Investment banks warn: Trump tariffs could hamper Europe's growth in 2025!

A new wave of trade uncertainty could hit Europe's already sluggish economy as top US investment banks raise concerns over potential tariffs from President Donald Trump's administration. With euro zone growth forecasts down and corporate profits under pressure, analysts say markets should brace for an uncertain 2025.

Economists at Goldman Sachs and JPMorgan said in separate reports this week that the risk of tariffs combined with potential European retaliation could weigh heavily on the eurozone's economic outlook. While the European Union was not included in the first round of U.S. tariffs, which hit Mexico, Canada and China, President Donald Trump has suggested that the bloc, given its large trade surplus with the U.S., could be next.

How much damage can tariffs cause?

Goldman Sachs forecasts eurozone gross domestic product growth of 0.7% in 2025, notably below the consensus estimate of 1% and the 1.1% forecast by the European Central Bank in December. According to Sven Jari Stehn, chief European economist at Goldman Sachs, a 10% tariff on all US imports from the EU, if met with full retaliation, could wipe a percentage point off eurozone growth.

Beyond GDP, European corporate earnings could also come under pressure. Goldman Sachs’ equity team forecasts European earnings per share growth of just 3% in 2025, well below the consensus of 8% from the bottom up. “It’s not necessarily the tariffs themselves that matter,” the team said, “but the trade uncertainty that hits economic growth and investment targets.”

Which sectors are most at risk?

The EU accounts for about 15% of total U.S. imports, with machinery, pharmaceuticals, and chemicals among the top European exports to the U.S. Other key industries, including cars, metals, and technology, could also face significant tariff exposure.

Goldman Sachs analysts note that stock market sectors with high margins and defensive characteristics, such as health care, tend to be less affected by trade uncertainty. In contrast, auto manufacturers and cyclical stocks are particularly vulnerable.

A group of large-cap European stocks, often referred to as "GRANOLAS" - which includes companies such as GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP and Sanofi - have underperformed recently, but tend to perform better when trade policy uncertainty increases.

Could a weaker euro mitigate the impact?

A weaker euro could provide some relief for European stocks, especially multinational firms with significant exposure to global revenues. Goldman Sachs’ foreign exchange strategists expect the EUR/USD exchange rate to fall to 0.97 over the next 12 months, while GBP/USD could weaken to 1.20. However, the relationship between a weaker euro and European stocks is complex.

Historically, a strong US dollar has been associated with poor performance in non-US markets, as dollar-based investors in European stocks see diminished returns unless they hedge against currency fluctuations. "The weakening of the euro normally comes along with an increase in the risk premium, which offsets the translation and competition advantages," the analysts said.

Europe's revenge strategy: What happens next?

Uncertainty also surrounds how the EU might respond to new US tariffs. According to JPMorgan economist Nora Szentivanyi, “the motivation, the objectives, the timing and the tariffs are all unclear.” However, the European Commission has stated that it will retaliate ‘decisively’ against any tariffs imposed by the US.

If the EU follows its 2018 strategy of targeted retaliation, it will likely avoid tariffs on energy products but could impose steep tariffs that could exceed 50% on goods that most affect Trump's voter base.

JPMorgan already projects a 0.5 percentage point drag on annual growth over the next four quarters due to heightened trade policy uncertainty. However, Szentivanyi notes that new tariff threats combined with weak eurozone growth could further weigh on the region’s economic outlook.

On Tuesday, US Treasury Secretary Scott Bessent met with ECB President Christine Lagarde to discuss economic priorities and transatlantic cooperation. While no specific details were disclosed, the meeting underscores the growing focus on US-EU trade tensions as financial markets await further clarity on Washington's trade policy stance.

How much are the major currencies being exchanged today?

The European currency was bought today at 98.5 lek and sold at 99.5 lek without any significant change from the day before according to the local exchange......

Analysis/ Trump: Trade wars are easy to win! Is this true?

Donald Trump has dismissed trade wars, claiming they are easy to win. The US president imposed 10 per cent tariffs on China on Tuesday, while Mexico and......

Why did China restrict exports of critical minerals? - Aimed at strengthening global dominance in technology and military

China announced sweeping export controls on Tuesday, targeting five metals important to defense, clean energy and other industries. The move came after U.S.......

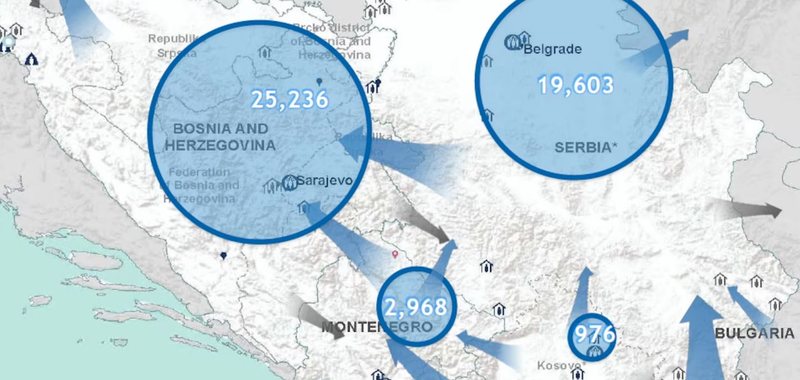

Albania with the lowest number of foreign asylum seekers in the Balkans during 2024!

Albania has the lowest number of irregular foreigners who entered the country and were referred to the asylum system in the Western Balkans in 2024, while......

Australia bans DeepSeek on government devices citing security concerns!

Australia has banned DeepSeek from all government devices over concerns that the Chinese artificial intelligence startup poses security risks, the government......

Hundreds of people flee Santorini after repeated earthquakes rock the island

Hundreds of people fled Santorini by ferry and plane on Tuesday to reach the safety of Athens as a series of earthquakes continued to shake the popular Greek......

Analysis/ Europe's 'iron' leaders no longer seem so strong!

Europe's so-called "strong" leaders, most of whom are allies with allies like US President Donald Trump and Russian President Vladimir Putin, are looking......

Installation of solar panels for water heating - The second call for subsidies for 2 thousand families opens!

The second call for support for 2,000 families to install solar panels for water heating has been launched. The announcement was made by Deputy Prime......