 25% "without exceptions", in a move he hopes will help......

How did interest rates change during 2024? From deposits to government securities. Treasury bills and bonds, with decline

Savings have been seen as a form of security for the future, with individuals placing their money in bank deposits, earning minimal but guaranteed interest.......

Who supplies steel to Albania? An analysis of two key metals and their origins

In the analysis of foreign trade regarding the main groups that our country imports, we find products such as means of transport, fuels, machinery and......

Small HPPs will sell energy on the free market - Procedure for changes to their contract with OSHEE begins

Priority Energy Producers will also be able to sell the generated energy on the free market. The Energy Regulatory Authority has initiated the procedure for......

How much money is needed to live in Albania? - Study/ 250 euros per month, the minimum limit to cover expenses

While the labor force has declined, businesses are looking for qualified employees, and are encouraged to increase wages, in parallel the cost of living has......

"The new railway connection to the airport is becoming a reality" - HSH: Towards the completion of the Domje-Rinas segment!

Albanian Railways announces that the new railway connection with Rinas Airport is becoming a reality as construction works for the Domje-Rinas segment are......

Elon Musk, 97.4 billion USD for OpenAI - Tesla CEO seeks to prevent startup from becoming a profitable firm

A consortium led by Elon Musk said it has offered $97.4 billion to buy the nonprofit that controls OpenAI, in another attempt by the billionaire to block the......