Gold "stops growth" - "Easing" global trade tensions reduces the value of the metal

Gold fell sharply from a record high last week as risk sentiment faded after Donald Trump's dovish tone on China tariffs. While the price decline could continue in the short term, analysts expect gold to extend its long-term rally due to ongoing uncertainties.

Global stock markets experienced a easing rise amid signs of an easing of tensions in the global trade war, particularly between the United States and China.

Both spot gold and futures fell about 6.5% from their record highs reached last Tuesday. Investors may have started to take profits from the precious metal as demand for safe-haven investments has eased.

Demand for safe-haven assets has surged amid economic uncertainty stemming from U.S. President Donald Trump's tariffs. Gold, a traditional hedge against financial crises and inflation, has outperformed global markets, rising more than 25% so far this year. Indirectly, the strengthening euro, which has put significant pressure on the U.S. dollar, has also contributed to the precious metal's rise.

The feeling of “American supremacy” has significantly reduced the value of the dollar in 2025, while the euro has strengthened significantly against the greenback. The EUR/USD pair has risen by 11% since the beginning of February. “The strength of the euro and the weakness of the US dollar were again a key driver of gold’s performance, along with an increase in tariff fears,” the World Gold Council said in a report. The euro’s rise also made gold less expensive for European investors, with exchange-traded funds buying reaching $1 billion in Europe in March, making it the second-largest buyer among the regions.

However, the precious metal could face further risks in the near term based on several factors, including fading risk sentiment, signals of overbought conditions, liquidity risks and a slowing pace of purchases by global central banks.

The main reason for gold's decline has been the removal of risk sentiment after Trump said he would cut tariffs "significantly" on China, triggering a broad rally in global stock markets. Trump's change in stance could lead to a rebalancing among fund managers and retail investors.

He defrauded hundreds of citizens with their bank accounts. Police operation against cybercrime. 23-year-old from France arrested

He sent fake links to various citizens in Albania to fill in their bank details, masquerading as a branch of a second-tier bank, in order to withdraw money......

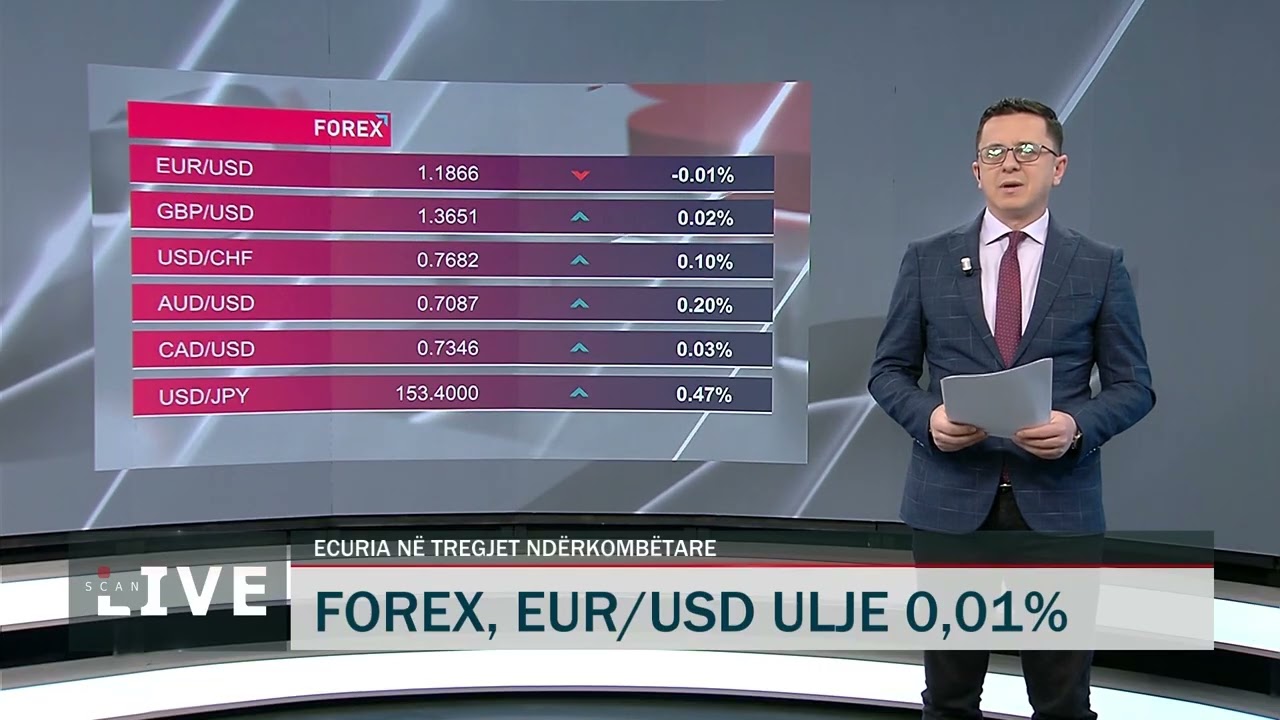

How has this week started for the major currencies?

The US dollar has started the week at stable values compared to the continuous fluctuations it suffered last week, being bought today at 86.5 lek and being......

Property tax, buildings account for 75.6% - What will change from January 1, 2026 and will there be exceptions?

Municipalities have significantly increased their revenues from real estate taxes over the years, and this has also been influenced by the increase in......

KAYO signs agreement with Israeli company - On May 8, the aircraft landing test on the runway of Vlora Airport

An agreement was signed this Sunday in the coastal city of Vlora between Albania's state-owned military company, KAYO, and Israeli defense giant Elbit......

''On May 8th, the first flight from Vlora'' - Balluku: It will be the first test of the airport

Deputy Prime Minister, Minister of Infrastructure and Energy, Belinda Balluku announced today that on May 8, the first flight from Vlora International......

DP-ASHM, meeting with Albanian emigrants in Thessaloniki - Berisha: 2025, the year of the Diaspora

The Chairman of the Democratic Party, Sali Berisha from Thessaloniki, where he held a meeting with Albanian citizens living and working in the Greek state,......

''GDP increased 2.5 times within a decade'' - Rama: Aviation Academy in Vlora, regional

Prime Minister Edi Rama declared from Vlora that the level of Gross Domestic Product today is 2.5 times higher in just a decade. According to him, for 2030,......

Sejko at the spring meetings of the International Monetary Fund and the World Bank!

The Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group (WBG) were held in Washington, D.C., from 21 to 26 April 2025. The......