Eurozone inflation exceeds forecasts, but euro falls on tariff fears!

Eurozone inflation rose more than expected in January, adding to economic uncertainty as investor sentiment remained weighed down by the looming threat of U.S. tariffs on Europe. Annual inflation in the eurozone rose to 2.5% in January 2025, from 2.4% in December, according to a flash estimate from Eurostat. The reading beat economists' forecasts, which had forecast inflation to remain unchanged at 2.4%, marking the highest level since July 2024.

Core inflation, which excludes volatile energy and food prices, remained steady at 2.7%, defying expectations for a slight decline to 2.6%. Among the main components of inflation, services recorded the highest annual rate at 3.9%, but slightly lower than the 4.0% recorded in December. The cost of food, alcohol and tobacco rose by 2.3%, a slowdown from 2.6% a month earlier.

However, energy prices rose by 1.8%, recovering significantly from 0.1% recorded in December, while inflation for non-energy industrial goods remained stable at 0.5%. Among the euro area member states, Croatia recorded the highest annual inflation rate at 5.0%, followed by Belgium at 4.4% and Slovakia at 4.1%. The lowest inflation rates were recorded in Ireland, Finland and Italy at 1.5%, 1.6% and 1.7% respectively. On a monthly basis, Slovakia and Lithuania experienced the sharpest price increases, both increasing by 1.6%.

Market reaction: euro under pressure amid trade tensions!

Despite stronger-than-expected inflation data, the euro struggled to gain traction and remained under pressure on growing concerns over U.S. trade policy. The currency found support briefly at 1.0230 against the U.S. dollar, but was still down 1.2% on the day. Earlier in January, it had fallen to 1.0175, its lowest level since November 2022.

The U.S. dollar strengthened broadly, rising 0.7% against the British pound. The Canadian dollar weakened more than 1%, while the Mexican peso fell 2.1% as traders reacted to trade tensions. The currency market volatility came after U.S. President Donald Trump repeated threats to impose tariffs on the European Union. The administration had already imposed tariffs of 25% on Canadian and Mexican goods and 10% on Chinese imports, with Trump warning that Europe could be the next.

While he did not specify a timeline, he said the new tariffs would be implemented “very soon.” Analysts suggested that markets had not yet fully appreciated the risk of escalating trade tensions. BBVA’s Alejandro Cuadrado noted that tariffs are likely to remain a dominant market theme in the coming months. “Tariffs will continue to dominate markets and some traders still believe they could be reversed. The full impact may not yet be felt in currency markets,” he wrote on Monday.

Francesco Pesole of ING warned that the prospect of a global trade war, with tariffs extending to the EU, represented a clear downside risk for the euro. He added that “the potential for a big US trade report in April could keep investors in a rally-selling mindset for EUR/USD.” Luca Cigognini, a market strategist at Intesa Sanpaolo, highlighted 1.0180 as a key technical support level for the euro, warning that if breached, the currency could fall towards 1.0120.

European stocks fall, auto sector hit hardest

European stock markets fell sharply as trade concerns overshadowed inflation data. The Euro STOXX 50 fell 1.9%, while Germany's DAX index fell 2%. The auto sector suffered the biggest losses as fears of U.S. tariffs on European cars rattled investors. Volkswagen shares fell more than 6%, Mercedes-Benz fell 4.9%, and BMW lost 4.5%. In Milan trading, Stellantis fell more than 7%, while tire maker Pirelli saw its stock fall 5.5%.

Uncertainty over trade policy and its potential economic impact sent investors seeking refuge in sovereign bonds, pushing yields down across Europe. German Bund yields fell eight basis points to 2.40%, while French OAT yields fell six basis points to 3.15%.

Investors are betting that Musk and Tesla will make a fortune under a Trump presidency!

For Elon Musk fans, it’s a half-trillion-dollar bet. That’s how much Tesla’s stock market value has risen since the presidential election, a dizzying and......

Celebrate love with DigitAlb, with discounts up to 50%

In February, love is celebrated in every form, with your partner, family, or friends. To make this month even more special, DigitAlb brings the most......

Inflation in Turkey falls for 8th consecutive month as food prices fall!

Inflation in Turkey fell for the eighth straight month in January, taking it to its lowest level since June 2023 and showing that the country is gaining a......

Exports to the US fall - Imports increase by 3 billion lek!

Based on figures published by INSTAT, Albanian exports to the United States of America have decreased in value during 2024, compared to 2023. Referring to......

IMF "limits" Greece's economic growth - Forecasts 2.1% expansion in 2025, slowdown in the medium term

Greece's economy is forecast to grow by 2.1% in 2025, driven mainly by investment, the International Monetary Fund mission said, adding that any crisis in......

SME Support Schemes - Investment Development Agency announces calls. Deadline until February 28

The Albanian Investment Development Agency opens the call for the support and development of micro, small and medium-sized enterprises for 2025. According......

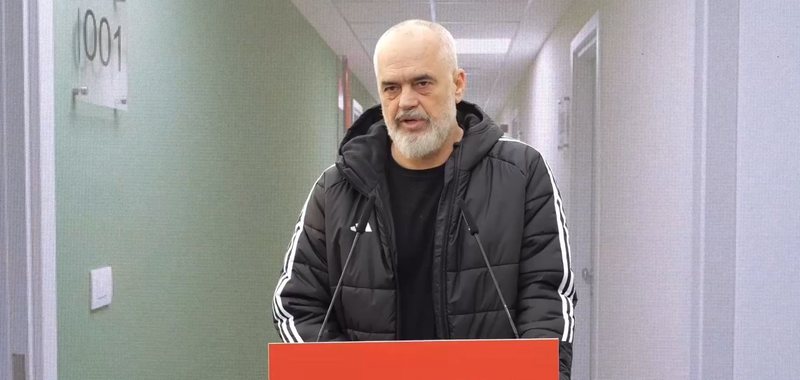

Two new buildings in Student City/ Rama: Category A in the EU, we remain faithful to the commitments made!

The Prime Minister of the country, Edi Rama, together with the Minister of Education and Sports, Ogerta Manastirliu, and the Mayor of Tirana, Erion Veliaj,......

Government debt securities are less preferred - The amount of investment in the primary market has decreased by 24%!

The demand to purchase treasury bills or bonds, which are otherwise called debt securities issued by the Bank of Albania or financial institutions, is......