Loan with 2% interest and 70% collateral covered - Who benefits from the Sovereign Guarantee instrument in agriculture?

Farmers and agribusinesses who have an investment plan in agriculture, livestock, agro-processing, agricultural mechanization, rural tourism and marine aquaculture are given the opportunity to apply to second-tier banks for soft loans with an interest rate of 2% as well as Sovereign Guarantees with 70% collateral coverage.

The Sovereign Guarantee with a fund of 3 billion lek, or 30 million euros, is an instrument that has been placed at the service of the private sector with the aim of facilitating access to finance for farmers and Small and Medium Enterprises.

The aim of these instruments is greater financial access with a focus on investments that increase production capacity and quality in agricultural activities.

The Albanian government has signed agreements with 11 commercial banks in the country to enable the application of the sovereign guarantee in the agricultural sector.

The guarantee stimulates lending by banks to enable micro, small and medium-sized enterprises in the agricultural sector, as well as farmers equipped with NPT, to invest in physical and technological assets that increase their production capacities, production quality and operational efficiency.

According to the agreement, the government undertakes to pay 70% of the loan received from banks in the event that it is not repaid by the borrower, but does not undertake to guarantee interest, late fees and penalties or any other type of monetary obligation arising from the loans.

According to the agreement, the total amount of loans granted by banks to a borrower must not exceed 250 thousand euros and the loan term cannot be less than three years and greater than 5 years.

To qualify for credit, entities must meet certain criteria set out in the agreement.

Specifically, the applicant must be an entity that develops activity as a micro, small, medium-sized enterprise or a farmer with an active grandson; be registered with the National Business Center; must not have unpaid obligations at the time of application; must not have problem loans; the entity's representative must not have been judged by a final decision for fraud, corruption, involvement in a criminal organization or any other type of illegal activity that damages the financial interests of public funds, and must not have historical and current obligations to the Ministry of Finance arising from previous state guarantee schemes.

Criteria that applicants must meet

Be a micro, small, medium-sized enterprise, or a farmer with an active grandson

Be registered with the National Business Center

There must be no outstanding liabilities at the time of application.

The representative of the entity must not have been convicted by a final decision.

There should be no obligations in the past or in the present.

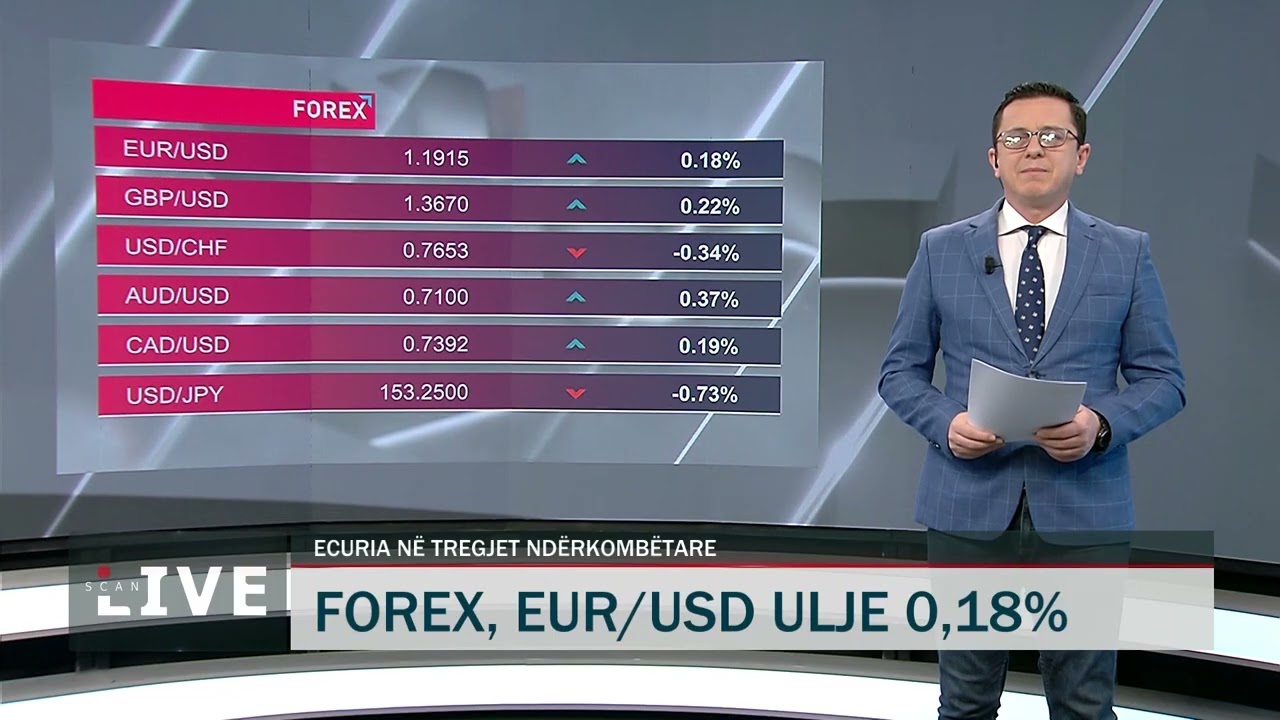

Exchange rate/ What is happening to the US Dollar?

The US dollar continued to follow a downward trend this Wednesday, recording points again from yesterday as it was bought today at 80.5 lek and sold at 81.6......

Sovereign guarantee in agriculture, low interest - Finance, Agriculture and BoA, meeting with banks: Orient farmers towards the scheme

A few months after the green light for the sovereign guarantee in agriculture, agro-processing businesses have started to show interest in benefiting from......

In Tirana, 80% of apartments are sold for 80 thousand-250 thousand euros/ New dynamics in the real estate market. But how has 2026 started?

According to the Investropa study, based on data collected from authoritative sources such as the Bank of Albania and INSTAT, the average price of a house in......

Legalization decisions now online in e-Albania - ASHK: Fast procedure towards ownership title

The State Cadastre Agency announces that decisions on the legalization of informal constructions will be sent to citizens directly to their profile on the......

US strengthens ties with Azerbaijan and Armenia - Aiming for transit corridor "Trump Road to International Peace and Prosperity"

US Vice President JD Vance signed a strategic partnership with Azerbaijani President Ilham Aliyev in Baku during a historic visit to the South Caucasus, as......

Zero loans for business start-ups in 2025/ Businesses rely on overdraft, 42% of loans go for liquidity

In 2025, lending to businesses in Albania has increased significantly, reaching 296.2 billion lek, from 268.9 billion lek a year earlier. However, the......

AI steals investors, $20 billion bond sale - Alphabet funds spending on artificial intelligence

Google parent Alphabet said on Monday it had sold $20 billion in bonds in a seven-tranche offering, tapping the debt market to finance its growing spending on......

"Urgently reduce energy prices" - Austrian Chancellor's appeal to the European Commission

"EU leaders must urgently focus on reducing energy prices that are weakening industry," Austria's chancellor said ahead of an informal summit in......