"Cryptocurrencies could damage trust in banks" - ECB warns of risks to the traditional financial system

European Central Bank official and Bank of Italy Governor Fabio Panetta called for close monitoring of the reputational risks banks face in providing crypto-asset services, warning that losses could damage customer confidence.

Presenting the Bank of Italy's annual report, Panetta warned of the growing links between the world of cryptoassets and the traditional financial system, pointing to the high number of agreements between banks and digital asset providers.

"Users of cryptoassets may not fully understand their nature and confuse them with traditional banking products, with potentially negative consequences for confidence in the lending system if there are losses," Panetta said.

Italy's largest bank, Intesa Sanpaolo, in January conducted a "test run" by buying 1 million euros in bitcoin, the world's largest digital currency. Intesa created a separate trading unit for digital assets in 2023 and last year began conducting direct trading in cryptocurrencies.

Spain's Santander is considering an expansion into cryptoassets, including early-stage plans to offer a stablecoin, as well as access to cryptocurrencies for retail customers of its digital bank.

Panetta said that stablecoins, which are designed to maintain a stable value against underlying currencies or assets, pose a threat to traditional means of payment if large foreign-based technology platforms decide to promote their use. "In the absence of proper regulation, their suitability as a means of payment is questionable," he said.

The central banker warned, however, that it would be unwise to think that the spread of cryptoassets, including stablecoins, can be curbed simply by imposing restrictions.

"A response is needed that is consistent with the ongoing technological transformation," Panetta said, adding that "the digital euro project stems precisely from this need."

The European Central Bank is working to develop a digital currency to compete with private alternatives that risk undermining the role of central bank money.

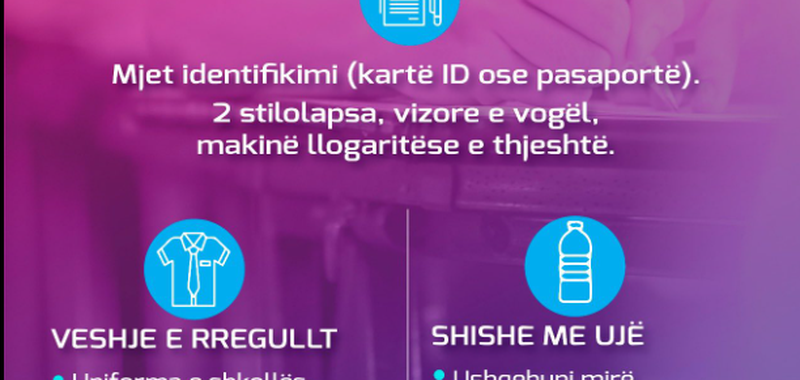

Tomorrow the first State Matura exam - Minister of Education, Ogerta Manastirliu publishes the rules

Tomorrow, the "fever" officially begins for high school graduates, as they take the first mandatory test, that of Foreign Language. One day before the first......

Significant decline in the foreign exchange market - How has this month started for foreign currencies?

The US dollar has started this month on a downward trend after registering a decrease in value this morning, being bought today at 86 lek and being sold at......

Germany "expands" army - Up to 260,000 troops needed to meet NATO requirements

Germany will need up to 260,000 active-duty soldiers to meet growing NATO defense demands, the head of the country's military union has warned, a number......

The Youth Center in the Saranda Municipality opens its doors to over 6 thousand young people of Saranda - Muzhaqi: "From a dilapidated building to a center of opportunities for young people"

The young people of Saranda will have at their service the new Youth Center. A modern and functional space, transformed from a dilapidated building into an......

Farmers "thirsty" for oil - Over 68 thousand applications in the agricultural scheme

Over 68,000 farmers applied for agricultural subsidies, 90% of whom are seeking to benefit from excise-free oil. The deadline for applications to the......

Trump announces 50% increase in steel and aluminum tariffs!

During a rally at a steel mill, the US president announced that he would raise tariffs on steel imports from 25 to 50 percent. He later announced the same......

Korça "reigns", 5% increase in tourists - Macron's master plan "ignites" the southeast

The Korça region remains among the most preferred destinations for foreign tourists this year. The prefect of the district, Nertil Jole, says that during......

10% tax on Google and Facebook - Germany considers imposing measures on digital platforms

Germany is considering a 10% tax on major online platforms such as Google and Facebook, sources at the country's Culture Ministry said. The move is expected......