World markets vulnerable to Trump tariffs - China, Europe and Canada at risk from US trade policies

From China to Europe, including Canada and Mexico, global markets are feeling the risk of Donald Trump's promise to raise tariffs when he takes office as US president in less than two weeks.

Trump has promised tariffs of up to 10% on global imports and 60% on Chinese goods, plus an additional 25% on imports on Canadian and Mexican products, duties that trade experts say would disrupt trade flows, raise costs and would cause retaliatory measures.

The scale and scope remains to be seen, but the road ahead appears fraught with obstacles.

1/ China's fragility

"China is likely to be the main target of Trump 2.0 trade wars," according to Goldman Sachs. Investors are already reacting, forcing the country's bourses and central bank to defend the yuan and falling stocks.

China's controlled currency is at its weakest level in 16 months, with the dollar trading well above the symbolic landmark of 7.3 yuan that authorities had defended. Barclays sees the yuan at 7.5 to the dollar by the end of 2025 and slipping to 8.4 in a scenario in which the US imposes 60% tariffs.

Even without tariffs, the currency has been hurt by a weak economy that is pushing up Chinese government bond yields, widening the gap with elevated U.S. Treasury yields.

Analysts expect China to allow the yuan to weaken to help exporters manage the impact of tariffs, but gradually. A sudden drop would bring to the fore dormant fears of capital outflows and shaken confidence, already damaged as stocks saw their biggest weekly drop in two years.

2/ "Toxic mixture" for the euro

The euro has fallen more than 5% since the US election, more than all major currencies, hitting a two-year low of around $1.03. JPMorgan and Rabobank think the currency could fall to $1 this year, due to tariff uncertainty.

The US is the European Union's most important trading partner, with $1.7 trillion in two-way trade in goods and services.

Markets are anticipating a 100 basis point European Central Bank rate cut this year to shore up the weak economy. But traders, speculating that the tariffs could boost US inflation, expect only a 40 basis point Fed rate cut, adding to the dollar's appeal against the euro.

A weakened Chinese economy also hurts Europe. Tariffs hitting China and the EU at the same time could be a "very toxic mix for the euro," currency strategist ING said.

3/ Vehicle problems

In Europe, auto stocks are also particularly vulnerable to tariff-related threats. The swings highlight the vulnerability of investors in an already depressed sector that has seen its shares lose a quarter of their value since their April 2024 peak.

Barclays' head of European equity strategy said cars are among the trade-exposed consumer sectors he is watching closely. Other sectors include everyday products, luxury and industrial goods.

A Barclays basket of the most tariff-exposed European stocks is down about 20%-25% against the main market in the past six months. Eurozone economic weakness could also extend the underperformance of European stocks.

How much do Albanians insure property against fire? - AMF: In 9 months, the number of contracts increased by 2%

Voluntary insurance premiums during the period January-November 2024 reached about 8.5 billion ALL, 6.69% more than in the same period of 2023. Also, the......

"Fragmentation of financial markets harms Europe" - EU Commissioner aims to unify the system to increase competition

The European Union's financial industry faces burdens equal to a 110% tariff due to the fragmentation of the bloc's financial services markets, EU Financial......

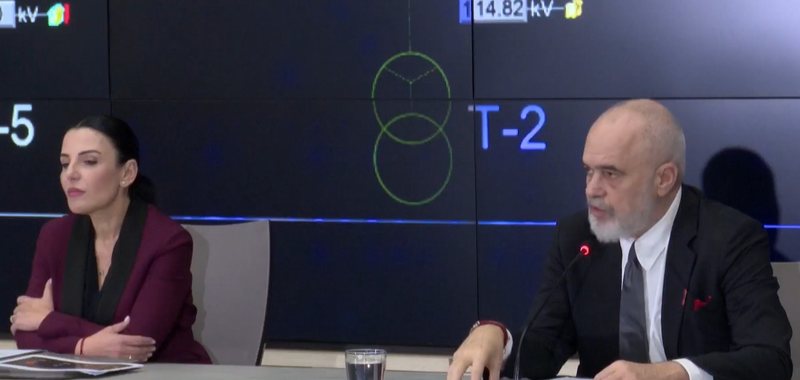

The new price of energy/not billing with bundles, but according to consumption/ Rama: Albania, in first place in the region for energy production

"One of the most significant achievements of our government, the first decrease in the history of these 35 years of electricity prices". This is how Prime......

The price of energy is reduced for 880,000 families. New scheme for the consumption of up to 700 kWh/month. Affected are those who pay up to 8,000 ALL/month

Starting from February 1, all families who currently pay a monthly electricity bill of no higher than 8,000 Lek will benefit from the reduction in the price of......

How did the income of working abroad change in 5 years?/ Record growth in 2024, 3 times more than during the pandemic

Income from working abroad is an important component of the economies of many countries. Immigration for employment purposes has become a common phenomenon,......

Bird flu/ What should consumers do? - Running: Here are the elements you should check, don't buy in informal markets

During the last months, various cases of bird flu and African swine fever have appeared. But despite the fact that the Ministry of Agriculture has taken......

The global price of sugar falls - But the world food index remains higher than in 2023

World food prices fell slightly in December compared to November, but are still at high levels, the United Nations Food and Agriculture Organization......

Lowering the price of energy for households - Balluku: The performance of the sector and the reduction of losses influenced the decision

During the media conference, Deputy Prime Minister Belinda Balluku mentioned some of the factors that led to the reduction of energy prices for households.......