New insurance scheme in agriculture, preparations begin - How will the Turkish TARSİM model be applied in Albania?

This year, the scheme that will be followed for compulsory insurance in agriculture will be defined in detail. Currently, Albanian farmers are completely unprotected against natural hazards, such as floods, hail, frosts or storms, due to the lack of a proper insurance scheme, causing them to waste all their hard work in these conditions.

Official sources from the Ministry of Agriculture indicate that a Turkish delegation was in Albania last week to discuss how the Turkish insurance model could be implemented in Albania.

According to the Ministry of Agriculture, the scheme will involve several actors, including state insurance companies and farmers, and the possibility of creating a reserve fund that will be used in cases of natural disasters is being considered.

So far, there is still no calculation of the costs that the state budget should bear for the implementation of this scheme.

In October last year, the Ministry of Agriculture signed an agreement with the Turkish Ministry of Agriculture on cooperation in the field of agricultural insurance. The signed declaration aims to bring a new insurance model for Albanian agriculture, similar to the Turkish Agricultural Insurance Fund (TARSIM).

TARSİM is the agricultural insurance system in Turkey, designed to protect farmers from natural risks and disasters that could damage their agricultural production. It was established in 2005 and includes a combination of private insurance and state support.

Some types of agricultural insurance are mandatory, such as crop insurance, while others are voluntary, such as livestock or fishing insurance.

TARSİM covers a wide range of natural risks such as hail, storms, floods, earthquakes, frost, diseases and pests. This helps farmers protect their investments and reduce financial losses.

The Turkish state supports a significant portion of insurance premiums, typically from 50% to 67%, making it more affordable for farmers.

TARSİM is operated by a consortium of private insurance companies, supported by the government. These companies participate in the agricultural insurance scheme through a common platform.

In case of damage, farmers apply for compensation through insurance agencies. After the damage is assessed by experts, farmers are compensated for their loss within a short time.

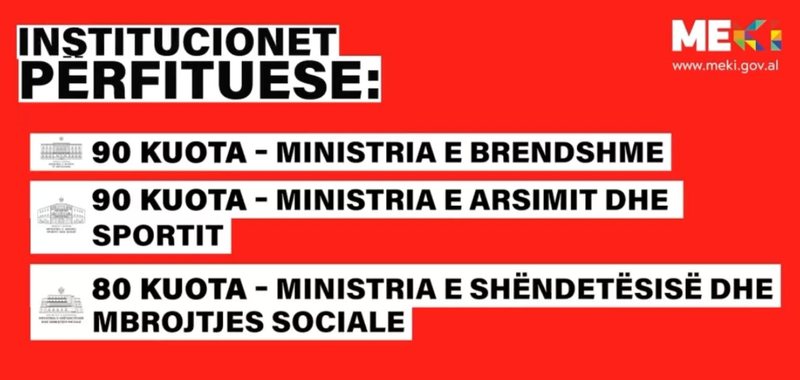

0% interest loan for housing – MEKI: Applications open for 530 public administration employees!

The Ministry of Economy, Culture and Innovation announced today the opening of applications for 0% interest loans for the purchase of a home for 530 public......

Military industry, another step towards recovery - State-owned company "KAYO" sh.a takes ownership of the copper processing plant

The arms manufacturing industry in Albania has recently taken another step towards its revival. The former copper processing plant in Rubik has been taken......

How much were our savings “hit” by the exchange rate? - BoA: Foreign currency deposits remain at high levels. Credit, the most affected

As a result of tourism revenues, remittances and foreign direct investment, euro flows continue to flood into Albania at alarming levels. This has made the......

Consequences of Trump's tariffs: US stocks lose $4 trillion in value!

President Donald Trump's tariffs have spooked investors, with fears of an economic downturn fueling a stock market sell-off that has wiped $4 trillion off......

Gyms in Albania, more expensive than in Paris! Numbeo: Tirana ranks 43rd and first among countries in the region

A recent report, published by Numbeo, shows the monthly prices of gyms in several major European cities. According to these statistics, Tirana ranks 43rd out......

245 million euros in unpaid employee contributions - Businesses do not pay their obligations on time. Years of work, "lost"

Many employees in the country, despite being in a formal employment relationship, face unpaid social and health contributions from their......

Another expansion for Tirana-Durrës - ARRSH prepares the tender for phase III, the limit fund will be 2.5 billion lek

The Tirana-Durres highway will be expanded even after the Rinas overpass. The Albanian Road Authority plans to open the tender for the third phase of the......

Greece, economic growth exceeds expectations - GDP reached 2.3% in 2024, driven by consumption and investment

Greece's economic growth rate for 2024 was 2.3%, slightly higher than the 2.2% budget forecast for 2025, according to the Hellenic Statistical Authority......