Banks "shake hands" for loans/ Citizens are expected to seek fewer loans in the third quarter

Citizens are expected to seek fewer loans for home purchases in the third quarter, as commercial banks will tighten lending standards. As previously announced, banks will have stricter criteria for approving a loan, based on the latest decision of the Bank of Albania that sets ceilings on the value of the loan that banks will provide for the purchase of a first or second home, in euros or lek, as well as the weight that the installment should take in the borrower's income.

What about the demand for loans from citizens in the second quarter?

According to the Bank of Albania's lending activity survey, individuals' demand for credit increased in the second quarter, both for housing purchases and for consumer financing. This increase in demand came as a result of more favorable interest rates and improved consumer confidence.

Banks have responded to the high demand with a larger number of approved loans. The factors that most influenced the decline in the rate of individual loan rejections were the stability of employment in the labor market and that of relations with the bank.

As for lending standards, they remained almost unchanged in the second quarter of 2025. These standards include the internal guidelines or criteria for approving a loan at a bank. They are determined before the loan is negotiated on terms and conditions. The standards define the types of loans that the bank considers desirable and undesirable, the necessary characteristics of the borrower (for example, balance sheet conditions, income situation, age, employment status), so that a loan can be obtained.

Meanwhile, the terms and conditions of lending were also unchanged in the second quarter. They refer to the terms and conditions of the approved loan as defined in the loan contract, which is agreed upon between the bank and the borrower.

Strengthening and reconstruction of substations/ OSSH invests 600 million lek for the 35kV line in Elbasan

The High Voltage Directorate of OSSH sh.a has announced the opening of the tender for the construction of the 35kV line, 220 kV substation Elbasan - Mjekës -......

What are the steps to reduce cash? Isaji: Strategy is required, banking infrastructure is ready in Albania

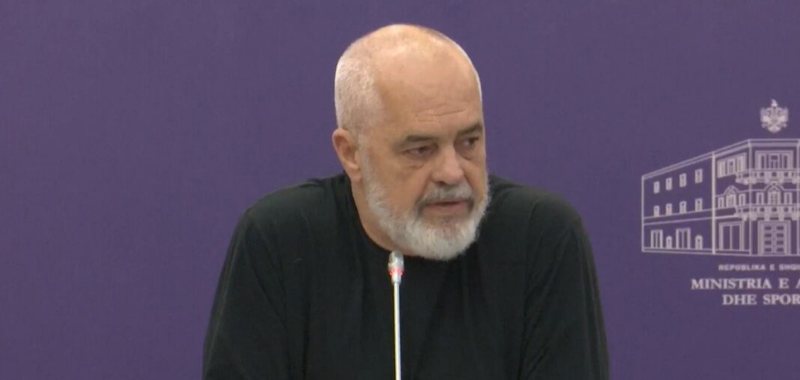

"We have another ambition, that by the end of this decade, Albania will be "cashless" This is what Prime Minister Edi Rama recently stated, from where by......

Pensions, which regions are the oldest? Tirana holds the record for the number of pensioners

The number of pensioners in Albania is increasing due to the aging population, the phenomenon of emigration and the decline in the birth rate, causing high......

"Achievements and challenges towards University 4.0"/ Report of the Accreditation Board of Higher Education Institutions Presented

The Report of the Accreditation Board of Higher Education Institutions, "Achievements and Challenges Towards University 4.0", a journey of transformation of......

Why is Albania so dependent on physical money? Measures to be taken by 2030. From POSs to the limit on cash payments

At a time when many countries are close to fully implementing electronic payments, the situation in Albania is different. Albanians continue to be closely......

Albania leads Europe again/ Around 166% more commercial flights in June than before the pandemic

Albania is increasingly attracting the attention of foreign vacationers, especially after the pandemic. Tourism seems to be one of the fastest growing......

250 USD fee for non-immigrant visa to the US! According to the “One Big Beautiful Bill” recently approved by the Trump administration

Visitors entering the United States will be required to pay a “visa integrity fee,” under a provision of the One Big Beautiful Bill recently passed by the......

Customs "listens" to business/Invites to evaluate services to improve them

The General Directorate of Customs invites business to contribute to the improvement of customs services through a new questionnaire The General Directorate......