“The crisis of state-owned enterprises threatens the Serbian economy” - World Bank calls for reforms to increase the efficiency of public finances

Serbia needs to address fiscal risks posed by its large state-owned enterprise sector to ensure long-term fiscal sustainability and unlock economic growth potential, the World Bank said.

According to the public finance review report, the country needs a reform strategy for state-owned enterprises, especially in the energy, infrastructure and transport sectors, including eliminating operational deficiencies and restoring financial discipline in the short and medium term.

“The performance and governance of state-owned enterprises have a direct impact not only on the efficiency of public services and the competitiveness of the economy, but also on the sustainability of public finances,” the World Bank said.

In 2023, the Serbian government owned 176 state-owned enterprises with 107,000 employees, about 4.5% of formal employment, dominating key sectors such as energy, transport and utilities. That same year, state-owned enterprises negatively impacted the government balance sheet by 0.7% of GDP, or almost a third of the total fiscal deficit, according to the report.

The World Bank noted that “chronic deficiencies” in state-owned enterprises, such as energy company EPS and gas importer Srbijagas, often require large subsidies to cover losses or keep prices low for social and political reasons. For example, in 2022, the government provided 1.4 billion euros to state-owned energy companies to offset the effects of the energy crisis.

Between 2015 and 2023, Serbia's state-owned enterprises recorded a total profit of 1.68 billion euros, with an average return on assets of only 0.7%. Persistent losses in many companies, dependence on budget support, and ineffective investment models highlight structural weaknesses in governance and organization.

According to the World Bank, this fiscal burden is mainly the result of strategic and operational problems, including the decline in production in the electricity sector, the lack of transparency in reporting loans provided by the budget to state-owned enterprises, and their increased dependence on external borrowing.

AI will eliminate up to 3 million jobs in Britain - Many positions risk "disappearing" by 2035

Up to 3 million low-skilled jobs could disappear in the UK by 2035, due to automation and artificial intelligence. According to the National Foundation for......

"Black Friday", businesses "start" their engines/ Around 25 thousand active ads on social networks

Black Friday, or known in Albanian as E premëtja e zëzë, has become one of the most important days of the year for both consumers and businesses. What once......

How much does flood protection cost? - $115 million per year to "save" until 2031

Farmers, citizens, and businesses are facing significant economic damage this year due to flooding in several municipalities across the country, as a result......

Britain increases minimum wage by 4.1% - Over 2.7 million workers benefit. Businesses warn of price hikes

The UK government announced that the minimum wage will rise by 4.1% to £12.71 an hour from April next year, to bring it in line with the average wage,......

"8 member states are deviating from targets" - EU calls on states to limit budget spending

The European Commission warned that public spending in eight EU countries, including Spain, Hungary, Malta and the Netherlands, is deviating from agreed......

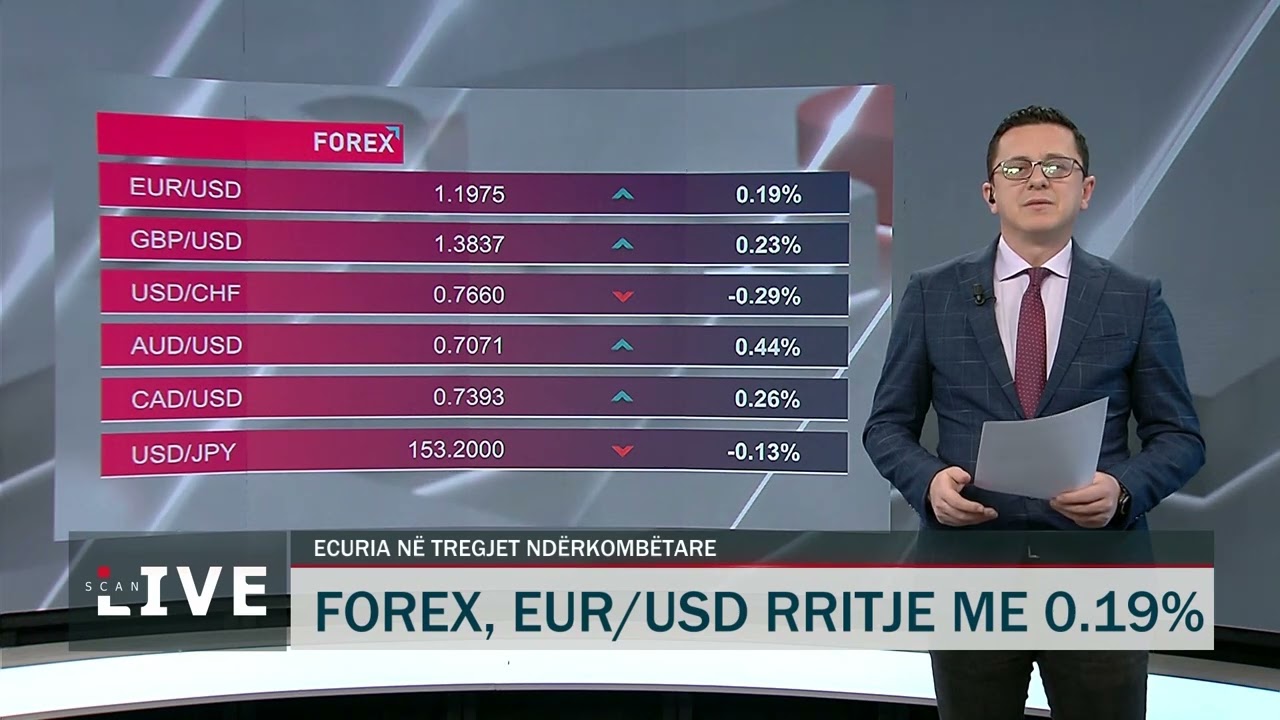

Fluctuations in the foreign exchange market – The US dollar loses points. The Swiss franc strengthens!

The US dollar has recorded a decline for the first time this week after a continuous increase since the beginning of the week, as it was bought this morning......

Greece, tourism brings in over 20 billion euros - Revenues increased by 9%. Over 31 million tourists visited the country

Tourism revenues reached more than 20 billion euros during the January-September period, marking a 9% increase compared to 2024. According to data from the......

AI will eliminate up to 3 million jobs in Britain - Many positions risk "disappearing" by 2035

Up to 3 million low-skilled jobs could disappear in the UK by 2035, due to automation and artificial intelligence. According to the National Foundation for......