Oil sees first monthly decline since November – Cause, uncertainty about the global economy and fuel demand!

Oil prices eased on Friday as they headed for their first monthly decline since November, dragged down by uncertainty over global economic growth and fuel demand, given Washington's tariff threats and signs of a U.S. economic slowdown.

The most active May Brent crude contract fell 59 cents, or 0.8%, to $72.98 a barrel by 0747 GMT. U.S. West Texas Intermediate crude supplies were at $69.70 a barrel, down 65 cents, or 0.9%. First-month Brent, which expires on Friday, traded at $73.42, down 62 cents, or 0.8%.

Both benchmarks are on track to post their first monthly decline in three months. Factors including expectations of a U.S. economic slowdown, tariffs, OPEC+ plans to increase supply in April and the possibility of peace in Ukraine, which could make more Russian oil available, have dampened investors' risk appetite.

“The only argument against it is that the price has already fallen a lot,” said IG market analyst Tony Sycamore, adding that WTI is well supported between $65 and $70 a barrel based on technical charts. U.S. President Donald Trump said on Thursday that proposed 25% tariffs on Mexican and Canadian goods would take effect on March 4, along with an additional 10% tariff on Chinese imports.

Economists at Fitch's BMI research unit said market participants are struggling to assess the impact of all the energy-related policy announcements made by the Trump administration this month.

“Those weighing on the downside, particularly U.S. tariff measures, are currently gaining,” BMI said in a note. Also weighing on investor sentiment, data showed U.S. jobless claims rose more than expected last week, while another government report provided further evidence of slowing economic growth in the fourth quarter.

BP has cut planned investments in renewable energy and said it would increase annual oil and gas spending to $10 billion.

However, oil prices rose more than 2% on Thursday as supply concerns resurfaced after Trump revoked a license granted to major U.S. oil company Chevron ( CVX.N ), opening a new tab to operate in Venezuela.

The cancellation could lead to the negotiation of a new agreement between the American producer and state-owned company PDVSA to export crude oil to destinations other than the United States, sources close to the talks said.

OPEC+ is debating whether to increase oil production in April as planned or freeze it, as its members try to read the global supply picture.

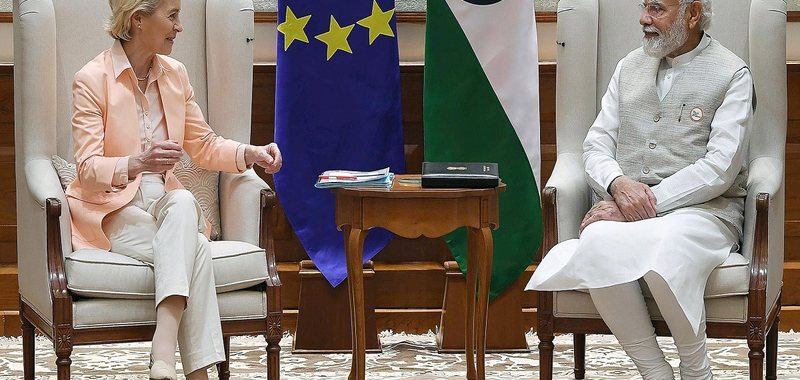

"Free trade pact, within the year" - EU-India agree to accelerate talks to reach agreement

Indian Prime Minister Narendra Modi and the European Union have agreed to push for the conclusion of a free trade pact this year, European Commission......

TIA: From March 1, passengers at Rinas will have an electronic boarding pass!

TIA announces that starting tomorrow, March 1, passengers who already have an electronic boarding pass on their phone can travel from Tirana International......

How much does the pedestrian project in the former Block cost? - Pashako: Parking lots will be eliminated, lanes will continue as they are

The project that is expected to transform the former Blloku into a pedestrian zone will cost around 3 million euros. Tv Scan sheds light on the project,......

OpenAI introduces GPT-4.5. New language model offers improvements in information accuracy

OpenAI has released the research preview of GPT-4.5, a broad, general-purpose language model. It will initially be available to software developers and......

How is America's appetite for gold 'sucking up' gold or silver bullion from other countries?!

Strong U.S. demand for gold is sucking up bullion or silver from several countries as traders try to stock up before U.S. President Donald Trump's tariffs on......

Britain, 37% fewer work visas in 2024 - Immigration restrictions affect health, social care sectors

The UK suffered a sharp drop in the number of visas granted to foreign workers in 2024, according to official figures. Far fewer health and social care......

Production of fiscal stamps/MoF: We have taken all measures!

The Ministry of Finance informs through a media release that the production of fiscal stamps until 31.12.2024 has been carried out by the concession company......

"Ease for citizens and businesses" - Berisha: Minimum wage 500 euros, average wage 1,200 euros. We reduce the price of energy

During a press conference, the leader of the Democratic Party, Sali Berisha, once again returned to the economic program of this political force, mentioning......