WEF warns: The economic costs of global fragmentation could be greater than the Covid-19 pandemic!

The economic costs of global fragmentation could potentially be greater than the Covid-19 pandemic or the 2008 global financial crisis (GFC), according to a recently published report by the World Economic Forum (WEF), titled Navigating the Fragmentation of the Global Financial System. The report was developed in partnership with US management consulting firm Oliver Wyman.

This is largely due to a growing number of countries using worldwide trade and financial systems to strengthen their geopolitical positions, largely through a mix of industrial policies, sanctions, and other economic measures.

There has already been a 370% increase in sanctions since 2017, according to the London Stock Exchange Group (LSEG), along with a notable increase in the number of subsidies observed across the globe during this time.

This has resulted in increased fragmentation worldwide . Global gross domestic product could potentially be reduced by anywhere between $0.6 trillion and, in cases of very high fragmentation, up to $5.7 trillion (€5.47 trillion), or 5%, as a result.

The decline in cross-border capital flows and the decline in trade are expected to be the main drivers of this potential loss in GDP. A decrease in economic efficiency is likely to exacerbate this situation. Similarly, inflation worldwide is estimated to increase by more than 5%, in cases of very high segregation.

However, the WEF report highlights the importance of implementing an economic state that focuses on sustainable development, cooperation and resilience at the global level. As a result, citizens are expected to be able to defend their sovereignty and national security in a more sustainable way, while also reducing the economic impact of fragmentation.

Matthew Blake, head of the World Economic Forum's Center for Financial and Monetary Systems, said in a press release: " The potential costs of fragmentation in the global economy are staggering. Leaders face a critical opportunity to protect the global financial system through principled approaches."

The effect of a split on global GDP growth and inflation is greatly influenced by the policies implemented by individual country leaders. In the worst-case scenario of fragmentation, there could be a complete economic separation of the Eastern bloc, which could include Russia, China, and more countries, and the Western bloc, which could include the United States and its allies.

However, in a lower fragmentation situation, trade and capital flows are likely to be closely monitored only in areas important to competitiveness and national security. Models of trade relations have described four possible fragmentation situations: low, moderate, high, and very high.

In the low scenario, the Western bloc could see a GDP decline of 0.6%, while in a medium fragmentation scenario, this could worsen to a 1.8% decline. In a high scenario, the Western bloc could potentially see its GDP decline by 2.8%, while in the worst-case scenario, it could fall by 3.9%.

Coming to the Eastern bloc, in the low fragmentation scenario, GDP could decrease by 1.4%, while in the medium scenario, it could fall by 3.2%. If there is a high fragmentation scenario, Eastern bloc GDP could potentially fall by 4.6%. However, in an extreme fragmentation scenario, Eastern bloc GDP is expected to fare somewhat better, with a decline of 3.5%.

In a worst-case scenario, countries that are not part of either the Eastern or Western blocs could be forced to trade only with whichever bloc is most important to them economically. This includes countries like Brazil, Turkey, and India, along with other countries in Southeast Asia, Latin America, and Africa. These countries could potentially experience a GDP decline of more than 10% in a very high fragmentation situation.

Matt Strahan, head of private markets at the World Economic Forum, said: " Fragmentation not only fuels inflation, but also negatively impacts economic growth prospects, particularly in emerging markets and developing economies that depend on an integrated financial system for their continued development. By protecting the integrity and functionality of the global financial system, including ensuring that actors retain their right to engage with counterparts across the geopolitical spectrum, leaders can deliver a more effective financial system for all stakeholders."

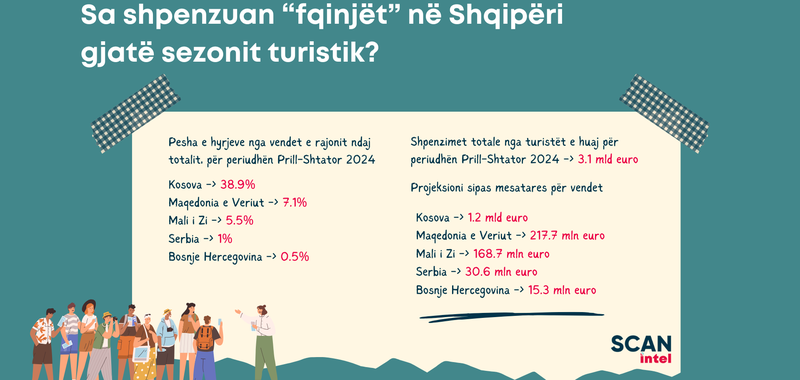

How much did the "neighbors" in Albania spend during the tourist season? North Macedonia the most "lazy", Serbia ranks at the bottom of the list

The tourism industry in Albania has seen its best days throughout 2024, contributing significantly to the economy. Expectations are that this sector will......

Potato crisis in Europe - Farmers give up growing them due to rising costs!

Potato production in Romania continues to decline, as seed costs have doubled in recent years and labor has become increasingly expensive and difficult to......

Why are the Apple and Google empires facing antitrust investigations in the UK?!

Britain's competition regulator on Thursday launched an investigation into the vast mobile ecosystems of Apple and Google to determine whether the tech......

The world's most valuable technology giants - Brand Finance publishes its Global 500 report

Technology companies continued to be some of the most valuable brands in the world this year, driven by continued brand loyalty as well as new innovations in......

Trump "removes" the right to automatic citizenship at birth in the US: What happens now?!

Four Democratic-led states will ask a federal judge in Seattle on Thursday to block the administration of US President Donald Trump from implementing a......

EU, solar energy surpassed coal in 2024 - Wind generation reduced, despite capacity growth

Solar power surpassed coal in total European Union generation for the first time last year, while wind generation declined, according to data from energy......

Personalized cancer treatment in 48 hours? Trump's $500 billion plan sparks hope and debate

US President Donald Trump unveiled a $500 billion artificial intelligence (AI) infrastructure project at the White House alongside business leaders who said......

"Climate Change Funding Cuts" - Trump's Decision, Qirjo: Slows Down Efforts, But Many Other Factors Will Advance Them

The withdrawal of the United States of America from the Climate Agreement slows down global processes, but there are still a number of other factors that......