"Tariffs less productive than US projections" - Economists warn of negative effects of tariff policy

US President Donald Trump says the tariffs will make the US richer. But those gains are expected to be far less than the White House has projected, economists say. The final amount could have major consequences for the US economy, the country's debt and legislative negotiations over a tax cut package, they explain.

The White House trade adviser estimated that the tariffs would raise about $600 billion a year and $6 trillion over a decade. While auto tariffs would add another $100 billion a year. The projection comes as the US plans to announce more tariffs against trading partners on Wednesday.

Economists expect the Trump administration's tariff policy to generate a much smaller amount of revenue. The total revenue from some projects would be less than half. There are big questions about the scope of the tariffs, including details such as the amount, duration, products and countries affected; all of which have a significant impact on total revenue.

The White House is considering a 20% tariff on most imports. The Trump administration could ultimately opt for a different policy, such as state-by-state tariffs, based on each nation’s trade and non-trade barriers. The U.S. imported about $3.3 trillion in goods in 2024. Applying a 20% tariff on all of those imports would take about $660 billion in annual revenue.

That's because an accurate estimate of revenue must account for the multiple economic impacts of tariffs in the U.S. and around the world. These effects combine to reduce revenue, economists said.

A broad 20% tariff would raise about $250 billion a year (or $2.5 trillion over a decade) when these effects are taken into account. There are ways to raise larger sums, but they would involve higher tariffs. For example, a 50% tariff across the board would raise about $780 billion a year, according to economists at the Peterson Institute for International Economics. Even that is an optimistic estimate, as it doesn’t take into account lower U.S. economic growth due to retaliation or the negative growth effects of the tariffs themselves, they add.

Why would revenue be lower than expectations?

In general, tariffs raise prices for consumers. A broad 20% tariff would cost the average consumer $3,400 to $4,200 a year. Consumers would naturally buy fewer imported goods if they cost more, experts explain. Lower demand means fewer imports and less tariff revenue from those imports.

For example, U.S. companies that do not pass on the costs of tariffs to consumers through higher prices are likely to see profits fall. Consumers could pull back on spending, further reducing corporate profits and tax revenues. Firms that take a financial hit could therefore lay off workers, economists say.

Foreign countries are also expected to retaliate with their own tariffs on American products, which would hurt companies that export products abroad. Other nations could experience an economic downturn, further reducing demand for U.S. products.

There is also expected to be some inconsistency in tariff policy, as well as exemptions for certain countries, industries or products. For example, when the White House imposed tariffs on China in February, it indefinitely exempted “de minimis” imports worth $800 or less. The US administration could also channel some of the revenue from the tariffs to pay some parties hurt by the trade war, economists said.

President Trump did this in his first term: The government sent $61 billion in “relief” payments to American farmers facing retaliatory tariffs. That amount was about 92% of the revenue from tariffs on Chinese goods from 2018 to 2020, according to the Council on Foreign Relations.

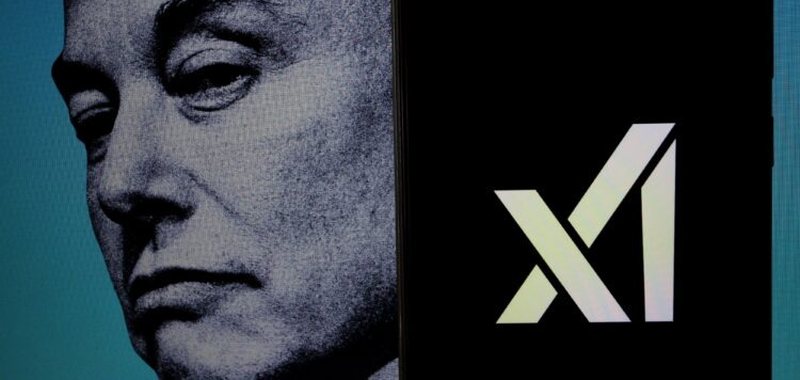

Why did Elon Musk merge his AI and X companies into one? What does this mean for your data?

Elon Musk’s own acquisition of his artificial intelligence (AI) company xAI and social media platform X (formerly Twitter) is the latest sign of the......

NATO countries begin annual military exercise in the Black Sea – Albanian forces among them!

Military personnel from 12 NATO countries began an annual Romanian-led naval exercise in the Black Sea and the Danube Delta this week. More than 2,300 troops......

From white gold to new oil – Why is Greenland's mineral wealth in the spotlight?!

Danish Prime Minister Mette Frederiksen will visit Greenland on Wednesday, as diplomatic relations between Washington and Denmark deepen after the US......

General growth in the foreign exchange market – Major currencies strengthen!

The US dollar has gained points again this morning compared to yesterday, being bought today at 91.2 lekë and being sold at 92.2 lekë according to the local......

About 2.7 billion euros for holidays abroad - BoA: Albanians, 17.4% more spending in 2024

Albanians spent 2.7 billion euros on trips abroad in 2024. The latest data from the Bank of Albania shows that resident travelers (including Albanians and......

Food safety, AKU merger warned - Placing chicken meat with salmonella on the market speeds up the process

The latest case of the release of a significant amount of salmonella-tainted chicken meat has called into question the future of the national food......

New National Center for Children's Culture nearing completion - Rama: It will be equipped with international programs

The country's Prime Minister, Edi Rama, inspected the construction site of the new National Center for Children's Culture, near the Great Lake Park.......

Forbes: Samir Mane, the first Albanian billionaire and the richest in the Western Balkans

Albania has its first billionaire this year, with new entrant Samir Mane, who has built an estimated fortune of $1.4 billion from investments in shopping......