About 9 thousand construction companies "targeted" by taxes - 7 legal obligations that penalize them. From salaries, to invoices and premises contracts

The construction sector plan, which has begun to be implemented by the tax administration, aims to reduce informality and increase transparency in the sector, as well as to encourage voluntary compliance with obligations. In order to draft and implement the plan, 8,784 active taxpayers in this sector were considered, of which 51% of taxpayers have the form of organization of a limited liability company. 47% of them are located in Tirana, 14% in Durrës and the rest are distributed in other regions.

In total, the sector employs 64,572 individuals, of whom 25% are included in the salary range of 40,001 - 50,000 lek and only 7% have salaries over 120 thousand lek.

In this context, the Tax Administration invites and encourages all taxpayers in this sector to fulfill their legal obligations correctly and on time, indicating specifically which points will be checked and penalized if they are caught in violation.

Specifically, companies are required to fulfill the obligation to declare each employee employed, in accordance with tax and social security legislation; Real declaration of salaries, based on the profession practiced, qualification, experience and real labor market conditions; Issuance of fiscalized invoices with NIVF/NSLF for each sale or transaction made, including prepayments; Purchase of any goods or services only with a regular tax invoice, guaranteeing the traceability of transactions; Accurate, complete and updated declaration of data in the Taxpayer Registry; Accurate declaration of rental contracts of premises where economic activity is carried out; Use only certified software for fiscalization, according to the requirements of the legislation in force.

The Tax Administration informs that it has and analyzes a wide range of data provided from various sources, including: data received from public and private third parties; data obtained from the CPCM system (electronic invoicing system); self-declarations of taxpayers who exercise activity in the construction sector or in its supply chain which are used to conduct in-depth risk analyses, to identify discrepancies, deviations from reference indicators and behaviors that may signal tax evasion.

Failure to comply with these obligations, as well as any other behavior aimed at tax avoidance, ascertained through risk analysis, categorizes the taxpayer as a risky entity. In these cases, the Tax Administration undertakes verification and monitoring measures, in accordance with legal powers, which may include controls, monitoring, tax investigations and administrative measures according to legal provisions.

"The European economy needs a deep overhaul" - ECB President Lagarde: We must face the new world order

The European economy needs a "deep overhaul" to face "a new international order", declared the president of the European Central Bank, Christine......

20% of EU steel and aluminum production - European Commission proposal by 2030

A European Commission proposal aimed at reindustrialising and decarbonising the bloc's heavy industry to combat fierce competition from China and the United......

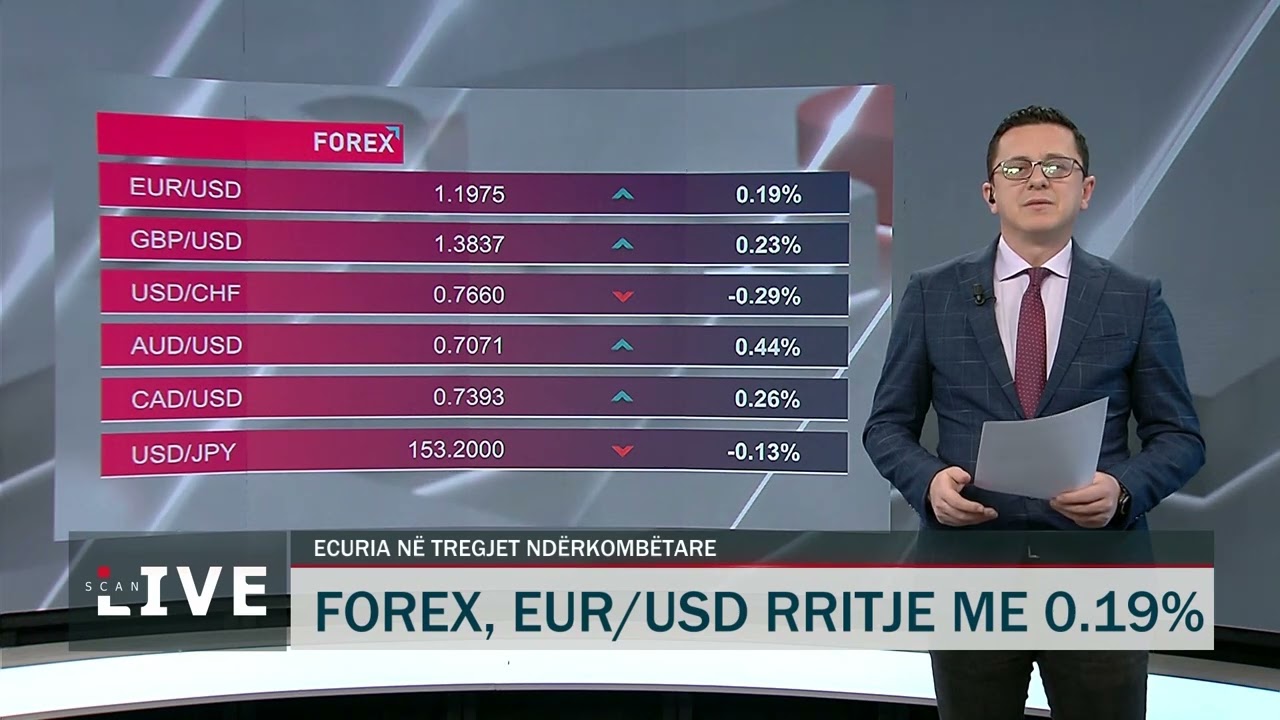

The Swiss Franc strengthens again - The US Dollar recovers that point too!

The US dollar has recorded an increase in value, recovering points from the previous day as it was bought this morning at 82 lek and sold at 83 lek according......

Poland has more gold than the European Central Bank - Target, 700 tons with total value of reserves around 94 billion euros

The President of the National Bank of Poland (NBP), Adam Glapiński, has emphasized for years that gold plays a special role in the structure of reserves. It......

Britain, highest unemployment in 4 years - ONS: Number of employees on payrolls fell by 43,000

The number of people employed in the UK has fallen, particularly in shops, restaurants, bars and hotels, reflecting a decline in employment, while wages in......

US "cashes" Venezuela's oil money - US Senator: Trump is doing this without a legal basis

Hundreds of millions of dollars that the US is collecting from the sale of Venezuelan oil have been sent to Qatar. The move is seen as an indirect route that......

Maliq, Ministri Salla: Çdo fermer me NIPT do të dëmshpërblehet për dëmet e reshjeve

Ministri i Bujqësisë dhe Zhvillimit Rural, Andis Salla, zhvilloi një takim me fermerët e Bashkisë Maliq, në përgjigje të kërkesës së tyre për bashkëbisedim......

Underdeclaration of salaries in construction, Taxes inspect 9 of the largest real estate companies

In implementation of the Operational Plan in the Construction sector, the Tax Investigation Directorate, in cooperation with the Field Verification and......