How much will pensions increase by 2030? - The government will review the minimum, average and social pensions

The government plans to increase the average pension in Albania by 50% by 2030. Currently, the average old-age pension in the country, according to 2024 data, is 184 euros for urban pensions and 110 euros for rural pensions. This means that within 5 years, urban pensions are expected to average 276 euros and rural pensions 165 euros.

The document approved by the government on measures to be taken for pensioners until 2030 states that maintaining and developing the gradual and sustainable reform of the retirement age for men and women is one of the ways to create financial independence for pensioners. It is also emphasized that gradually improving the incomes of the lowest pensioners, while providing sustainable financial support for the poorest elderly, is a necessity.

The elderly are considered to be the group most vulnerable to poverty in the country, this is because the 2015 pension reform currently does not provide the possibility of financial independence for the elderly and affording dignified living standards.

According to the document, there are significant differences in pension income between the elderly living in rural areas and those living in urban areas. Although the previous reform approved the right to social pension for those who were not contributors to the pension scheme, the number of social pension beneficiaries remained very low, due to a lack of information among citizens.

For this reason, it is underlined that the policy that will be implemented is that of reviewing the minimum pension, the average pension and the social pension, accompanied by more information campaigns.

One of the elements that has affected the contributory pension scheme as well as the social security scheme is the non-payment of contributions due to high informality or non-declaration of real salaries. This has caused the revenues in both contributory schemes, social security and health insurance, to be collected at the rate of 59% for social security and 60% for health insurance.

ERE, 24 million lek more from regulatory payments - The entity aims to collect 392.8 million lek from 392 licensed companies

The Energy Regulatory Authority predicts an increase in revenues from regulatory fees of companies operating in the energy market. In total, this department......

The Government approves the National Work Program - 250 young people will be employed in the public administration

The Council of Ministers has approved the National Internship Program in the State Administration and other public institutions for young......

Trump "closes" the borders - Bans citizens of 12 countries from entering the US

The Trump administration signed an order suspending travel to the US for citizens from 12 countries: Afghanistan, Myanmar, Chad, Congo, Equatorial Guinea,......

The US Dollar weakens again while the Pound recovers points!

The US dollar has recorded another decline this morning, as compared to yesterday it was bought today for 85.3 lek and sold for 86.5 lek according to the......

Bulgaria, part of the eurozone from January 2026 - ECB decision, will be the 21st member of the bloc

The European Commission and the European Central Bank gave Bulgaria approval to adopt the euro currency from the beginning of 2026. In a "convergence......

Fully electric plane lands at New York airport - American company aims to expand air taxi services

Beta Technologies became the first American company to land an all-electric passenger plane at New York's busy John F. Kennedy Airport. The ALIA flight to......

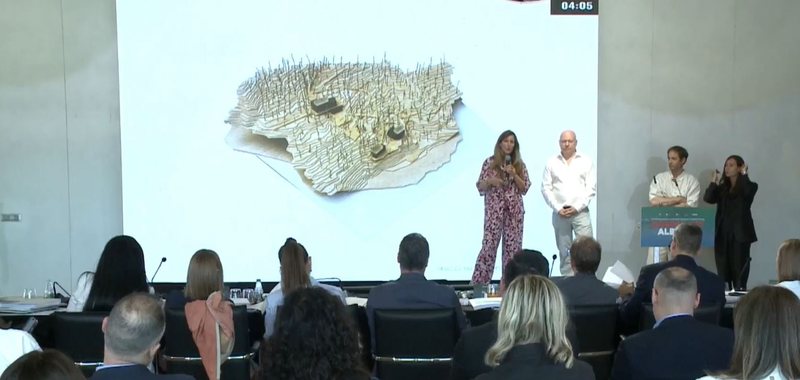

How are government residences expected to change? - Finalists present the reconceptualization of Villas in Velipojë and Vlora

The seven finalists of the second phase of "Hospitality Albania" presented architectural project ideas for the reconceptualization and modernization of......

Airlines stick to "net zero" target - The measure comes despite doubts about the supply of ecological fuel

Global airlines ended a two-day summit by sticking to a target for net zero emissions by 2050, but there was no shortage of concerns about the availability......