Who are the big losers of the Israel-Iran conflict? - The interests of many superpowers intersect in the Middle East

It is not yet clear whether the conflict between Israel and Iran has finally ended, despite the United States declaring a ceasefire.

A renewed tension in the region would have global consequences. First, it would further raise oil prices, leaving China and Europe vulnerable to supply disruptions. On the contrary, this would be good news for Russia.

"The biggest losers would be continental Europe and China, both dependent on imported energy and unprotected by domestic sources. They would face rising costs and high inflation," the analysts explain.

But peace in Iran, along with the countries in the Persian Gulf, is essential for the entire global economy, as the region produces a third of the world's oil.

Iran alone provides 10% of China's imported oil and controls the critical waterway of the Strait of Hormuz, through which a fifth of global oil passes.

The country was the fourth-largest producer of crude oil in OPEC in 2023. It was also the third-largest producer of natural gas in the world in 2022, according to the U.S. Energy Information Administration (EIA).

Despite Western sanctions on Iran, mainly related to its nuclear program, Tehran has secured its global trading position. Its main trading partners include China, Russia, Turkey, India, Pakistan, and its close neighbors, including Iraq and the United Arab Emirates.

According to the data, 60% of the value of exports is covered by oil and about 12% is occupied by chemicals and plastics. Oil exports go mainly to China, reaching approximately 1.7 million barrels per day.

"Any major disruption to Iranian supplies would hurt China, analysts say. They explain that Iran is also a major exporter of liquefied petroleum gas (LPG) to China, which is essential for the plastics industry. "This leaves China vulnerable on many fronts," the experts point out.

If China's economy falters, the global ecosystem feels the ripples. The country's domestic consumption provides the largest market for many Western companies, and Beijing's manufacturing is essential to the global economy.

"China will continue to increase its dependence on Russian and Central Asian energy to reduce its vulnerability to US intervention in the Middle East. Also, India will turn away from Russia and increase imports from America," according to analysts.

This would put Moscow in a particularly advantageous position if the global flow of oil or liquefied natural gas were to be disrupted. Russia could even see a slight increase in European demand, as the Old Continent is also dependent on the Persian Gulf region for this sector.

It is possible that the European Union could "reduce the implementation of sanctions against the Kremlin, gradually accepting more Russian natural gas, although not to pre-war levels," analysts point out. If the crisis in the Middle East continues, Europe could also increase energy imports from the United States.

According to economists, the most immediate impact on the old continent would be rising inflation. Rising energy prices would erode already fragile confidence in the EU, while central banks would raise interest rates.

NATO countries adopt 5% target - Members commit to increasing defense spending

NATO countries approved an increase in military spending to 5% of GDP. Leaders also reaffirmed their commitment to collective defense in the event of an......

Ibiza, the other side of the coin - The housing crisis "burdens" local residents

Beneath Ibiza's sun-kissed beaches and legendary nightlife lies a deep housing crisis, exacerbated by a post-pandemic surge in visitors. This has created an......

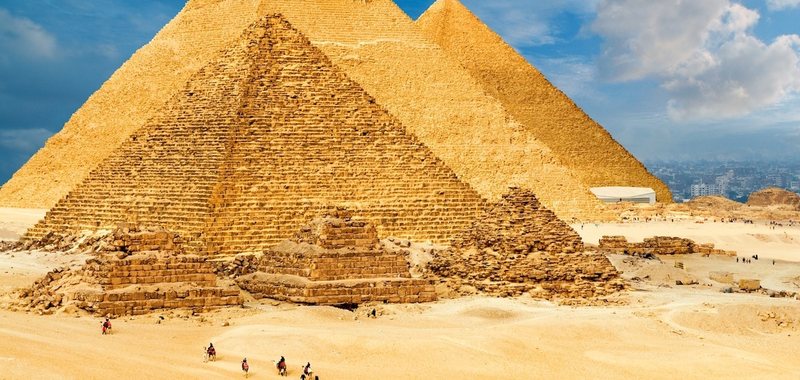

Egypt, 30 million USD to "transform" the pyramids - The reconstruction of the area significantly improves the tourist experience

About 2.5 million people visit the Pyramids of Giza each year, hoping for an epic experience worthy of one of the Seven Wonders of the World. But for......

Albania at the helm of the ICIC Presidency – Commissioner Dervishi: A belief that honors and motivates us

Berlin, June 25, 2025 – At the end of the three-day proceedings of the International Conference of Commissioners for the Right to Information (ICIC), held in......

Europe, electric car sales increase by 27% - Tesla records decline for the fifth consecutive month

Sales of new Tesla cars in Europe fell by 27.9% in May compared to a year earlier, even though purchases of fully electric vehicles in the region rose by......

Social media traces lead to hidden accounts - Treska: Online contracts reveal undeclared amounts to Taxes

For every euro or dollar earned, whether on online platforms, law enforcement agencies in Albania can monitor this income to determine the amount that must......

Turkish investments "flood" in Albania - BoA: 50 million euros in the first quarter of 2025. The Dutch are stepping down from the "throne"

Not only with the historical past, culture or cinematography, but Turkey is also closely linked to Albania in terms of investments. According to data from......

Albania "calls" students from around the world - Higher Education 2030, the country is promoted as a study destination

With the aim of attracting foreign students, the League of Universities “Gjon Durrësium” organized the “Higher Education 2030” forum. This forum was held......