European Parliament supports digital euro - Compatible with Council for online and offline use

The European Parliament has given its first major endorsement to the digital euro, aligning with the European Council's negotiating position for a central bank digital currency with both online and offline functionality.

The approval matters because the European Central Bank needs legislative approval from Parliament before it can issue a digital euro, meaning its aim for a 2029 launch depends on lawmakers' approval.

The assembly's stance marks a shift from previous parliamentary proposals focused solely on offline payments and signals closer alignment with the ECB in protecting the bloc's monetary sovereignty.

The ECB is developing a digital euro to preserve the role of central bank money in an increasingly digital economy and reduce dependence on non-European payment providers.

Declining transatlantic relations and rising geopolitical risks have fueled concerns about the fragmentation of EU payment services and the bloc's dependence on US providers such as Visa or Mastercard, with some countries lacking a domestic payments network at all.

However, the project encountered resistance from banking lobbies in countries such as Germany and progress in parliament stalled, with the draft remaining blocked for more than two years - much longer than the ECB had expected.

MEPs adopted two amendments to the parliament's resolution on the ECB's annual report for 2025, calling for a digital euro that ensures equal access to payment services and offers a new form of public money usable both online and offline.

Lawmakers also underlined that a digital euro is essential to strengthen the EU's monetary sovereignty and deepen the single market, reducing fragmentation in retail payments.

Parliament also urged the ECB to increase monitoring of crypto-assets, warning that the shift to digital payments, if left to private and non-EU providers, risks creating new forms of exclusion for users and merchants.

German auto industry in crisis as investment and jobs move abroad

Germany's position as an automotive industrial hub risks weakening as investment and jobs move abroad, an industry association has warned, calling on Berlin......

About 57% of prisoners are not yet guilty/ Statistics on prison population, Albanians spend years waiting for a trial

In Albania, prison no longer functions solely as a place to serve a sentence handed down by the court. Official data and Scan Intel's findings on the......

Is the state encouraging wage increases in the private sector? - Gjokutaj: It requires more than fiscal incentives

The increase in salaries in the public administration has brought back into focus the debate on the level of salaries in the private sector and the ways in......

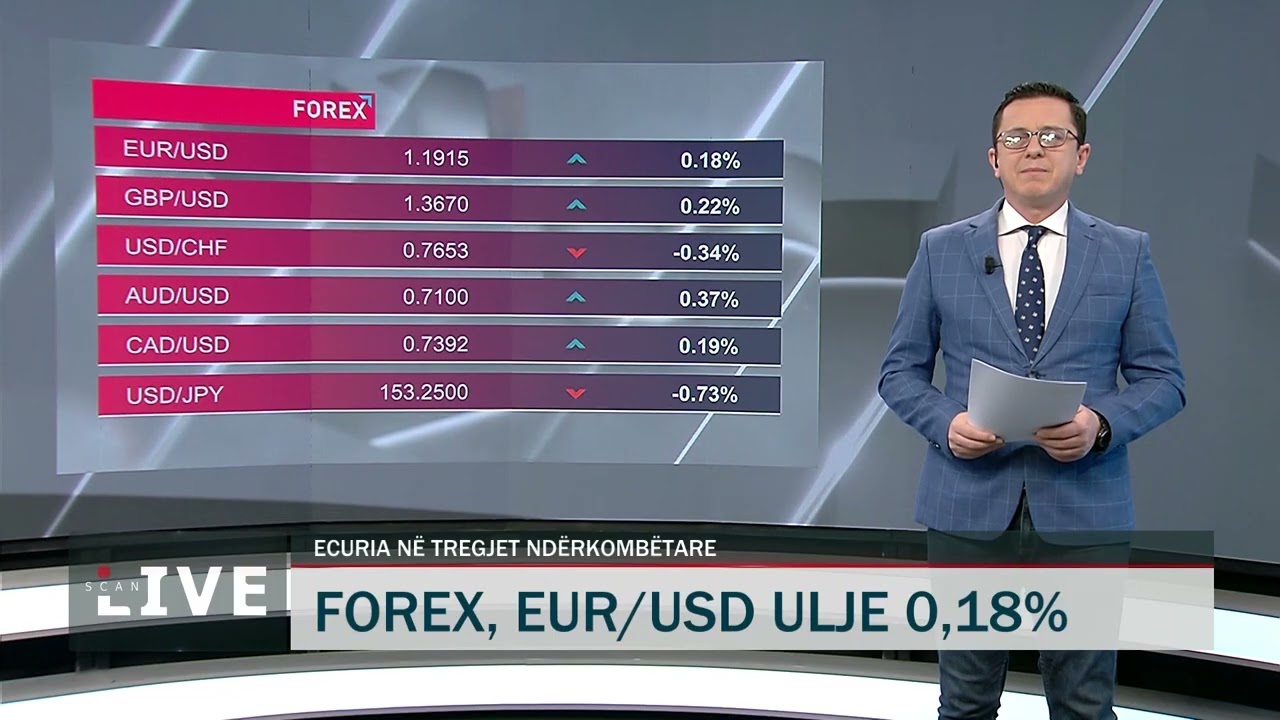

The exchange rate "hits" euro deposits - Where should we spend and invest money in the conditions of the strengthening lek?

The exchange rate risk has made many citizens reflect on their savings during 2025. Deposits in euros are opened mainly by individuals and businesses that......

"Approve the status of the miner" - Tabaku: Special social protection. SP MPs: Populist bill

Democratic Party MP Jorida Tabaku has requested the approval of the status of miners, to ensure special social protection and improved working conditions for......

Who benefits from VAT compensation in agriculture? - Instruction/ Farmers must keep sales receipts, tax application

Farmers must collect all invoices for the sale of agricultural products from collectors in order to benefit from the 10% VAT compensation measure. The......

There is no excise tax reduction for domestic beer! - The majority rejects the proposal. Tobacco: 11% production drop

The unification of the excise tax on beer in 2022 at 710 lek/hectoliter has led to damage to domestic production and an increase in imports. With the......

How much do banks earn from our interests? - BoA: Total net income including commissions, lower than in 2024

Have you ever wondered how much money banks make from the interest we pay on loans? Gross interest income last year was 97 billion lek, about 3% higher than......