Reference salary for tourism employees - New plan/ How will accommodation structures be controlled during the season?

While the tourist season has already begun and a high influx of tourists is expected, the tax administration will be on the ground to ensure that all tourist entities pay their real obligations.

In the tourism plan published by the General Directorate of Taxes, it is stated that the level of utilization of accommodation structures will be monitored as well as the weekly monitoring of the turnover of taxpayers who exercise activity in the tourism sector, using data from fiscalized invoices and tax declarations.

An important measure is the determination of reference salaries for professions in the tourism sector and the identification of taxpayers at risk in order to realistically declare payments during this period, when it is known that they are increasing.

The declaration of tax obligations in accordance with legal deadlines will also be supervised, including VAT, profit tax and withholding tax.

An important component will be monitoring the fulfillment of tax obligations through payments made and identifying cases of delays in the settlement of these obligations.

The tax administration will conduct an analysis of the status of taxpayers in the population (active/passive/newly registered) to identify structural changes and fiscal behaviors in the sector.

The focus will be on the analysis of taxpayers with deviant behavior, such as: Submission of declarations with zero values, despite exercising the activity; Significant decline in turnover compared to previous periods; Repeated delays in fulfilling tax obligations.

How will the comparison of fiscal data be done through: Turnover in fiscalized invoices and VAT declarations; Turnover between consecutive months and/or between consecutive years; Declared turnover and number of employees; Number of employees and tax liability for VAT.

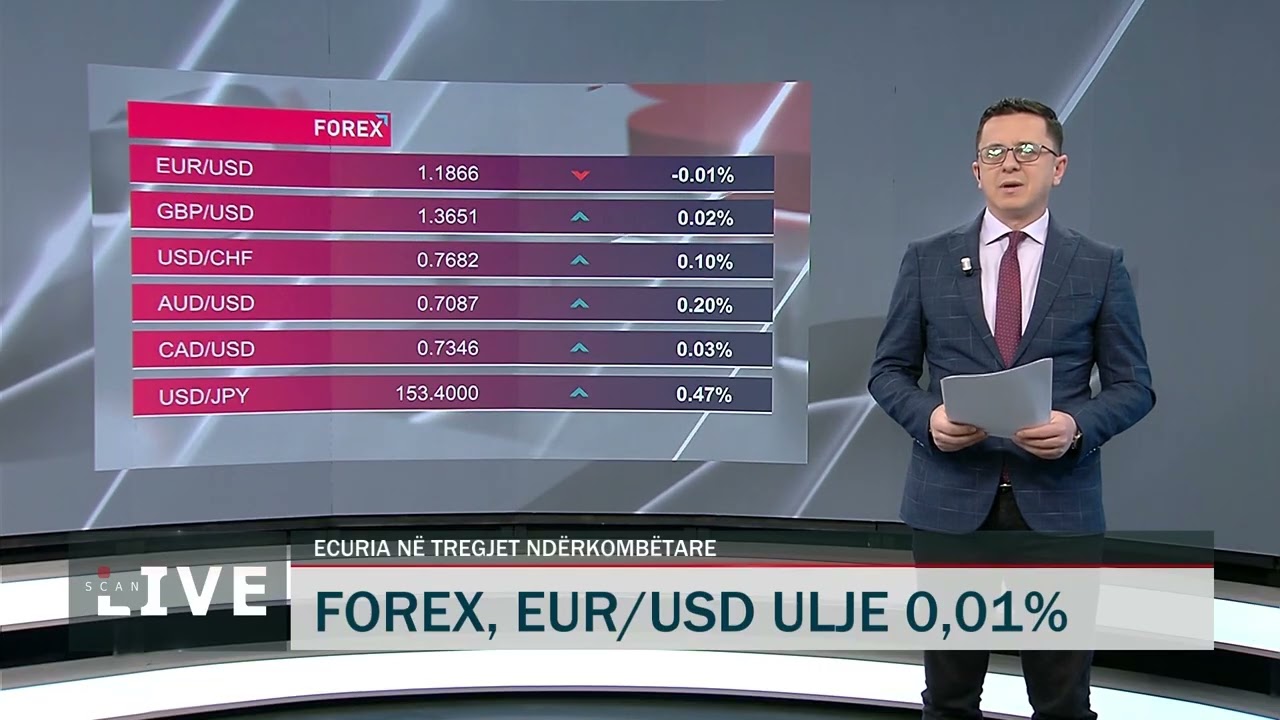

General decline in the foreign exchange market – Major currencies weaken significantly!

The US dollar started this day negatively, losing points from the day before as it was bought today at 85.2 lek and sold at 86.4 lek according to the local......

South Korea dominates vehicle imports - January-May 2025, registrations increase. Over 38 thousand new cars in circulation

The vehicle market in Albania is experiencing significant expansion. According to the Directorate of Road Transport Services, 38,028 new vehicles were......

US and China reach trade deal - Countries aim to strengthen bilateral trust after talks in London

China and the United States agreed in principle to implement the consensus reached by the leaders of the two countries during their phone call on June......

Remittances on the rise, but with a weak euro/ Emigrant remittances reach "peaks" for the first quarter of the current year

Remittances from Albanian emigrants have set another historic record in the first quarter of 2025, reaching 250.68 million euros, according to data from the......

Chinese tourists "land" in Europe - The number of Asian visitors increases, but spending "shrinks"

Cost-conscious Americans may be cutting back on their European vacations this summer, but another group is taking the vacated spot: Chinese travelers.......

"Arson is a criminal act. The perpetrators must be discovered and punished" - Minister Hoxha, with the leaders of the Fire Service

Interior Minister Ervin Hoxha called for measures to be taken for prevention, rapid and efficient intervention in cases of fires, but also for the......

Apple introduces new AI features - Reveals live translations and liquid glass technology

Apple announced several artificial intelligence features, including the underlying technology it uses for Apple Intelligence, in an update to its software......

Albanian immigrants are earning more money! - 154 million euros in salary in 3 months. In one year they increased by 12%

From working abroad, Albanian emigrants have benefited from 154.7 million euros during the first three months of 2025. According to data from the Bank of......