American Chamber, reservations about "Fiscal Peace" - "It endangers fair competition and legalizes dubious capital"

The American Chamber of Commerce has reservations about the fiscal peace package. According to this institution, the agreement in question poses a high risk of violating fair competition.

According to a statement made by the House, the bill proposes a scheme in which businesses that have correctly declared profits over the years are placed in a disadvantageous position, while entities that have evaded tax obligations directly benefit.

“ The provision of a mandatory increase of 18% of the previous year's profit, regardless of the sector or the real performance of the taxpayer, replaces the self-declaration process with an arbitrary formula that does not reflect the real financial performance of the entity and creates an unfair burden for regular taxpayers. Conversely, businesses with historically low profit declarations benefit from the low calculation base, causing significant distortion of competition. This situation harms serious businesses and contradicts the constitutional principle of equality before the law, ” the statement says.

It is also underlined that "Fiscal Peace" creates real opportunities for the legalization of capital of dubious origin by allowing the restatement of financial statements of the last five years, including the declaration of previously unreported cash, the write-off of liabilities or the declaration of other unregistered assets, without the need to justify them as accounting/tax errors or intentional non-declarations.

Another reservation of the US Chamber of Commerce is related to the effect on reducing the quality of tax administration, with the argument that it significantly limits tax control over income tax during the agreement period, relying only on administrative verifications “from the office”. This approach weakens the ability of the tax administration to identify evasion and creates a favorable terrain for abuses.

Referring to the declaration, a tax rate of only 5% will be applied in the case when the realized profit increases above 18%, as well as in the case of re-declaration of other financial items, creating a significant gap between the regular tax rates (15% for corporate income and 23% for certain categories of businesses) and the preferential rate of the scheme.

"This large difference has no economic justification and creates a strong incentive for all businesses to move towards the "fiscal peace" scheme, significantly reducing the potential revenues of the state budget. In a period where fiscal stability and predictability are required, this scheme encourages tax avoidance and shrinks the existing tax base, " the statement said.

It is also emphasized that this package violates the fundamental principles of taxation.

For this reason, it is recommended to fully review the draft law and undertake fiscal policies that promote formalization and honest fiscal behavior; guarantee fair competition; strengthen the integrity of the tax administration; preserve business confidence and the country's international reputation.

Wave of protests in Bulgaria - Thousands of citizens demand government resignation and justice reforms

Thousands of Bulgarians have protested against the country's minority government, which they say has failed to combat endemic corruption in the European......

The Albanian economy reduces the burden of external debt - About 10.37 billion euros, while the ratio to GDP marks a sharp decline to 38.9%

Albania's Gross External Debt has marked a significant decrease during the third quarter of 2025. According to data from the Bank of Albania, at the end of......

The labor market loses 11 thousand young people in one year/ Employment in absolute terms experiences contraction, despite a slight increase in the rate

Around 6,500 people aged 15 and over have exited the labour market over the last year, the latest INSTAT data show, although the employment rate has......

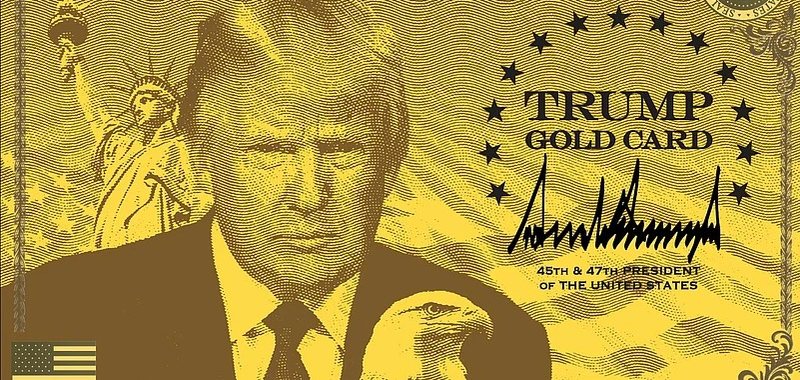

Trump introduces “Gold Card” program - Expedited visas at a cost of $1 million

President Donald Trump's administration has officially introduced the "Trump Gold Card" visa program, which offers foreigners a fast track to obtaining......

Fed cuts interest rate - Chairman Powell seeks to restore economic stability before leaving

The Federal Reserve announced a cut in the key interest rate by a quarter of a percentage point, or 25 basis points, bringing the target range to......

The US Dollar Weakens While the Franc Strengthens - How Much Are Major Currencies Exchanged Today?

The US dollar continued to decline this morning, as compared to the day before, it was bought today for 82.2 lek and sold for 83.3 lek according to the local......

New rules for seasonal employment - In North Macedonia, they come into effect from January 1, 2026

From January 1, 2026, the Law on Employment of Persons will enter into force in North Macedonia, a new regulation that aims to formalize seasonal employment......

Internal combustion engines are back in fashion - Reason: political and trade tensions, doubts about electric vehicles

Car buyers around the world are turning to internal combustion vehicles due to policy changes, trade wars and growing skepticism about the infrastructure and......