"European sovereignty at risk" - EU responds to Trump with digital euro

The European Union's confrontation with the United States is not limited to trade or the future of Ukraine. Eurozone finance ministers have addressed another controversial issue: the role of cryptocurrencies. Concern is evident in Europe after the presentation in Washington of two bills aimed at liberalizing a growing market. The birth of a digital euro currency is becoming urgent.

"The cryptocurrency market is evolving politically and technologically very quickly," official sources explain. At stake is nothing less than the "strategic autonomy" of the European Union as well as "the strength of our currency." Essentially, the risk is "to see new transfers of savings from Europe to the United States, with a structural weakening of the euro," they said.

Even before his return to the White House, President Donald Trump had floated the idea of promoting cryptocurrencies. European authorities had already expressed concern at that time. Two bills have been introduced in recent weeks, both of which deal with so-called stablecoins, i.e. cryptocurrencies backed by the dollar or another currency.

The principle of a stablecoin is simple: the issuer must be able to repay the investment at any time. The STABLE Act has stricter rules regarding reserve requirements, but allows the use of a variety of instruments to repay the investment: security deposits, short-term government bonds, repurchase agreements and even bank reserves. The GENIUS Act allows issuing companies to use money market instruments for repayment.

The legislative proposals are generally quite loose and pose the risk of incompatibility with the European rules of the Crypto-Asset Market Regulation, which entered into force in 2023. There are two main differences with the European regulatory framework: on the one hand, the American proposals provide for remuneration; on the other, they allow issuing companies to deposit money in Federal Reserve accounts. The risks, in the eyes of the European authorities, are not lacking.

There is a risk of witnessing a change in the very nature of currencies. They would no longer be simply a speculative instrument, as they currently are, but would also become a savings instrument, and even an alternative form of payment to traditional currencies, given the possible involvement of the American Central Bank. From this latter perspective, the European Union is proving to be particularly fragile.

The financial market in Europe remains fragmented, despite a single currency and the free movement of capital. American companies have been masters at taking advantage of this, offering pan-European solutions first in credit cards (Visa and Mastercard), then in new payment systems (Apple Pay and Google Pay). Today they are ready to do the same with cryptocurrencies.

The director of the European Stability Mechanism explained that “European sovereignty and financial stability” are at risk. Moreover, these currencies are a problem for European banks. Credit institutions would be bypassed by cryptocurrency transactions that would be carried out behind their backs. They would not be able to monitor the creditworthiness of their customers, as they do now with payment cards. Not in vain, the leaders of the eurozone reiterated their desire to accelerate the path to the digital euro.

Why is Portugal facing its third snap election in three years?!

Portugal is once again plunged into political crisis. Prime Minister Luís Montenegro, who leads the Democratic Alliance (AD), is currently embroiled in a......

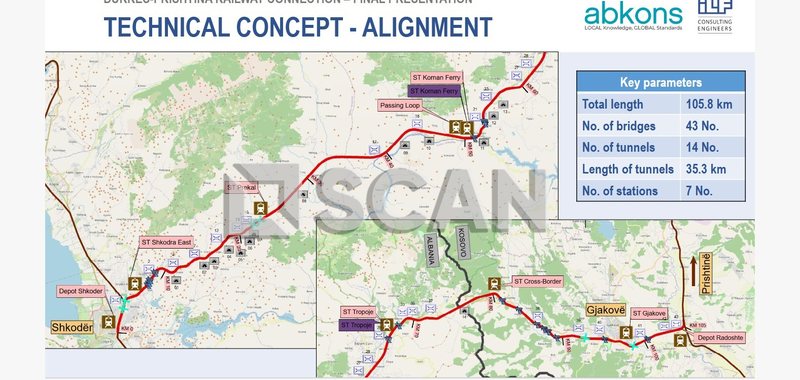

Durrës-Prishtina Railway, SCAN reveals the 1.8 billion euro project - Exclusive/ 43 bridges and 14 tunnels. 105.8 km with 7 stations from Shkodra to Gjakova

The railway line from Shkodra to Gjakova will have 7 stations, with a length of 105.8 km. TV SCAN has revealed details from the presentation of the......

Problems on the “X” platform - According to Musk, the cyber attack came from Ukraine

Social media platform X has suffered an outage, with owner Elon Musk saying it was the work of a powerful cyberattack. "We are attacked every day, but this......

"Artificial Intelligence in Procurement" - Rama: We will start at the end of next year

Albania is getting ready to "embrace" artificial intelligence in all areas, including public procurement. During the "Franco-Albanian Week on Artificial......

The opening of the EIB office in Albania is approved - Yzeiri: Loans are offered with lower interest rates than other institutions

The Parliamentary Committee on Economy has approved the agreement with the European Investment Bank for the opening of this institution's representative......

VAT for farmers remains "suspended" - Debate in the Economy Committee on Braça's proposal

The proposal of MP Erion Braçe to repeal the 2018 VAT scheme for farmers, which is 0% on purchases and 20% on sales, has sparked debate in the Economy and......

Around 464 million euros in payments with the AIPS system - BoA: The first two months of the year marked a record number of transactions compared to 2024

The AIPS-EURO system is increasingly being used to make very large payments in euros. The first two months of this year have marked a significant increase in......

Only 7 countries met WHO air quality standards in 2024!

Only seven countries met World Health Organization (WHO) air quality standards last year, data showed on Tuesday, as researchers warned that the fight......