Businesses get 54 million euros back in 4 months - VAT refund, 80% of requests are approved without control

In the first 4 months of the year, businesses have been refunded 5.4 billion lek or 54 million euros of VAT paid, through the refund procedure. Compared to a year ago, the figure for the January-April period has decreased by about 39%, as in 2024 87 million euros were refunded in 4 months.

Divided by month, a progressive increase in refunds made by the General Directorate of Taxes is observed, and the highest figure is in April with approximately 18 million euros, while the time for completing this process is being reduced.

In total, 539 entities were reimbursed, 80% of requests were approved without control.

VAT refunds for businesses throughout 2024, through the digital platform, were made within an average of 31 days, reducing waiting times and facilitating taxpayers. By 2027, the average refund deadline is planned to reach 25 days.

Taxable persons, registered for VAT, who result in a credit balance of over 400,000 thousand lekë, have the right to submit a request for VAT refund to the VAT Refund Directorate at the General Directorate of Taxes. This request is submitted according to the approved form “Request for VAT Refund” (online as well as officially at the VAT Refund Directorate at the General Directorate of Taxes).

VAT refunds are made within 60 days from the date of submission of the request through the Treasury system. The refund request is subject to the normal refund procedure, subject to a refund risk analysis. They are automatically refunded within 30 days from the date of submission of the VAT refund request, as zero-risk persons. In case of non-reimbursement of the amount approved for refund, the taxable person has the right to non-payment of other tax obligations in the amount of VAT claimed for refund.

If a refund, which should have been made by the tax administration, is not made within the legal deadlines, the tax administration pays late payment interest on the overpaid amount.

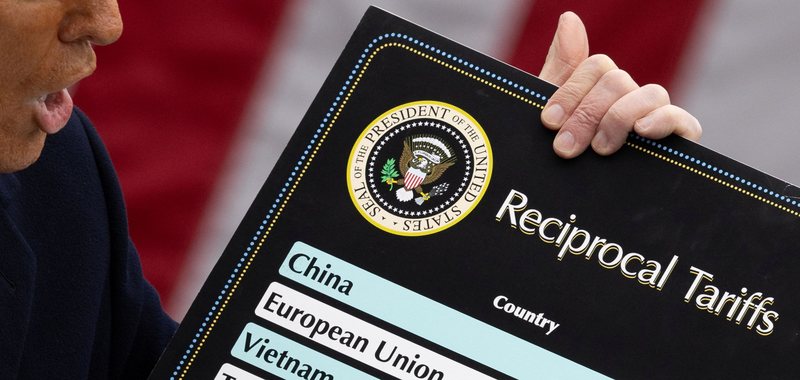

Doubled tariffs on metals take effect - Trump's move hits Canada and Mexico especially hard

The United States doubled tariffs on most steel and aluminum imports, further escalating the global trade war. The move comes as President Trump expects......

Albania, a "magnet" for tourists on a limited budget - Even "Rough Guides" recommends us as one of the 20 cheapest countries

Tourism in Albania has seen a remarkable surge in the last two years, breaking monthly records and drawing international attention. From the enchanting......

EU, convinced to avoid US 500% tariffs - Senators' bill targets Russian economy and key partners

The European Commission is confident that the European Union will manage to avoid the economic blow from a new US Senate bill that foresees 500% tariffs on......

Private pensions, 1,451 contributors added to the scheme - AFSA: Total fund assets “expand” by 493 million lek

More and more citizens are choosing to contribute to a private pension, in addition to the state one, in order to have a higher level of benefit in old......

What risks do businesses with tax debts face? - From confiscation of daily turnover to complete seizure of assets

Businesses are significantly neglecting the payment of tax obligations to the state budget, risking falling prey to harsh measures that could lead to the......

Temu's American users halve - Reason: elimination of the "de minimis" practice for shipments to the US

Global marketplace Temu's U.S. daily users fell 58% in May, according to data firm Sensor Tower. It's one of many struggles the e-commerce retailer is facing......

Durrës, with a new urban development plan - The Municipality begins the design phase for new investments

The Municipality of Durrës has announced the opening of the tender for the drafting of the master plan and preparation of implementation projects for a......

"Hospitality Albania" launches the competition for the selection of the best projects

"Hospitality Albania" is an investment project that aims to reuse and modernize government residences, which are currently depreciated structures with......