"US, 45% chance of heading into recession" Goldman Sachs predicts Fed rate cuts to boost economy

Goldman Sachs economists raised the possibility of a recession and predicted that the US Federal Reserve could cut interest rates more quickly following the Trump administration's tariff announcement.

Economists lowered their forecast for fourth-quarter GDP growth in Q2 2025 to 0.5% from 1% and increased the probability of a 12-month recession to 45% from 35%.

This follows "a sharp tightening of financial conditions, foreign consumer boycotts and a continued increase in policy uncertainty that is likely to reduce capital spending by more than we had previously assumed," they said.

According to analysts, the baseline forecast still relies on the assumption that the effective US tariff rate will increase by 15 percentage points in total, which would require a large reduction in tariffs scheduled to take effect on April 9.

If most of the April 9 tariffs go into effect, they said, then the effective tariff rate would rise by about 20 basis points when those increases and potential sectoral tariffs take effect, even allowing for some country-specific agreements at a later date.

"If that is the case, we expect to change our forecast to a recession," they said.

On the current, non-recessionary basis, Goldman economists said they expect the Fed to create a package of three consecutive 25-basis-point "cuts," starting in June rather than July, to lower the funds rate to 3.5-3.75%.

"In a recession scenario, we would instead expect the Fed to cut by about 200 basis points over the next year," they said. "Our probability-weighted Fed forecast now implies 130 percentage points of rate cuts this year, up from 105 previously expected, reflecting our increased probability of a recession," the economists said.

Foreign exchange reserves expanded by 421 million euros - BoA: The exchange rate had a positive impact in 2024. About 64% of it was in euros

During the past year, Albania's foreign exchange reserves reached 6.2 billion euros. In 2024, it turns out that they have increased by 421 million euros......

The agreement with the EIB for the financing of the strategic Durrës-Rrogozhina railway project is signed!

Deputy Prime Minister, Belinda Balluku, also Minister of Infrastructure and Energy, and the Director of the European Investment Bank, Lionel Rapaille, signed......

Rama receives Kaja Kallas - The head of European diplomacy comes to Tirana for the first time

The High Representative for Foreign Affairs and Security Policy of the European Union, Kaja Kallas, is paying an official visit to Tirana today. To be......

Over 60 thousand vehicles fail technical inspection - Old vehicles are being taken out of circulation, almost 2000 deregistered

The General Directorate of Road Transport Services has published data for the period January-March 2025 regarding the technical inspection service of......

Taxes collect 123 million euros more - January-March 2024, revenues increase by 11.9%

The tax administration has significantly increased the revenues collected in the state budget. According to data from the General Directorate of Taxes, total......

Why does Turkey think Trump's tariffs could be an advantage for the country's economy?!

Turkey was hit with a 10% base tariff in U.S. President Donald Trump's trade announcement last week, compared with higher tariffs on many other countries,......

New Pediatrics Specialty/ Koçiu: Investments make perfect sense when they touch the most fragile lives!

The Minister of Health and Social Protection, Albana Koçiu, shared today on social networks images from the new facilities in the pediatric specialties at......

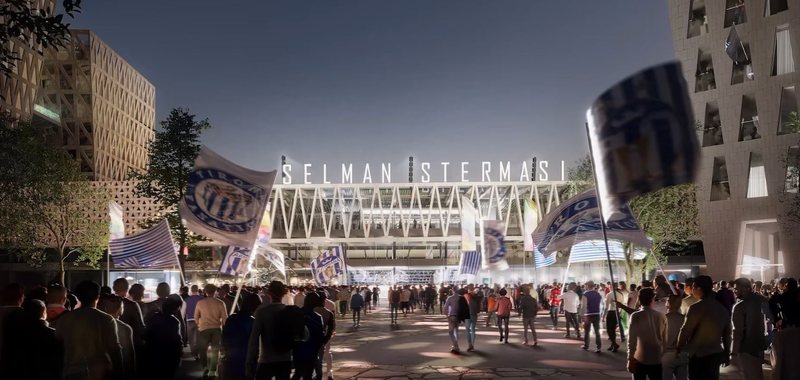

The renaissance of the Selman Stërmasi – Rama Stadium The winning project will give Tirana another beautiful urban center!

After announcing the winning project in the international competition for the architectural design concept for the revival of the "Selman Stërmasi" stadium,......