6.1 million euros returned to freelancers - Taxes: The process is not over. What should businesses that have not been reimbursed do?

The tax administration has so far returned 6.1 million euros to freelancers, which were paid as advance installments of the Simplified Profit Tax, or Profit Tax as a result of the income tax law.

Meanwhile, there are still taxpayers who have not yet been reimbursed for prepaid installments for 2024, due to lack of a bank account or incorrect data.

The tax administration informs that these entities must submit a request to the Regional Directorates (in writing or via eFiling). Taxpayers must have an active bank account in lek and specify their data and upload it in advance to eFiling (menu “My Profile”).

As a result of incorrect data declared by taxpayers, an unreimbursed amount of 380 thousand euros has remained.

This process was expected to reimburse a total of 7,157 freelancers who had paid the installments.

Freelancers had a deadline of December 18 to declare their bank account details in order to receive their prepaid installments.

The Income Tax Law, which came into force on January 1, 2024, taxed approximately 29,000 freelance professionals at a rate of 15-23%. The professionals did not agree with this tax regime and took the case to the Constitutional Court. After several hearings, the Constitutional Court decided to repeal the article that taxed this group, calling it discriminatory. However, during this period, a good part of them had paid the relevant obligations.

Protecting maritime space in Albania/ Vengu: Coast Guard ships, a key role!

Minister of Defense, Pirro Vengui, today brought to attention the importance of the Navy's mission, while sharing the testimonies of Captains Arjan Demçe and......

SPAK balance for 2024: 629 security measures for 2024, 5.1% for corruption offences!

The Special Prosecution Office against Corruption and Organized Crime announced today that it has issued security measures for a total of 629 people for......

Green Climate Fund, 687 million USD investments - Distributed in 42 countries, projects also include the Balkans

The Green Climate Fund, the world's largest fund to help developing countries cope with the impacts of climate change, approved $686.8 million in funding at......

Debts for OSHEE bills slightly reduced. The stock of arrears reaches 80.43 billion lek

The total debt that customers have towards the Electricity Distribution Operator decreased very slightly during 2024, compared to 2023. According to......

Zelensky: I am ready to resign as leader! If it brings peace and Ukraine's membership in NATO

Ukrainian President Volodymyr Zelensky said he was "ready" to resign as leader if it meant it would bring his country to power, suggesting he could trade it......

40% of Albania's workforce works abroad - Report: Country is also transit for Afghans, Syrians and Pakistanis

Around 40% of Albania's workforce works abroad, according to the latest report by the International Organization for Migration, which highlights that due to......

3rd anniversary of Ukraine invasion: Trump calls Zelensky 'dictator', world leaders arrive in Kiev as EU provides 3.5 billion euros in new financial aid!

Ursula von der Leyen arrived in Kiev by train on Monday morning to mark the third anniversary of the start of Russia's war against Ukraine and as Donald......

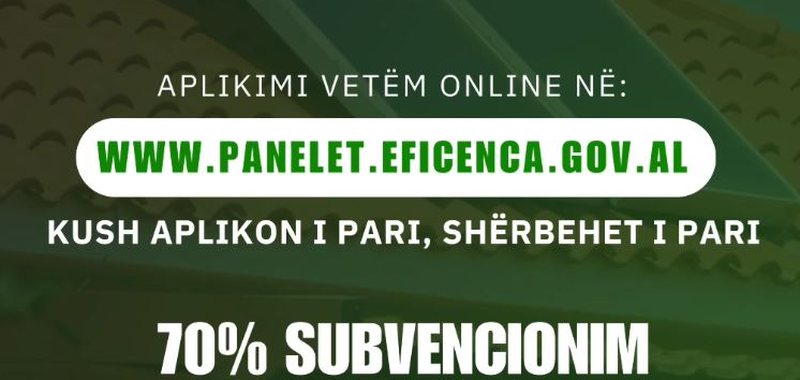

Applications open for solar panels for water heating/ Balluku: 70% support for 2 thousand families!

Deputy Prime Minister, Minister of Infrastructure and Energy, Belinda Balluku announced that starting today, citizens can apply to benefit from a subsidy of......