Rivlerësimi i pasurive, cila është procedura që ndiqet? - Ligji hyn në fuqi më 22 Janar, afati deri në 31 Dhjetor 2026

Nga data 22 janar deri më 31 dhjetor 2026, të gjithë individët, të cilët kanë në pronësi pasuri të paluajtshme, do të kenë mundësi që të bëjnë rivlerësimin e kësaj pasurie me vlerën e tregut duke paguar një normë tatimore prej 5%.

Ligji “Për rivlerësimin e pasurisë së paluajtshme” është botuar në Fletoren Zyrare dhe hyn zyrtarisht në fuqi më 22 janar dhe nga kjo iniciativë pritet të përfitojnë drejtpërdrejt 500 mijë familje.

Referuar ligjit, kërkesat për rivlerësim të dorëzuara pranë Agjencisë Shtetërore të Kadastrës për të cilat janë kryer pagesat e tatimit, por nuk kanë përfunduar procedurat administrative nga ASHK-ja brenda datës 31 dhjetor 2026, konsiderohen objekt rivlerësimi sipas këtij ligji dhe procedurat administrative përfundojnë deri më 31 mars 2027.

Por cilat janë procedurat që duhet të ndjekin qytetarët për rivlerësimin?

Rivlerësimi mund të bëhet nga një ekspert i licencuar për vlerësimin e pasurisë së paluajtshme nga institucionet përkatëse ose nga drejtoritë vendore të Agjencisë Shtetërore të Kadastrës.

Në rast se individi vendos që të kryejë rivlerësimin me vlerën e tregut, atëherë ai zgjedh një ekspert të licencuar. Aplikimit të tij për rivlerësim të pasurisë së paluajtshme i bashkëlidh edhe aktin e vlerësimit të ekspertit. Në këtë rast, drejtoritë vendore të Agjencisë Shtetërore të Kadastrës përllogarisin: bazën e tatueshme, e cila llogaritet si diferencë ndërmjet vlerës së pasqyruar në aktin e vlerësimit të ekspertit, e cila nuk mund të jetë më e vogël se çmimet fiskale në fuqi në momentin e rivlerësimit, dhe vlerës së regjistruar të pasurisë ose vlerës së rivlerësuar, sipas ligjeve të mëparshme të rivlerësimit, për të cilën është paguar tatimi si dhe tatimin që duhet të paguajë individi për ta regjistruar këtë rivlerësim.

Në rast se individi vendos që rivlerësimi të kryhet me çmimet minimale fiskale në fuqi, atëherë ai aplikon pranë Agjencisë Shtetërore të Kadastrës dhe ky fakt shprehet në formularin, që i bashkëlidhet aplikimit t ë tij për rivlerësim. Në këtë rast, drejtoritë vendore të Agjencisë Shtetërore të Kadastrës përllogarisin: bazën e tatueshme, e cila llogaritet si diferenca ndërmjet vlerës së dalë nga rivlerësimi me çmimet fiskale në fuqi në momentin e rivlerësimit dhe vlerës së regjistruar të pasurisë ose vlerës së rivlerësuar, për të cilën është paguar tatimi.

Për rastet e kalimit të së drejtës së pronësisë mbi pasuritë e paluajtshme, në zbatim të legjislacionit në fuqi për tatimin mbi të ardhurat, të bërë pas rivlerësimit, tatimi llogaritet sipas normave në fuqi mbi fitimin e realizuar, si diferencë e vlerës, në momentin e kalimit të së drejtës së pronësisë, me vlerën e rivlerësuar për të cilën është paguar tatimi.

Gjithashtu ligji u jep të drejtë edhe personave juridikë, të cilët kanë të regjistruar në pasqyrat e tyre financiare pasuri të paluajtshme me vlerë më të vogël se ajo e tregut, që të bëjnë rivlerësimin me vlerën e tregut të këtyre pasurive brenda datës 31 dhjetor 2026.

Reshje intensive në të gjithë vendin - IGJEO: Vërshime të shpejta të lumenjve dhe rrëshqitje dherash

Reshjet e dendura të shiut që kanë pushtuar vendin prej disa ditësh vijojnë edhe këtë të enjte. Sipas institutit të Gjeoshkencave, priten reshje intensive në......

Pagat e grekëve, më të ulëta se përpara krizës - Të fundit në BE për rrogat mesatare, të parët për çmimet!

Pesëmbëdhjetë vjet pas shpërthimit të krizës së madhe fiskale, Greqia ende po përballet me të kaluarën, pasi pavarësisht rimëkëmbjes së ndjeshme të dekadës......

Luhatje në tregun valutor- Sa këmbehen sot monedhat e huaja?

Dollari amerikan ka regjistruar një rritje të lehtë të kuotës këtë mëngjes duke fituar pikë nga një ditë më parë pasi është blerë sot me 82 lekë dhe është......

Ngadalësohet rritja ekonomike e Kroacisë - Në tremujorin e katërt 2025 ishte vetëm 0,9%

Rezultatet ekonomike të Kroacisë tregojnë një normë rritjeje të PBB-së prej 0.9% në tremujorin e katërt të vitit 2025, nga 2.3% në tremujorin e tretë, sipas......

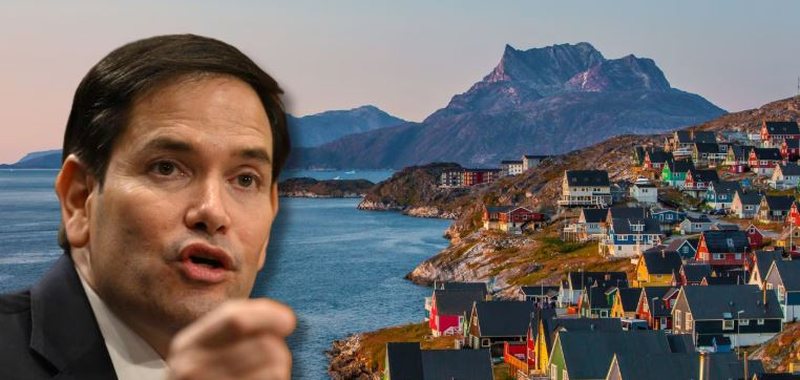

Rubio do të takohet me udhëheqësit e Danimarkës - Deklaron se nuk do të tërhiqet nga qëllimi i Trump për Groenlandën

Kryediplomati amerikan deklaroi se do të takohet me udhëheqësit e Danimarkës javën e ardhshme, por nuk sinjalizoi asnjë tërheqje nga qëllimi i Presidentit......

India, ekonomia e katërt më e madhe në botë - Renditet pas SHBA, Kinës dhe Gjermanisë

Ekonomia e Indisë ka kaluar atë të Japonisë në terma të Prodhimit të Brendshëm Bruto nominal, duke u bërë kështu e katërta më e madhe në boto pas SHBA, Kinës......

Analiza, pse është aq e lakmuar Groenlanda? - Nga rëndësia strategjike, tek burimet e pashfrytëzuara të nëntokës

Presidenti i SHBA-së, Donald Trump, ka ringjallur ambicien e tij për të fituar kontroll mbi Groenlandën, duke argumentuar se ishulli Arktik është jetik për......

Reshjet, Ministrja Koçiu në Durrës: Institucionet në gadishmëri të plotë, hidrovorët funksionalë për menaxhimin e situatës

Ministrja e Punëve të Brendshme Albana Koçiu, nga Durrësi, theksoi se të gjitha strukturat janë në gadishmëri të plotë për përballimin e situatës së krijuar......