Euro hits highest level in 3 years - Gold continues to 'reign' as the safest asset in global stock markets!

The euro rose to its highest level in more than three years against the US dollar during the Asian session on Friday as investors continued to dump US assets amid US President Donald Trump's chaotic tariff rhetoric. The EUR/USD pair jumped from a mid-1.09 range to 1.1387, extending gains seen since Thursday after Trump halted reciprocal tariffs on all countries except China, where he raised the tax to 145%.

Besides the euro, other G10 currencies also strengthened against the greenback, especially traditional haven currencies like the Swiss franc and the Japanese yen. By 4:40 a.m. CEST, the USD/CHF pair had fallen below 0.82, a level not seen since January 2015, when the Swiss National Bank abandoned its 1.20 peg to the euro. Meanwhile, the USD/JPY pair fell to just above 143, its lowest level since September 2024. The U.S. dollar index, which measures the currency against a basket of foreign currencies, also fell below 100, its lowest reading since July 2023.

“There will be a transition cost and transition problems, but it will be a beautiful thing in the end ,” Trump said at the White House on Thursday. “We are in very good shape .” However, financial markets responded in the opposite direction, with the U.S. dollar weakening further, renewed selling on Wall Street and continued pressure on U.S. Treasuries. Investors appear to be fleeing U.S. assets amid uncertainty fueled by tariffs.

On Thursday, the U.S. Bureau of Labor Statistics released weaker-than-expected inflation. The data may have also added to the weakness in the U.S. dollar, which in turn boosted other major currencies. Markets expect the Federal Reserve to cut rates more this year due to economic risks, although officials reiterated caution due to higher inflationary pressures related to tariffs.

Gold hits record high as US government bonds fall

Gold prices have risen 8% since Wednesday, following Trump's decision to impose a 90-day pause on reciprocal tariffs. The precious metal, long considered a safe-haven asset, had fallen earlier in the week as investors sold holdings to cover losses in other riskier assets. By 4 a.m. CEST, spot gold rose to $3,218 an ounce, while COMEX gold futures reached $3,238 an ounce - both record highs.

According to a Bloomberg report, Chinese investors pumped $1 billion (€0.88 billion) into gold exchange-traded funds (ETFs) last week since Trump announced the steep tariffs on China. Meanwhile, the World Gold Council reported that global gold-backed ETFs peaked at a monthly high of $345 billion (€305 billion) in March.

In contrast, U.S. government bonds, traditionally considered safe assets, resumed selling on Thursday. 10-year and 30-year Treasury yields rose by 11 and 21 basis points, respectively. As bond prices fall, yields rise, reflecting the government’s cost of borrowing. The sharp sell-off in long-dated U.S. Treasuries since the start of the week suggests investors are seeking higher risk premiums amid a worsening outlook for the U.S. economy.

European markets to rise despite fresh Wall Street sell-off

After a historic rally, U.S. stocks resumed selling on Thursday. The S&P 500 fell 3.46%, the Nasdaq fell 4.31%, and the Dow Jones Industrial Average fell 2.5%, signaling continued market anxiety despite recent policy changes. Broader Asian markets largely followed suit on Friday. As of 5:30 a.m. CEST, Japan's Nikkei 225 was down 3.9%, South Korea's Kospi was down 0.8%, and Australia's ASX 200 was down 1.3%. However, China's Hang Seng Index managed to gain 0.6%.

Despite the global risk sentiment, futures are pointing to a higher open in European markets. At 5:30 a.m. CEST, the Euro Stoxx 50 was up 0.57%, Germany's DAX was up 0.61%, and the FTSE 100 gained 0.49%.

Strong decline for the Pound and the Dollar – How did this week end for the major currencies?

The US dollar suffered a significant drop in value this Friday, closing the week negatively as it was bought today for 87.2 lek and sold for 90 lek according......

Tonight on SCAN TV, "Election Room" starts - a different format that brings detailed figures and analysis to citizens.

"Election Room" starts tonight on SCAN Television, as a show dedicated to the electoral campaign for the May 11 parliamentary elections. In this daily......

Trump "boosts" shipbuilding in the US - The decision aims to challenge China's dominance in this sector

US President Donald Trump signed an executive order directing the heads of the departments of defense, commerce, labor, transportation and homeland security......

Documentation for external voting is being prepared - According to the CEC, the process includes several important logistical and technical phases

The Central Election Commission has officially launched the process of preparing electoral documentation for Albanian voters living abroad and who will......

"Solar energy accounts for 10% of production" - Deputy Prime Minister Balluku, at the inauguration of the Karavasta Photovoltaic Park

The volume of photovoltaic energy production in the country has reached about 10%, declared Deputy Prime Minister and Minister of Infrastructure and Energy......

Saudi Arabia finds new "treasures" - Aramco announces the discovery of 14 oil and gas fields

Saudi Aramco announced the discovery of 14 new oil and natural gas fields across the Eastern Province and the vast Rub' al Khali desert, marking a......

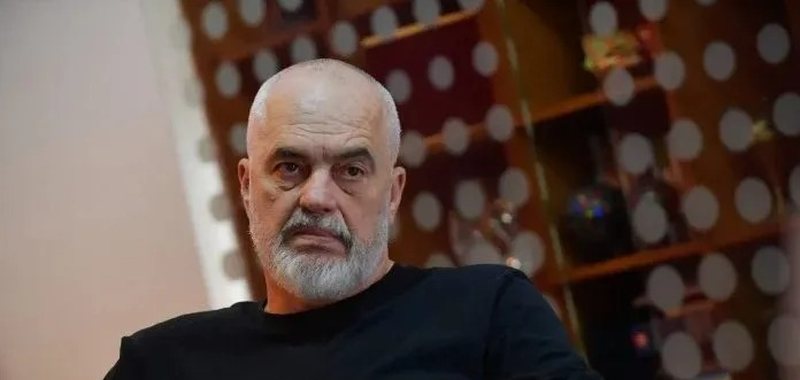

"Trump, an opportunity to reawaken Europe" - Prime Minister Edi Rama, interview for "Bloomberg"

Albanian Prime Minister Edi Rama hailed Donald Trump as "good for everyone," portraying the president's harsh treatment of US allies as an opportunity for......

Protein boom in Albania - Supplement imports to the country increased by 39%

Albanians are increasingly taking care of their bodies, although they are increasingly achieving this through the use of nutritional supplements. According......