"US tariffs, negligible for Albania" - Governor Sejko, at the IMF and WB Constituency Meeting

The Governor of the Bank of Albania, Gent Sejko, participated in the Constituency Meeting of the International Monetary Fund (IMF) and the World Bank Group (WB), held in Varese, Italy.

The meeting brought together the governors and finance ministers of the member countries of this constituency to discuss the latest developments in the world economy and their respective economies.

Currently, the world is facing new geopolitical, geoeconomic challenges and trade restrictions, so the meeting discussed industrial policies that can boost the competitiveness and economic growth of countries.

Senior representatives of the IMF and the WB presented the perspectives of the two institutions to guarantee financial stability and sustainable and long-term economic growth.

During the meeting, Governor Sejko presented the latest economic developments in the country, emphasizing the important role that the Bank of Albania plays in macroeconomic stability. He presented the Bank's views on the main topics of discussion, sharing similar views with international financial institutions, and stressed the importance of maintaining the country's economic and financial stability, as a prerequisite for sustainable and long-term growth.

The Governor stated that for Albania, as a small and open economy closely linked to the European Union, the initial round of US tariffs has a negligible direct impact on our economy, as our trade and financial ties with the US are quite limited (around 0.2% of GDP). However, he noted that a global tariff war would mean a decline in export demand, imported inflation that would increase domestic prices, as well as potential risks in the financial sector, as companies exposed to trade would face more difficult conditions.

On the other hand, resilience remains essential to cope with the frequent and overlapping crises that threaten economic development. Countries around the world are increasingly exposed to natural hazards and disasters. This presents them with choices about financing and insuring disaster risks, which are essential for adapting to climate change and strengthening resilience, and which include investments in both physical risk reduction and financial preparedness.

In conclusion, the Governor stated that: “- As a central bank, our priority is to maintain price stability, guarantee financial stability and strengthen economic sustainability, while being attentive to global and regional developments, and continuously improving our economic policy framework.”

During the meeting, discussing developments in the field of payment systems, innovation in technology and infrastructure, as well as the challenges associated with them, the Deputy Governor of the Bank of Italy, Mr. Luigi Federico Signorini, thanked Governor Sejko in particular for the successful cooperation with the Bank of Albania regarding the contribution and leadership shown for the modernization of the payment system in the country and at the regional level.

Development and conservation of biodiversity - New management plan for four protected areas

The National Agency for Protected Areas has announced the opening of the tender for the drafting of an integrated management plan for the......

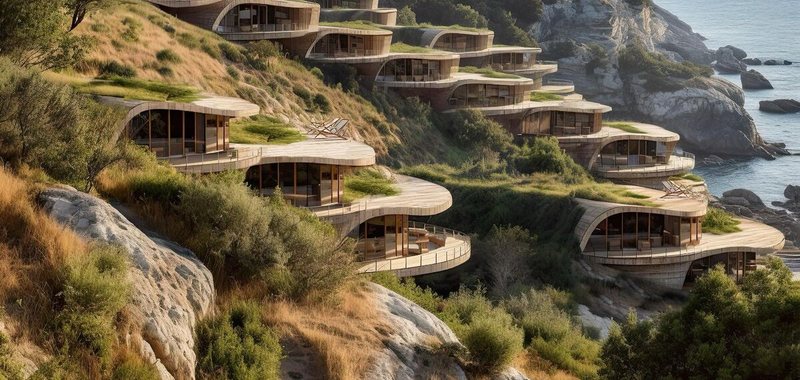

Government, shareholder in the luxury resort of Sazan - The new company that will represent the country in this project is registered

The Albanian state will be an active participant in the giant tourist project expected to be built on the island of Sazan. A new company named “Albania State......

How did this week end for the major currencies?

The US dollar has closed this week at unstable values, experiencing negative fluctuations throughout this period, being bought this morning at 83.2 lekë and......

Greece attracts the rich - 1,200 foreign millionaires expected to move in by 2025

Around 1,200 more foreign millionaires are expected to move to Greece by 2025, according to estimates by Henley & Partners, which advises wealthy clients on......

33.20 million euros were purchased from the foreign exchange market - Did the strengthening of the lek indirectly soften? The BoA organized a three-month auction for the first time

In order to increase foreign exchange reserves, the Bank of Albania purchased 33.20 million euros during the first 3 months of 2025. The Central Bank......

Trump's pressure on the Fed knocks the dollar - Powell's possible replacement "rocks" markets and strengthens the euro

The dollar fell to multi-year lows against the euro and Swiss franc on Thursday as concerns about the independence of the U.S. Federal Reserve dented......

How much were loans affected by the exchange rate? - BoA: The strengthening of the lek led to a decline in unsecured loans of 23.5% during 2024

During 2024, banks have provided more loans to the private sector than to individuals. Figures show that 60% of the loans were taken by businesses and only......

Energy, global CO2 emissions record - Report: Pollution in this sector increased for the fourth consecutive year

Global carbon dioxide emissions from the energy sector hit a record high for the fourth consecutive year last year. Fossil fuel use continued to rise even as......