Property revaluation, when does the process start? - Instructions, deadline until February 5. 500 thousand families benefit

The law that gives citizens and businesses the right to revalue their real estate with a tax rate of 5% officially enters into force on January 22. But this does not mean that the procedure starts on the same date. This is because the Ministry of Finance has a legal deadline of 15 days to approve the relevant instruction on how the process will work in detail.

Which means that the green light will finally open around February 5, a process that is expected to last until December 31, 2026, where all those who own real estate will have the opportunity to increase its value by making it equal to the market value.

This process is expected to significantly impact the promotion of property transactions which until now have been awaiting fiscal relief, in order to avoid paying the current tax rate of 15%.

This initiative is expected to directly benefit 500,000 families.

Referring to the law, requests for revaluation submitted to the State Cadastre Agency for which tax payments have been made, but administrative procedures have not been completed by the ASA by December 31, 2026, are considered subject to revaluation under this law and administrative procedures are completed by March 31, 2027.

But what are the main procedures that are defined in the law and that citizens must follow for the reassessment?

The revaluation can be carried out by a licensed real estate valuation expert from the relevant institutions or from the local directorates of the State Cadastre Agency.

If the individual decides to carry out the revaluation at market value, then he chooses a licensed expert. He also attaches the expert's valuation act to his application for revaluation of the immovable property. In this case, the local directorates of the State Cadastre Agency calculate: the taxable base, which is calculated as the difference between the value reflected in the expert's valuation act, which cannot be less than the fiscal prices in force at the time of the revaluation, and the registered value of the property or the revalued value, according to the previous revaluation laws, for which the tax was paid, as well as the tax that the individual must pay to register this revaluation.

If the individual decides that the revaluation should be carried out at the minimum fiscal prices in force, then he applies to the State Cadastre Agency and this fact is expressed in the form attached to his application for revaluation. In this case, the local directorates of the State Cadastre Agency calculate: the taxable base, which is calculated as the difference between the value resulting from the revaluation at the fiscal prices in force at the time of the revaluation and the registered value of the property or the revalued value for which the tax was paid.

In cases of transfer of ownership rights over immovable property, pursuant to the legislation in force on income tax, made after revaluation, the tax is calculated according to the rates in force on the profit realized, as the difference between the value, at the moment of transfer of ownership rights, and the revalued value for which the tax was paid.

The law also gives legal entities, which have real estate assets registered in their financial statements with a value lower than the market value, the right to revalue these assets at the market value by December 31, 2026.

Snow in the north and southeast of the country - ARRSH: Drivers should be equipped with winter tires

During the night, the country's territory was covered by moderate rainfall, while snowfall began in the northern and southeastern areas. The Albanian Road......

About 9 thousand construction companies "targeted" by taxes - 7 legal obligations that penalize them. From salaries, to invoices and premises contracts

The construction sector plan, which has begun to be implemented by the tax administration, aims to reduce informality and increase transparency in the sector,......

"The European economy needs a deep overhaul" - ECB President Lagarde: We must face the new world order

The European economy needs a "deep overhaul" to face "a new international order", declared the president of the European Central Bank, Christine......

20% of EU steel and aluminum production - European Commission proposal by 2030

A European Commission proposal aimed at reindustrialising and decarbonising the bloc's heavy industry to combat fierce competition from China and the United......

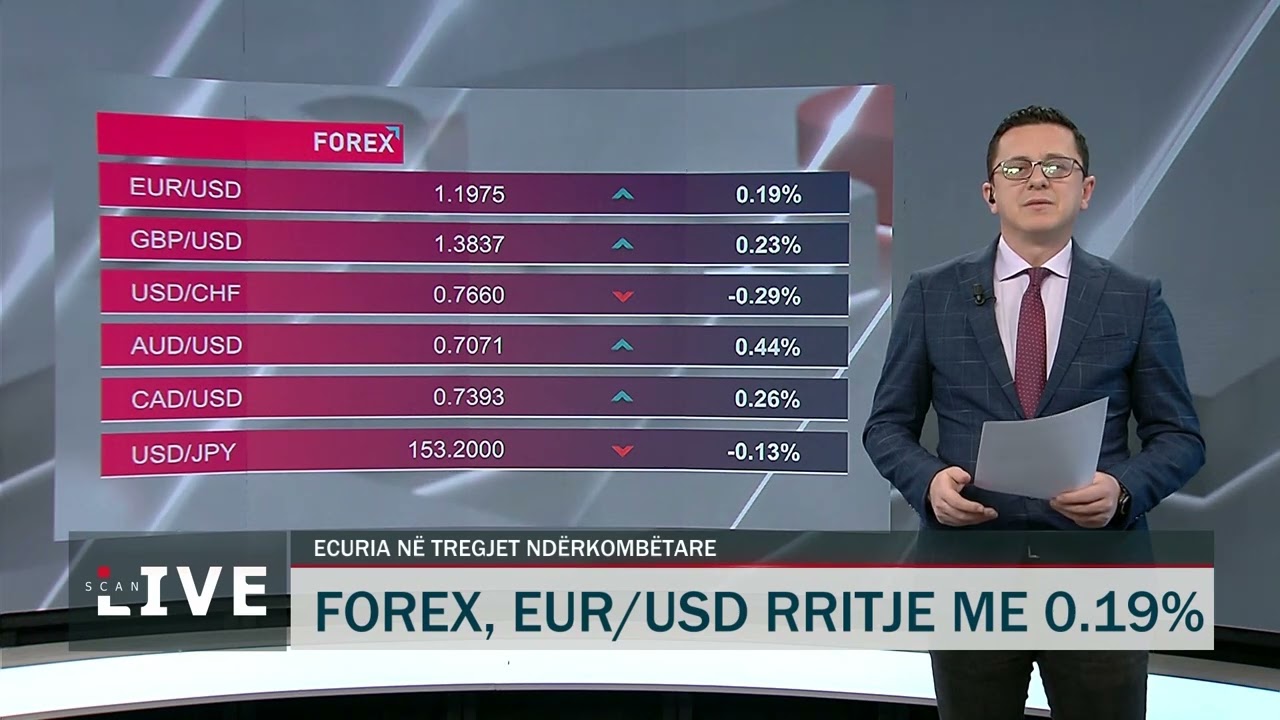

The Swiss Franc strengthens again - The US Dollar recovers that point too!

The US dollar has recorded an increase in value, recovering points from the previous day as it was bought this morning at 82 lek and sold at 83 lek according......

Poland has more gold than the European Central Bank - Target, 700 tons with total value of reserves around 94 billion euros

The President of the National Bank of Poland (NBP), Adam Glapiński, has emphasized for years that gold plays a special role in the structure of reserves. It......

Britain, highest unemployment in 4 years - ONS: Number of employees on payrolls fell by 43,000

The number of people employed in the UK has fallen, particularly in shops, restaurants, bars and hotels, reflecting a decline in employment, while wages in......

US "cashes" Venezuela's oil money - US Senator: Trump is doing this without a legal basis

Hundreds of millions of dollars that the US is collecting from the sale of Venezuelan oil have been sent to Qatar. The move is seen as an indirect route that......