How heavy is the credit burden for businesses? - BoA survey: In the small and medium segment, the cost of borrowing has eased

In the second half of 2024, small businesses resulted in fewer loans received from banks, while borrowing by medium-sized businesses increased somewhat during the period and by large enterprises remained unchanged.

Businesses have mainly taken out loans to cover short-term expenses and to make long-term investments. Compared to the previous six months, the share of enterprises that have taken out loans to cover short-term expenses has increased in the case of medium-sized and large businesses, while for small businesses, this share has remained unchanged.

At the same time, all types of businesses have taken out more loans to make a long-term investment. Borrowing for more than one purpose continues to have a significant impact, with a combination of the two above-mentioned purposes dominating, as well as a combination to cover short-term expenses and repay an older loan.

The payment burden has been higher for large enterprises, with around 28% of them reporting that this payment exceeds 20% of income, a share which has increased. In contrast, the payment burden has resulted in some easing for small and medium-sized enterprises, and the share of those declaring that the cost of the loan exceeds 20% of income has decreased.

The majority of businesses, around 74%, state that loan payments amount to “up to 20% of their income,” and this has decreased by 1 percentage point.

According to the latest Bank of Albania survey on borrowing in the second half of 2024, small and medium-sized businesses have mainly received loans in lek. Around 51% and 56% of them declared that they have only loans in lek. However, in the case of small enterprises, this weight has decreased by 5 percentage points over the period, shifting towards borrowing in foreign currency, while in the case of medium and large enterprises the opposite has happened.

To cover the costs of loan servicing, enterprises during the period mainly relied on the use of various reserves (in 26% of cases) and a combination of several methods (in 26% of cases). Increasing the price of products, or reducing business expenses, were used by only 16% of borrowing businesses.

67 thousand farmers benefited from agricultural funds - Free oil for tillage, over 52 thousand applicants were financed

Over 67 thousand farmers across the country have benefited from financing from the Agricultural Subsidy Scheme throughout 2024. Official data from the......

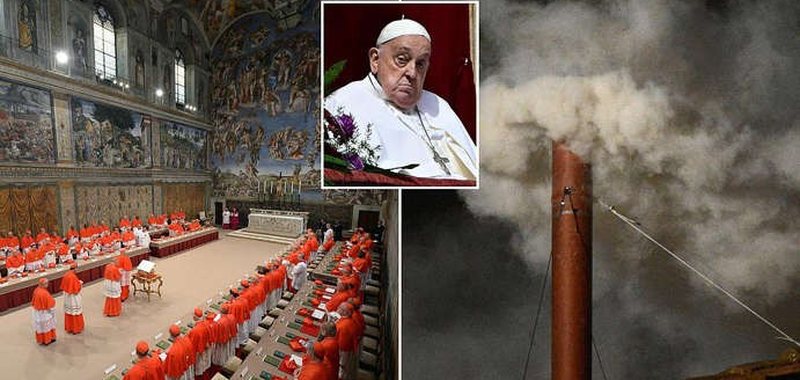

Disinformation and conspiracy theories as the secret conclave begins to elect the next Pope!

Misinformation circulating online has sown confusion as the secret conclave to elect the next pope began at the Vatican today. The conclave comes after the......

Taxes collect 379 million euros in April - Income from wages and consumption exceed the plan in 4 months

The tax administration has collected nearly 379 million euros during April of this year alone. Referring to official data from the General Directorate of......

Tax havens/ In which European countries do the rich benefit from the most tax breaks?

European governments are facing budget constraints. Weak growth, trade shocks and an aging population continue to strain public coffers, while countries are......

The US Dollar Weakens Again - What Happened in the Foreign Exchange Market Today?

The US dollar has recorded another decline in value this morning after a slight recovery yesterday, being bought at 85.6 lek and sold at 87 lek according to......

“Global growth to slow in 2024” - UN report warns of economic challenges and risks of “AI”

Progress in global development slowed in 2024, raising concerns that achievements in recent years may be eroding, according to a new UN report. The annual......

$1,000 to leave the US - How is Trump trying to fight illegal immigrants?!

US President Donald Trump's administration said on Monday it would pay illegal immigrants $1,000 (880 euros) to voluntarily return to their countries of......

Super May at DigitAlb. Sports, adrenaline and super offers

May is the month of crowning the champions of the most prestigious leagues in Europe. The most elite football championships have entered the most defining......