Businesses will face limits on cash balances due to obligations with money in the bank– Exchange agencies will not be allowed to have more than 17 thousand dollars in cash

Beginning in 2023, companies will no longer keep turnovers in the cash register and pour them into banks as they wish. In the draft fiscal package for next year, there are going to be clear limits on the amounts that companies can keep in cash.

The new obligation seems to affect mostly Foreign Exchange Agencies, which need significant amounts of money for daily operations. The draft of the Ministry of Finance determines that this business will not be able to keep more than 1.7 million ALL, or 17 thousand dollars in cash.

Meanwhile, entities with a daily turnover of up to 2 million ALL will not be allowed to keep more than 55 thousand ALL in the cash register. Also, businesses with a daily turnover of 2 to 10 million ALL will not be able to keep cash balances above the value of 250,000 ALL.

While, businesses with a turnover of over 10 million ALL will be allowed to keep up to 500,000 ALL in cash, or 2% of the annual turnover of the previous year. Meanwhile, it will be the Foreign Exchange Agencies that will find difficulties with this measure, due to the large amounts of cash they have to carry out in daily operations.

What is known so far about the consultations of the Ministry of Finance with stakeholders for the 2023 fiscal package, is the dissatisfaction of business associations regarding the very few fiscal facilities provided in the draft, but also the strong tightening of fines for fiscal evasion.

Lorenc Rabeta / SCAN

Si është mbyllur kjo javë për valutat e huaja?!

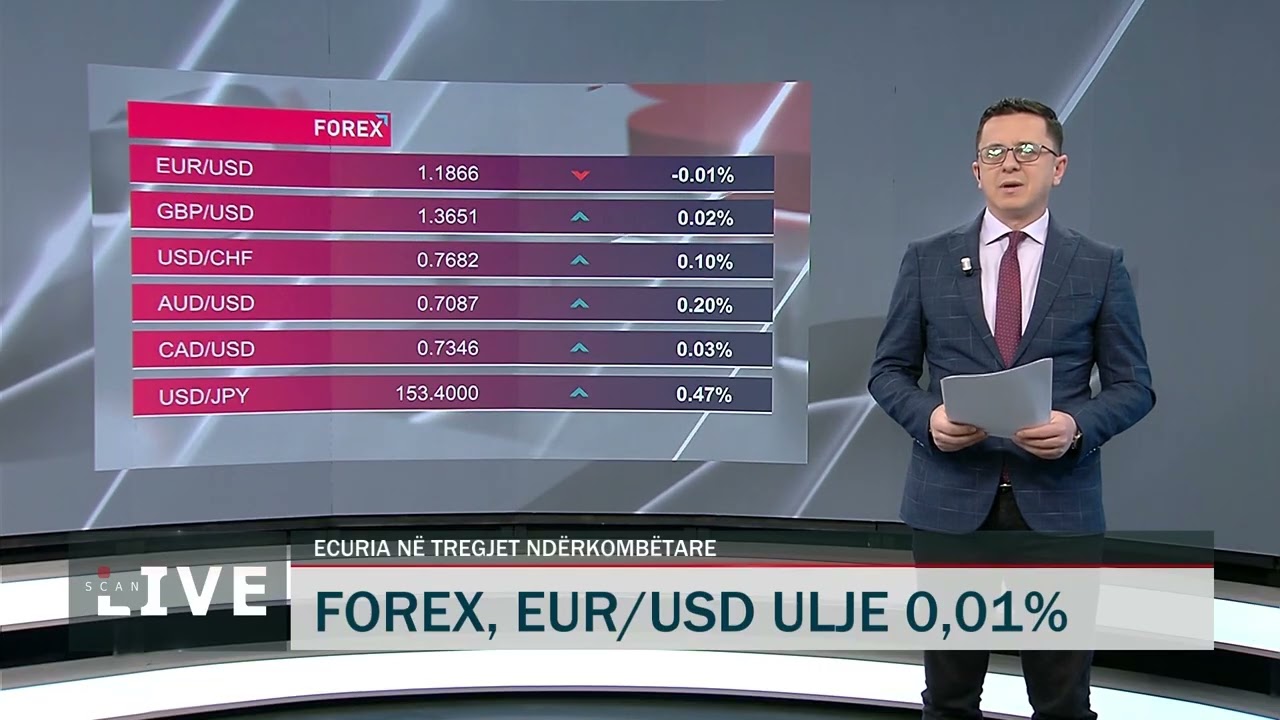

Dollari amerikan është blerë sot me 119.2 lekë dhe është shitur me 120.4 lekë duke e mbyllur këtë javë relativisht i qëndrueshëm pa shënuar luhatje të ndjeshme......

"Corruption remains a serious concern"—What progress has Albania made according to the European Commission report?!

The European Commission's document on Albania's progress highlights once again the same level of corruption. This document comes as a detailed analysis of our......

Shndërrimi i ujit të oqeanit në ujë të pijshëm mes thatësirës më të keqe në 1200 vjet – Pritet të miratohet impianti i shkripëzimit prej 140 milionë dollarë!

Një impiant shkripëzimi prej 140 milionë dollarësh pritet të miratohet nga rregullatorët e Kalifornisë të enjten, pasi shteti amerikan po lufton se si të......

“Korrupsioni mbetet shqetësim serioz” - Progres Raporti i Komisionit Europian, ku qëndron Shqipëria?!

Dokumenti i Komisionit Europian për progresin e Shqipërisë nxjerr në pah edhe një herë vijimin në të njëjtin nivel të korrupsionit. Ky dokument, një radiografi......

What's wrong with the self-employment tax?

The new tax law that provides for the inclusion of freelancers in the income tax scheme during the next year has several defects, for which the affected party......

“Shërbimet Financiare” - Progres Raporti i KE vlerëson përparimin e bëra në kuadrin ligjor dhe rregullator në Shqipëri

Komisioni Evropian, në Progres Raportin për Shqipërinë ka vlerësuar përparimin e bërë me përafrimin ligjor e rregullator me acquis të BE-së dhe praktikat......

Balluku: Raporti i KE për amnistinë fiskale, hipotetik - Ambasadorja e BE: Bashkë me pasaportat e arta rrezikoni integrimin

Kritikat dhe këshillat e Komisionit Europian për realizimin e amnisitisë fiskale në Shqipëri, zëvendëskryeministrja Belinda Balluku i ka konsideruar......

Çfarë nuk shkon me tatimin e profesioneve të lira? - Lika: Penalizim për subjektet e reja, tatohen me 23 %

Ligji i ri për tatimin mbi të ardhurat i cili parashikon përfshirjen në skemën e tatim-fitimit të profesioneve të lira gjatë vitit të ardhshëm, ka disa difekte......