Italy, tax revenues on the rise - Inflation, employment expansion boost profits and reduce budget deficit

Italy's tax revenues are growing faster than expected, thanks to rising employment and inflation. The trend is bringing the budget deficit back towards the European Union's 3% of GDP limit, a year earlier than planned.

Tax revenues rose by more than 16 billion euros between January and July, 5% more than in the same period last year, exceeding the Italian Treasury's forecast of just 0.8% expansion for the year as a whole. The government had estimated a deficit of 3.3% of GDP in 2025, but the additional tax revenues mean the fiscal gap is likely to be significantly lower.

Prime Minister Giorgia Meloni and her right-wing allies are taking credit for these positive figures, however, economists emphasize that this improvement comes mainly from factors not directly related to the government, which took office at the end of 2022. Analysts estimate that the anti-tax evasion reforms undertaken over the years are yielding results, although a large part of the "weight" falls on the effect of inflation and employment growth, with around 2 million new jobs created in the last four years, which have increased tax revenues.

Meloni often cites the increase in employment as a success of her government, but does not mention the “fiscal drag,” a simple economic phenomenon where inflation and nominal wage growth increase the percentage of income tax, bringing more money into the state coffers. Experts estimate that thanks to this effect, the state has collected about 25 billion euros more from 2021 to 2024, while revenues continue to grow this year.

Consumer prices in Italy have risen by 19% since 2020. Wages have also increased in nominal terms, but less than inflation, leaving ordinary citizens worse off economically. Real incomes in Italy, adjusted for inflation, are currently below their 1990 level.

In contrast, in Germany, the government adjusts income tax limits every year to fully compensate for the effect of inflation.

The improvement in Italy's public finances is also the result of new rules gradually introduced since 2011, which have narrowed the possibilities for tax evasion. Successive governments have promoted traceable digital payments and strengthened controls.

September 30, deadline for the self-employment program - Grants of up to 1 million lek for new business ideas

The National Employment and Skills Agency announces that September 30th is the deadline for all unemployed job seekers with a clear business idea to apply......

Pensions increase from October 1 - Indexation at 2.5%, total fund 1.14 billion lek

From October 1, all pensioners in Albania will benefit from a pension increase of 2.5 percent above the amount they currently receive. The decision......

Amazon pays record $2.5 billion fine for consumer fraud

Amazon has agreed to pay $2.5 billion to settle a lawsuit filed by the US federal government, which accused the company of deceiving millions of people into......

Kosovo, imports reach over 5 billion euros in 2025 - Chamber of Commerce: The country is importing inflation along with goods

Kosovo continues to deepen its dependence on imported goods, driving the trade deficit to a high and worrying level. The country imported goods worth over......

Integrating refugees into the labor market - Greek government aims to address labor shortage

Refugees who have been granted asylum in Greece will soon be integrated into the labor market, under a new government plan that aims to alleviate a severe......

US, towards government shutdown - Leaders fail to reach agreement at White House meeting

US President Donald Trump and his Democratic opponents made no significant progress during a White House meeting aimed at averting a government shutdown that......

How did this month end for foreign currencies?

The US dollar has closed this month unstable, fluctuating continuously throughout this time as it was bought this morning at 82.2 lek and sold at 83.2......

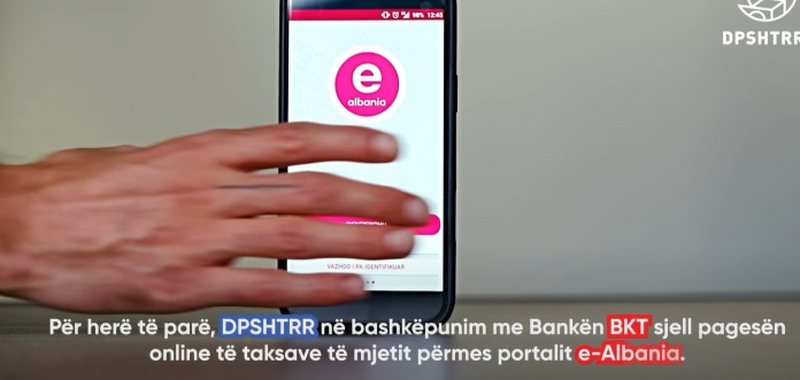

Rama: Online vehicle tax payment starts today in e-Albania!

Prime Minister Edi Rama announced that starting today, vehicle tax payments can be made online at "e-Albania", thus introducing the new service, stating that......